Research in Brief 16

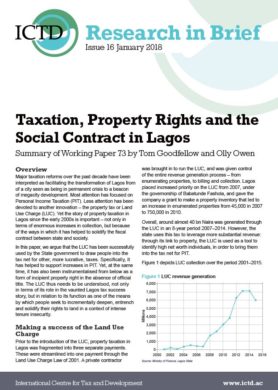

Major taxation reforms over the past decade have been interpreted as facilitating the transformation of Lagos from of a city seen as in permanent ‘crisis’ to a beacon of ‘megacity development’. Most attention has focused on Personal Income Taxation (PIT). Less attention has been devoted to another innovation – the property tax or Land Use Charge (LUC). Yet the story of property taxation in Lagos since the early 2000s is important not only in terms of enormous increases in collection, but because of the ways in which it has helped to solidify the ‘fiscal contract’ between state and society. Read the full working paper here.