May 31st was World No Tobacco Day. Every year, tobacco use causes more than 8 million deaths globally, and 80% of the world’s smokers live in low- and middle-income countries. The costs of tobacco are high in terms of the negative impacts on public health and the economy.

Increasing taxes on tobacco is the most effective way to reduce tobacco consumption, while also raising government revenues. However, as a policy tool, tobacco tax is widely underutilised. This is partly due to lobbying by the industry, which often makes exaggerated and false claims about the potential impacts of increasing taxes. With a large, young population, a desire to attract foreign investment, and weak tobacco control policies, Africa is vulnerable to the tobacco industry. Therefore, rigorous independent research and evidence is needed to inform policymakers in developing countries. To contribute to this, we’ve launched a new page with resources and analysis on the issue.

The page features our latest summary brief by Research Fellow Max Gallien (available in English and French). It draws on recent studies from across Africa, highlighting the complex relationship between smuggling and taxation, and arguing that smuggling should not deter African governments from increasing taxes on tobacco products. The French version of the page features a new blog on tobacco taxation in Burkina Faso by our Research Intern Soukayna Remmal.

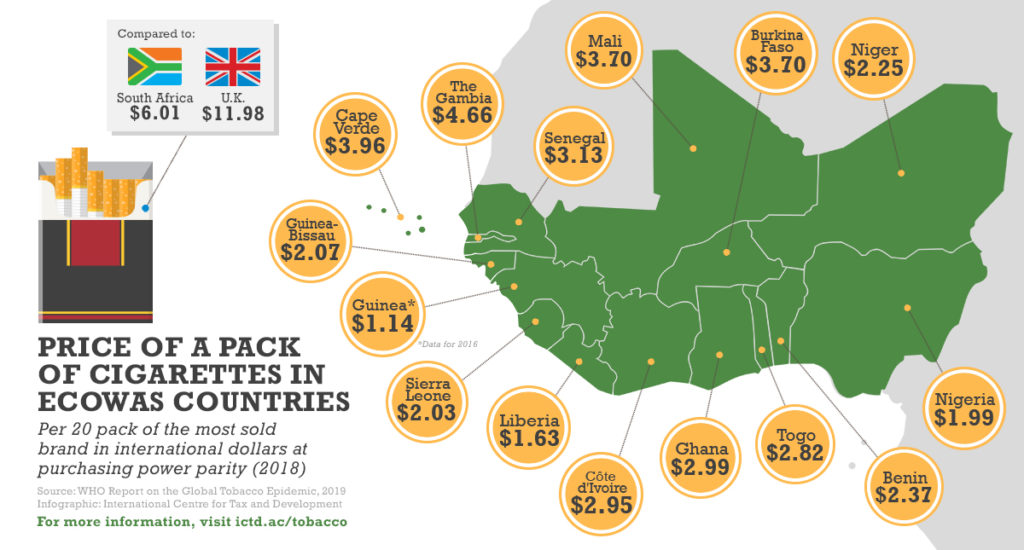

In addition, as part of the project on tobacco tax reform in West Africa in partnership with CRES (Senegal) and REEP (University of Cape Town), we have just published a series of tobacco taxation factsheets for all the ECOWAS countries. The project is part of the Economics of Tobacco Control Research Initiative funded by the International Development Research Centre and Cancer Research UK. The factsheets outline the costs of smoking (in terms of deaths, healthcare, and lost productivity), and make detailed recommendations for how each country can increase tobacco taxes in order to reduce these costs and be in line with the regional ECOWAS directive. The factsheets are available in both English and French.

Explore our new page on tobacco taxation.

Explorez notre nouvelle plateforme sur la taxation du tabac.