This dataset was created by the Nigerian Economic Summit Group. Read the blog about it by Neil McCulloch and Tom Moerenhout here.

To discover the attitudes and perceptions of Nigerians towards tax compliance and fuel subsidies, two major quantitative surveys were undertaken – a household survey and a survey of small firms. These were complemented by extensive qualitative research including Focus Group Discussions (FGD) and In-Depth Interviews (IDI) with tax officials in selected states.

The data collection process was coordinated by Neil McCulloch and Tom Moerenhout and funded by the Bill & Melinda Gates Foundation. The Nigeria-based survey firm ‘Practical Sampling International’ was hired to conduct the data collection exercise. The survey and FGDs were piloted in May 2018, and the data-collection exercise was conducted in July and August 2018.

The publication of the data includes the following (click to download each):

• Household survey dataset

• Household questionnaire

• Translated household questionnaires (in Hausa, in Igbo, in Pidgin, in Yoruba)

• Household codebook

• Firm survey dataset

• Firm questionnaire

• Translated firm questionnaires (in Hausa, in Igbo, in Pidgin, in Yoruba)

• Firm codebook

• Summaries of FGDs

• Anonymized summaries of IDIs

• Qualitative guides for FGDs and IDIs

• Training manuals

Methodology

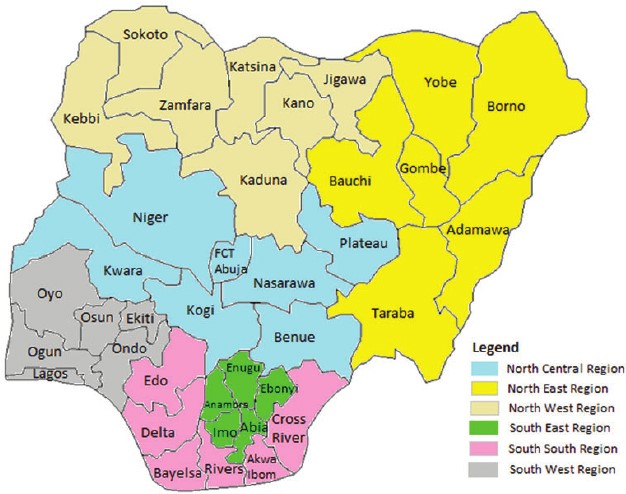

The basic methodology employed for data collection was in-home, face-to-face personal interview using a clustered, stratified, multi-stage random selection procedure to achieve a nationally representative sample. The main sample of 10,000 individuals provides an excellent picture of people’s perceptions on tax issues at the national and regional level. However, it was also desired to be able to provide representative results at the State level. Doing this for every state would have been prohibitively expensive. Therefore, a separate ‘over-sample’ was done in six states – one in each geo-political zone. The States selected for the ‘over-sample’ were:

- Ogun (South-West)

- Rivers (South-South)

- Abia (South-East)

- Nasarawa (North-Central)

- Kano (North-West)

- Bauchi (North-East)

In addition to – and at the same time as – the household/individual survey, a survey was conducted of 5,000 small firms. The National Bureau of Statistics definition of firm size was used, which defines firms as: micro (1-10 employees); small (10-49 employees); medium (50-199); large (200+). Because few firms exist with over 10 employees in rural areas, the project team defined small firms for the purpose of this survey as having between 5 and 49 employees. This survey included both registered and unregistered firms.

You can read the full methodology in the dataset’s introduction document here. For more details see the field technical and methodological report here.