Informality and Tax

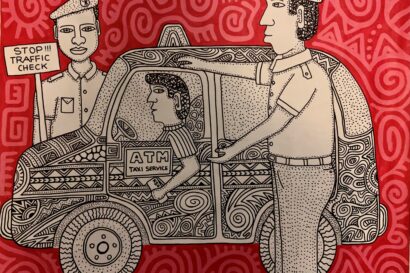

While research has historically focused on formal systems of taxation and user fees, there is mounting evidence of the importance of “informal” taxation for average taxpayers in much of Africa. While lying outside of statutory laws, the “tax-like” payments – which include informal user fees, informal contributions to community development projects, and informal payments to both state and non-state officials – impose a significant burden on many taxpayers, while playing a critical role in financing local public goods and services and shaping broader local governance. Our research aims to map the extent, composition and experiences of these payments, and to understand their implications for livelihoods, fiscal decentralisation, service delivery and broader local governance reform.