For more than 30 years, the World Health Organization (WHO) has designated May 31 as World No Tobacco Day, which aims to inform the public of the danger of using tobacco, the leading preventable cause of death in the world.On this day, we’re pleased to share with you our new website Taxing Tobacco in West Africa!

Tobacco kills more than 8 million people each year, and over 80% of the world’s smokers live in low- and middle-income countries. Increasing taxes on tobacco is the most cost-effective way to reduce tobacco use and its high cost to society, while also raising government revenue.

However, tobacco taxes are widely underutilised, particularly across Africa, where cigarettes have actually become more affordable in the last four years. With this trend, the WHO estimates that the number of tobacco-attributable deaths on the continent will double by 2030.

The WHO recommends that tobacco excise taxes account for at least 70% of the retail prices for tobacco products. In West Africa, the average falls far below this, at just 14%. In 2017, the Economic Community of West African States (ECOWAS) adopted a directive on tobacco taxation that set minimums for ad valorem and specific taxes on tobacco products, but so far, no country has implemented it fully.

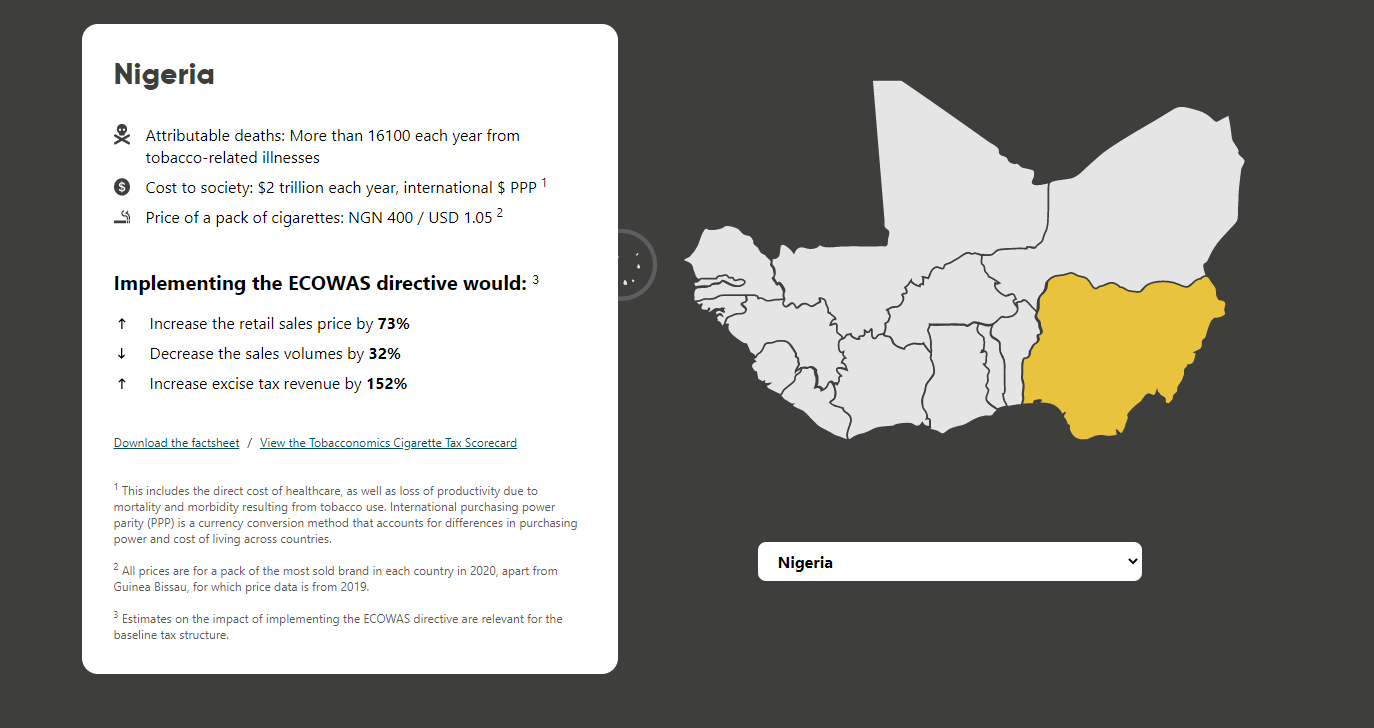

If the 15 ECOWAS members implement the ECOWAS directive, it would substantially increase the retail price of cigarettes (by an average of 51%) and decrease sales volumes (22%), while increasing tax revenue by nearly 400%. This would be a major change and would increase the excise tax burden in the ECOWAS countries to 37%, higher than the African regional average of 28%.

Our new interactive website has a trove of data for each West African country on deaths attributable to tobacco, its cost to society each year, and how implementing the ECOWAS directive would improve the situation for each country.

The site was produced as part of a project in partnership with the Research Unit on the Economics of Excisable Products (REEP) in South Africa and the Consortium pour la recherche économique et sociale (CRES) in Senegal, which was funded by the IDRC and CRUK Economics of Tobacco Control Research Initiative.

In order to avert the enormous costs of the looming tobacco epidemic to lives, livelihoods and health budgets, it is urgent for West African governments to implement the ECOWAS directive. Increasing taxes on tobacco is a clear win-win policy for public health and the economies of the region.

Explore the site at tobaccotax.info!

Le site est également disponible en français ici.