On the 7th & 8th of December, the ICTD and the Budget Advocacy Network (BAN) held the first conference focused on tax and development in Sierra Leone, in partnership with the National Revenue Authority (NRA) and the Ministry of Finance.

Over 100 policymakers, researchers, members of civil society, and other stakeholders gathered in the Radisson Blu Hotel in Freetown to present research and discuss policy recommendations.

The conference was comprised of eight sessions on topics including sources of untapped tax revenue, taxing the informal sector, building a more equitable tax system, the use of technology in tax administration, local government taxation (particularly property tax), tax transparency, and engagement with taxpayers. See the full programme here.

The ICTD has been conducting research in Sierra Leone for over a decade, with the first study published in 2013 co-authored by Dr Wilson Prichard, now the ICTD’s Executive Director, and Dr Samuel Jibao, now the Commissioner General of the NRA.

“I believe in research. As practitioners we want to hear what the data on tax has to say, because as a country we can’t rely on grants and loans, we need to mobilise domestic revenue to fund our budget and development plans.”

– Dr. Samuel Jibao, Commissioner General of the NRA

“In these hard times, it is important to engage with one another to determine the best policy options and do so transparently. That way, taxpayers can hold the government accountable for how public revenue is raised and utilised. So, it’s been fantastic to have all these stakeholders together in Freetown discussing critical tax issues over the last two days.”

– Abu Bakarr Kamara, Coordinator of BAN

“Strengthening public finances and improving domestic resource mobilisation is a top priority for us. Even in this very challenging economic context, we must create the fiscal space to allow us to safeguard our people, ensure debt sustainability, and continue making progress on our National Development Plan.”

– Dr. Yakama Manty Jones, Director of Research, Sierra Leone Ministry of Finance

Media Coverage

See media coverage highlights of the conference here.

The Sierra Leone Broadcasting Corporation’s (SLBC) Joseph Turay reported on the conference below:

SLBC programme “The Podium” had BAN Policy Analyst Abu Bakarr Tarawally on the show to discuss the conference. You can see the playback here.

Vanessa and Abu Bakarr Tarawally, a Policy Analyst at BAN, were invited to speak on Afriradio 105.3FM and Vanessa and Abu Bakarr Kamara appeared on Radio Democracy 98.1FM’s show Gud Morning Salone (watch here).

Conference sessions and materials

The presentations from the conference are available to view on Dropbox.

Opening

AYV TV recorded the opening of the conference which you can watch here.

Revenue potential and performance

The first panel was chaired by Jeneba Bangura, Deputy Commissioner General of the National Revenue Authority. Five esteemed panellists presented and discussed the topic:

- Sheku Seymour-Wilson (MRP, NRA) presented his “Assessment of the impact of reforms on compliance and revenue collection 2022.” See the presentation slides here.

- Mohamed Alie Bah (MRP, NRA) presented on “The economic potential of the tourism sector in Sierra Leone.” See the presentation slides here.

- Dr Yakama Jones (RDD, MoF) presented on “Benefit Incidence Analysis of the Basic Education and Health Sectors in Sierra Leone.” See the presentation slides here

Tax and Equity

The second session was chaired by Foday Bassie Swaray, the Executive Director of Action Aid.

- Ishmail Kamara (MRP, NRA) opened with his presentation on “Taxation of high-net-worth individuals in Sierra Leone.” See the presentation slides here.

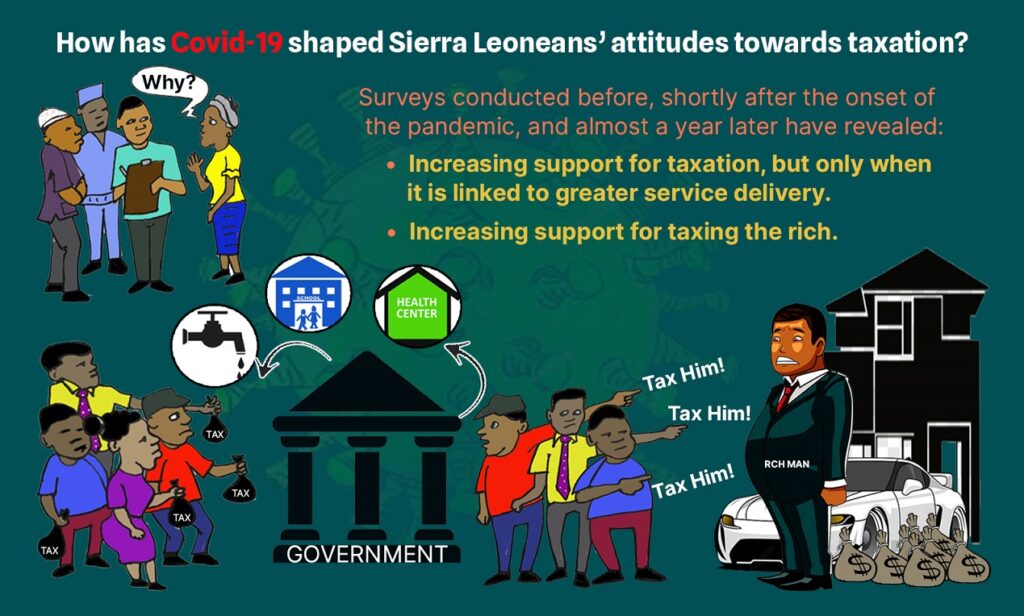

Graphic by Sahid Nasrallah, De Monk Arts & Media Production. - Next up Nicolas Orgeira Pillai (Research Associate, ICTD) presented “The politics of taxation and tax reform in times of crisis: Covid-19 and attitudes towards taxation in Sierra Leone.” See the presentation slides here.

- Aminata Kelly-Lamin (Policy and Advocacy Manager, Action Aid) presented on Action Aid’s “Fair tax monitor study for Sierra Leone.” See the presentation slides here. (Policy brief)

- Sripriya Iyengar Srivatsa (Research Associate, ICTD) presented her research on “Tax and gender in Sierra Leone.” See the presentation slides here.

Customs, excise taxes, and tax administration

Babatunde Oladapo, the Executive Secretary of the West African Tax Administration Forum (WATAF) chaired the panel, which included the following presentations:

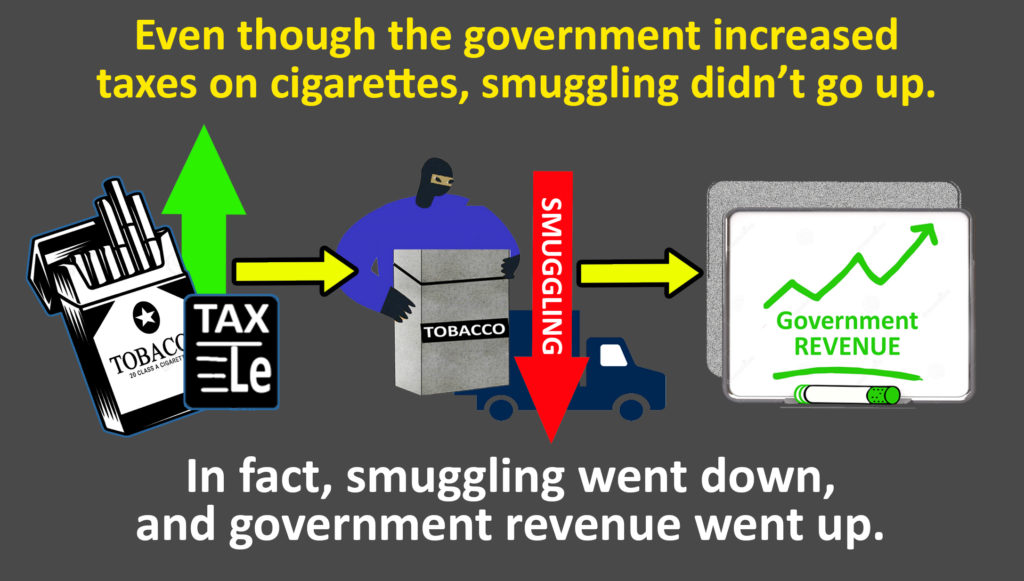

- The session saw a presentation from Giovanni Occhiali (Research Fellow, ICTD) on “Tobacco taxation and smuggling in Sierra Leone.” See the presentation slides here. (Research Summary)

Graphic by Sahid Nasrallah, De Monk Arts & Media Production. - Dr Philip Kargbo (Research Director, NRA) presented next on “ICT and tax administration in Sierra Leone“. See the presentation slides and research. (Research brief)

- Wilbourne Showers (Invest Salone) presented on “Import Duty Waiver Administrative Constraints.” See the presentation slides here.

- Franklin Bendu (Invest Salone) presented on “Assessing Importers’ Groupage in Sierra Leone.” See the presentation slides here.

Taxpayer engagement and transparency

The final session of the first day was chaired by Ibrahima Aidara, the Deputy Director of the Open Society Foundation of Africa.

- Abu Bakarr Kamara (Coordinator, BAN) presented “What do Sierra Leonean Businesses think about Tax? Key findings from Tax Perceptions Survey.” See the presentation slides here.

- Vanessa van den Boogaard (Research Fellow, ICTD) presented her research on “Tax transparency and taxpayer engagement in Sierra Leone.” See the presentation slides here. (Research in Brief; Résumé de Recherche; Shɔt TɔK Bɔt Di Risach)

- Rashid Kargbo (MRP, NRA) asks in his presentation “What drives people and business to pay tax? An analysis of taxpayer perception surveys in Sierra Leone.” See the presentation slides here.

- Sripriya Iyengar Srivatsa (Research Associate, ICTD) in her second appearance of the day presented “Identities and taxation in subnational Sierra Leone.” See the presentation slides here.

Taxation of the informal sector

Day two of the conference opened with a session chaired by Marcella Samba-Sesay, the Executive Director of the Campaign for Good Governance, Sierra Leone. The presentations were as follows:

- Vanessa presented first on “Taxation of the informal economy: Challenges and risks“. See the presentation slides here. (Research Summary)

- Giovanni presented his work “Catch them if you can: The practice of a taxpayer registration exercise in Freetown“. See the presentation slides here.

- Rashid Kargbo (MRP, NRA) presented his NRA research “Taxation of the informal sector in Sierra Leone“. See the presentation slides here.

- Alhaji Komeh (RDD, MoF) presented “Informality study: Methods and expected outputs“. See the presentation slides here.

Local government taxation in the provinces

The second session of the day was chaired by Adams Tommy a Project Manager at the World Bank and Lecturer at Njala University. The session featured:

- Kevin Grieco (PhD candidate, UCLA) in his presentation asks “Can Traditional Political Institutions Help the State Raise Revenue?“. See the presentation slides here.

- Vanessa presented next on “Taxation in rural areas: Challenges and implications“. See the presentation slides here. (Research Summary)

- Nicolas presented on “A Sub-National Property Tax Reform and Tax Bargaining: A Quasi-Randomized Evaluation from Sierra Leone“. See the presentation slides here.

Property taxation in Freetown

The third session of day two was chaired by Dr Ezekiel Kalvin Duramamy-Lakkoh, the Dean of the Faculty of Accounting and Finance at the University of Sierra Leone.

- Rosetta Wilson (Property Tax Reform Coordinator, Freetown City Council) and Emile Eleveld (Project Manager, IGC/ ICTD) opened the session with a joint presentation on “Property Tax Reform: A New Model and Lessons Learned“.

- Next Abou Bakarr Kamara (Country Economist, IGC) presented “Strengthening fiscal contracts through digital town halls in Freetown“

- James Suah Shilue (Director, P4DP) presented research on “Property tax reform in Liberia“. See the presentation slides here.

- To close Michael Rozelle on behalf of Laura Montenbruck (PhD student, University of Mannheim) presented “Perceived fiscal exchange and tax compliance in Freetown, Sierra Leone“. See their presentation slides here

Informal taxation

The last session of the conference was chaired by Samuel Wise Bangura of AYV TV. Vanessa presented several research papers in this session, including:

- “Informal taxation and revenue generation in Sierra Leone” (Research in Brief; Résumé de Recherche; Shɔt TɔK Bɔt Di Risach)

- “Gender and formal and informal taxation in Sierra Leone” (Research in Brief; Résumé de Recherche; Shɔt TɔK Bɔt Di Risach)

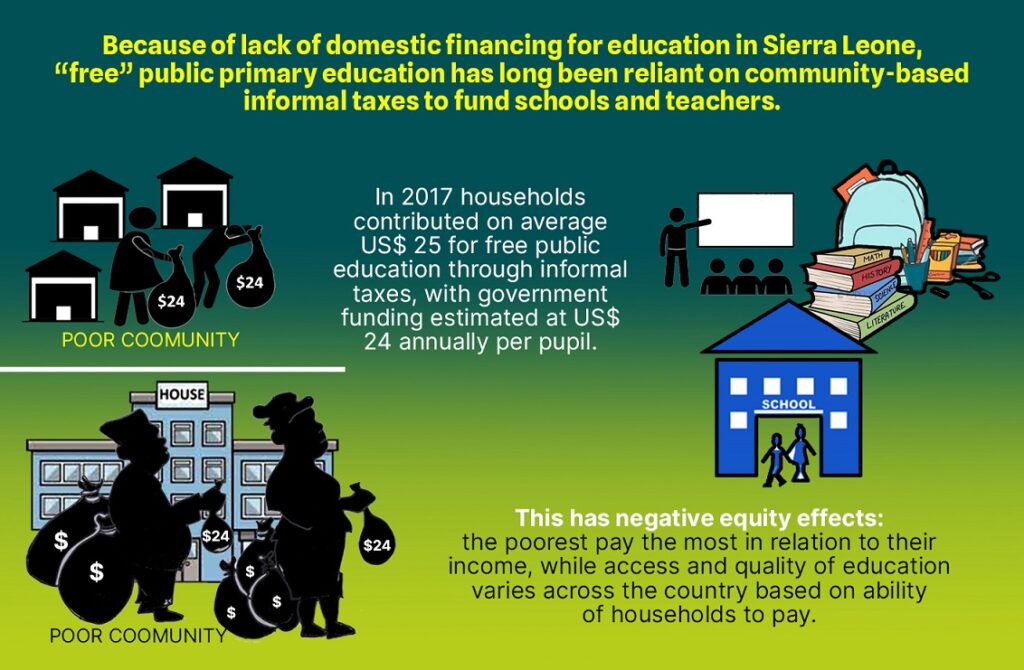

- And on “Informal taxation, education, and equity in Sierra Leone” (Research in Brief)

Graphic by Sahid Nasrallah, De Monk Arts & Media Production. - Finally Nicolas presented “Informal taxes and pandemic relief during the pandemic in Freetown“

Vanessa van den Boogaard and Abu Bakarr Kamara (BAN) expressed their thanks to each other in planning the event and to all the presenters and attendees for their participation in the conference at the closing.

Pictures

See the photos from the event in the Facebook album or find them in larger format on our Flickr.