Research in Brief 65

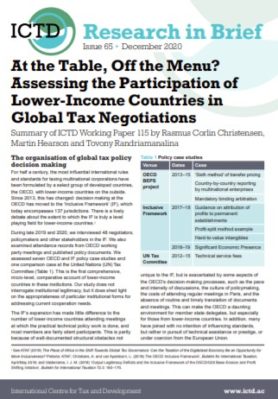

For half a century, the most influential international rules and standards for taxing multinational corporations have been formulated by a select group of developed countries, the OECD, with lower-income countries on the outside. Since 2013, this has changed: decision making at the OECD has moved to the ‘Inclusive Framework’ (IF), which today encompasses 137 jurisdictions. There is a lively debate about the extent to which the IF is truly a level playing field for lower-income countries. During late 2019 and 2020, we interviewed 48 negotiators, policymakers and other stakeholders in the IF. We also examined attendance records from OECD working party meetings and published policy documents. We assessed seven OECD and IF policy case studies and one comparison case at the United Nations (UN) Tax Committee (Table 1). This is the first comprehensive, micro-level, comparative account of lower-income countries in these institutions. Our study does not interrogate institutional legitimacy, but it does shed light on the appropriateness of particular institutional forms for addressing current cooperation needs. The IF’s expansion has made little difference to the number of lower-income countries attending meetings at which the practical technical policy work is done, and most members are fairly silent participants. This is partly because of well-documented structural obstacles not unique to the IF, but is exacerbated by some aspects of the OECD’s decision-making processes, such as the pace and intensity of discussions, the culture of policymaking, the costs of attending regular meetings in Paris, and the absence of routine and timely translation of documents and meetings. This can make the OECD a daunting environment for member state delegates, but especially for those from lower-income countries. In addition, many have joined with no intention of influencing standards, but rather in pursuit of technical assistance or prestige, or under coercion from the European Union. Summary of ICTD Working Paper 115 by Rasmus Corlin Christensen, Martin Hearson and Tovony Randriamanalina.