For more than 30 years, the World Health Organization (WHO) has designated May 31 as World No Tobacco Day, which aims to inform the public of the danger of using tobacco, the leading preventable cause of death in the world.

A looming threat

Africa is vulnerable to the tobacco industry. While global smoking rates have dropped by more than 10% since 2000, tobacco consumption is climbing in Africa. The WHO estimates that the number of tobacco-attributable deaths on the continent will double by 2030.

This is being driven by the tobacco industry using aggressive marketing tactics to target the continent’s young and growing population as well as lobbying and intimidating governments to undermine regulation.

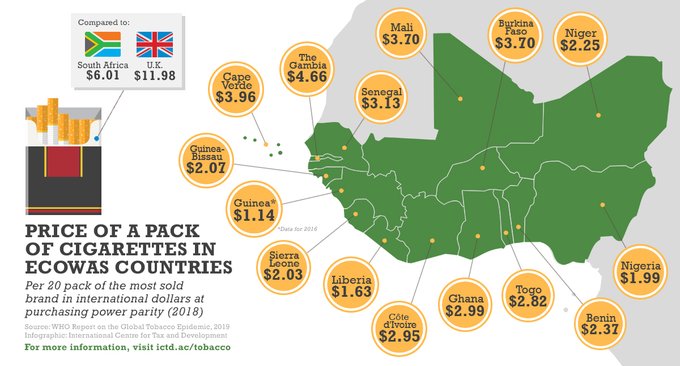

The societal costs of smoking are very high, both in terms of the direct costs to healthcare and the loss of productivity resulting from illness and death. While increasing the price of tobacco products is widely recognised as one of the most effective ways to prevent tobacco use and promote cessation, cigarettes actually became more affordable across West Africa between 2008 and 2018.

Cheap cigarettes: Between 2008 and 2018, cigarettes actually became more affordable across West Africa, with prices for a pack of 20 of the most sold brand ranging from between $1.14 and $4.66 in international dollars at purchasing power parity.

The efficacy of increasing taxes on tobacco

Taxing tobacco is the most cost-effective measure to reduce tobacco consumption and improve health outcomes, especially among youth, while also raising government revenues.

Nevertheless, Africa lags well behind other regions in implementing strong tobacco tax policies. The WHO recommends that tobacco excise taxes account for at least 70% of the retail prices for tobacco products. In West Africa, the average falls far below this, at just 14%.

The under-utilisation of tobacco taxes is in large part due to the tobacco industry, which often makes exaggerated and false claims about the potential impacts of increasing taxes, especially that it will increase smuggling. However, investigation has revealed that major tobacco companies have benefited from and been directly involved in fuelling the illicit tobacco trade, including British American Tobacco recently in West Africa.

Available research indicates that the relationship between taxation and smuggling is more complex, and that this scare tactic should not deter governments from increasing taxes on tobacco products. Still, more rigorous and independent research is needed to inform policymakers in the region, as our joint project aims to provide.

Research study models the impact of tobacco tax policies in West Africa

To combat the rising rates of tobacco consumption in the region, the two economic blocs adopted new directives on tobacco taxation in December 2017. The Economic Community of West African States (ECOWAS) consists of 15 countries (Benin, Burkina Faso, Cabo Verde, Cote d’Ivoire, the Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone, and Togo), while WAEMU is a subset of ECOWAS with 8 francophone member countries.

Both directives increased the minimum ad valorem excise on tobacco to 50%. This rate is levied on the import value/producer price, which is very low compared to the retail price in West Africa, and therefore has only a small impact on the total tax charged. Importantly, the ECOWAS Directive also introduced a minimum specific tax of USD 0.02 per cigarette, which does not depend on prices and is more effective in increasing the total tax burden.

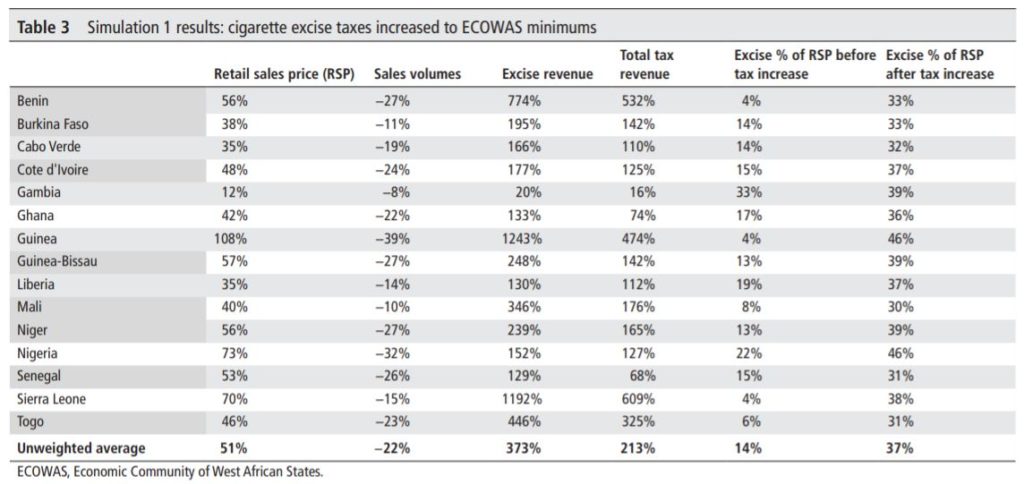

In a recently published study, Corné Van Walbeek and I used tax simulation models with comparable data for each of the 15 ECOWAS countries, using each country’s tax rates and structures, to estimate the effects of the two directives on cigarette prices, sales volumes and tax revenues (see table below).

If the 15 ECOWAS members implement the ECOWAS Directive, it would substantially increase the retail price of cigarettes (by an average of 51%) and decrease sales volumes (22%), while increasing tax revenue by nearly 400%. This would be a major change and would increase the excise tax burden in the ECOWAS countries to 37%, higher than the African regional average of 28%.

In contrast, the impact of the WAEMU Directive is minimal. Cigarette prices increase only 2% as sales fall by 1%, and tax revenues would only increase by 17%. In three of the eight WAEMU countries, the new directive does not require any changes to the status quo.

Increasing cigarette excise taxes to the ECOWAS minimums would substantially increase retail prices, reduce sales volumes, and increase tax revenues by nearly 400%.

Averting death and disease, and raising revenue for development

Based on the results from tax simulation models, we strongly recommended that ECOWAS member states implement the Directive and that WAEMU member countries opt to comply with the ECOWAS rather than the WAEMU Directive.

While no country in West Africa has yet brought its policies in line with the ECOWAS Directive, it is critically important that they do so. The costs of tobacco in the region will only continue to grow if governments do not take decisive action to limit its use.

In the context of the Covid-19 pandemic, organisations including the IMF, World Bank, and OECD have urged governments to increase taxes on harmful products like tobacco to help finance health systems and the recovery. Civil society organisations in West Africa (including for example in Ghana, Nigeria, and Cote d’Ivoire) have also been advocating for hiking tobacco taxes.

In order to avert the enormous costs of the looming tobacco epidemic to lives, livelihoods and health budgets, it is urgent for governments to implement such a win-win policy for public health and the economies of West Africa.

See our factsheets on all 15 ECOWAS countries to learn more.

This piece was written with support from Rhiannon McCluskey.