The ninth session of the Conference of the Parties to the World Health Organization Framework Convention for Tobacco Control (or COP 9) wrapped up on November 13. The discussions saw 161 countries, UN agencies, other intergovernmental organisations and civil society groups consider strategies to implement tobacco control measures more effectively, including taxation, and to stop industry interference in efforts made to end the tobacco epidemic, which strains Covid-19 recovery efforts and causes more than 8 million deaths globally each year.

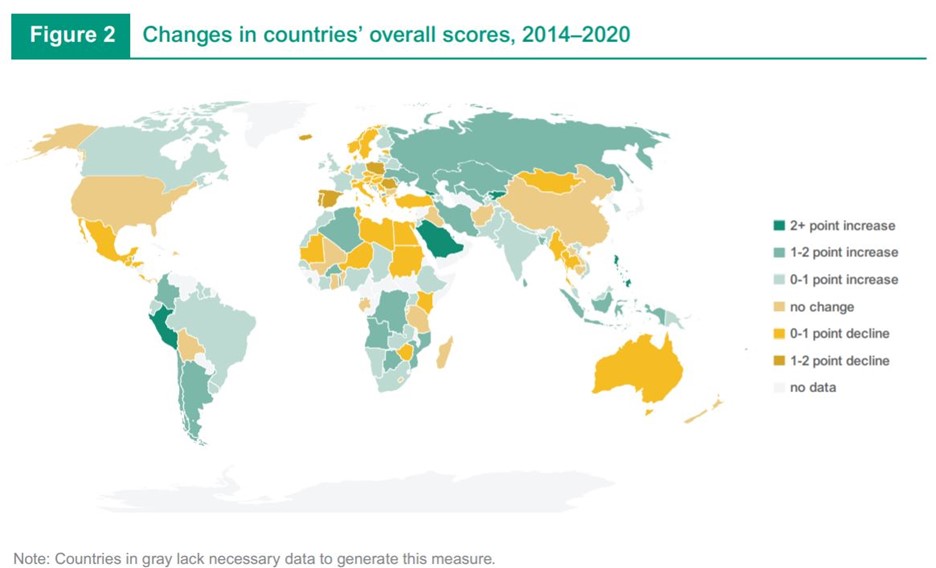

In the lead up to COP 9, the Tobacconomics team published the second edition of the Cigarette Tax Scorecard. Using new data from the WHO’s 2021 Report on the Global Tobacco Epidemic, the scorecard assesses countries’ cigarette tax policies in relation to widely accepted best practices for cigarette taxation.

The scorecard shows that African countries would benefit from improvements to their cigarette tax policies, based on four key components: cigarette price, change in affordability, tax structure, and tax share of retail price.

Low scores, yet signs of progress

The African region continues to rank the lowest on the scorecard, with an average of 1.64 out of 5.00 points. Still, there are signs of progress.

Liberia has demonstrated the largest overall score jump (0.5 to 3.125), while Mozambique had the largest increase in the tax structure score, which was due to a change from a tiered excise tax structure to a best-practice uniform specific cigarette excise tax that is automatically adjusted for inflation. Among the African countries, Botswana, Eswatini, Lesotho, Mozambique, Namibia, and South Africa implement this best-practice tax structure.

Chad’s and Liberia’s tax structure scores also significantly improved due to a change from a uniform ad valorem system to a mixed system with a greater share of specific tax. Taken together, these improvements allowed the African region to experience the highest average gain in the tax structure component, and one of the highest gains of overall score among the WHO regions.

Botswana’s cigarette tax policy is a high performer globally, with a uniform specific tax structure that is automatically updated for inflation, a significant reduction of affordability of cigarettes of nearly 8% annually over the past six years, and a price of the most-sold brand of cigarettes at over $Intl PPP 10.00. In fact, both Botswana and Seychelles rank 5th globally, with overall scores of 4.13.

Cigarettes still cheap and readily available

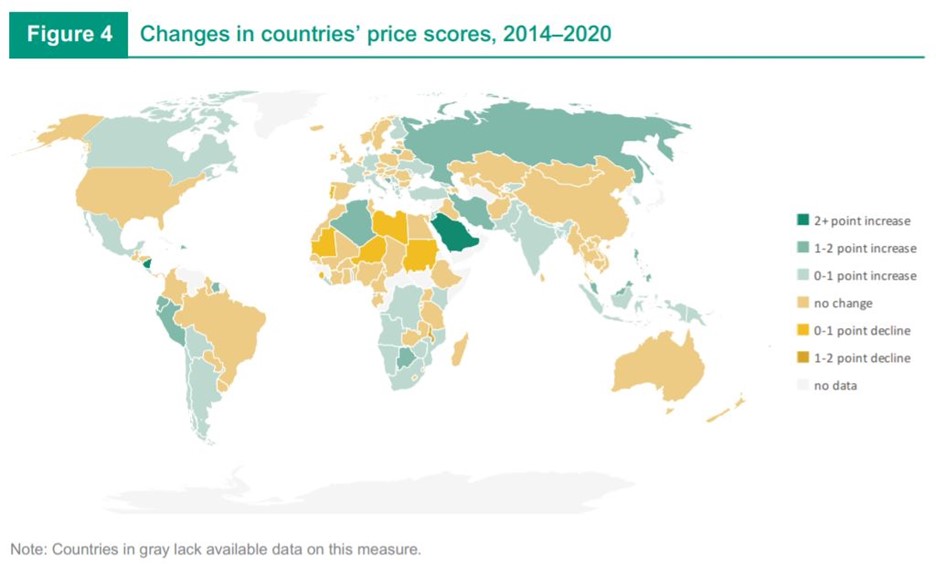

However, there are also several red flags for the region, with average cigarette prices (Intl$ PPP) at $4.10 in African countries being the lowest in the world.

Average cigarette prices in low-income countries—many of which are in Africa—actually decreased from 2018 to 2020 by $Intl PPP 0.28 and cigarettes became more affordable.

This Scorecard component is based on the price of a 20-cigarette pack of the most-sold brand in international dollars, adjusted for purchasing power parity (PPP).

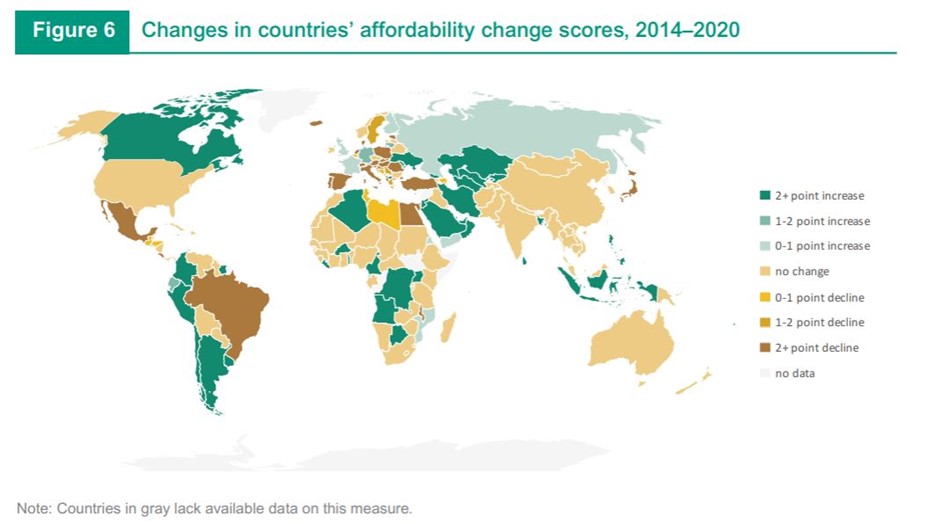

Lowering cigarette prices makes them cheaper and more accessible to low-income populations, especially young people. Whereas girls’ smoking prevalence was previously significantly lower than boys’ in Africa, it has been catching up and even surpassing boys’ in some countries.

The tobacco industry keeps prices low in Africa in order to expand their market in the region. They are able to subsidise cigarette prices in countries such as Chad, Madagascar, Mali, Niger, and Sierra Leone, while maintaining stable global profits, by increasing prices in other regions with more mature markets, such as the Western Pacific and Americas.

These expanded markets translate into increases in smoking prevalence and the resulting tobacco-related diseases and deaths (WHO estimates they will double in Africa by 2030), not to mention the economic burdens of added health care spending and lost productivity.

Tobacco products remain affordable in Africa

According to the scorecard, the African region has not raised its cigarette taxes by more than average income increases, which means that cigarettes have become more affordable for its citizens.

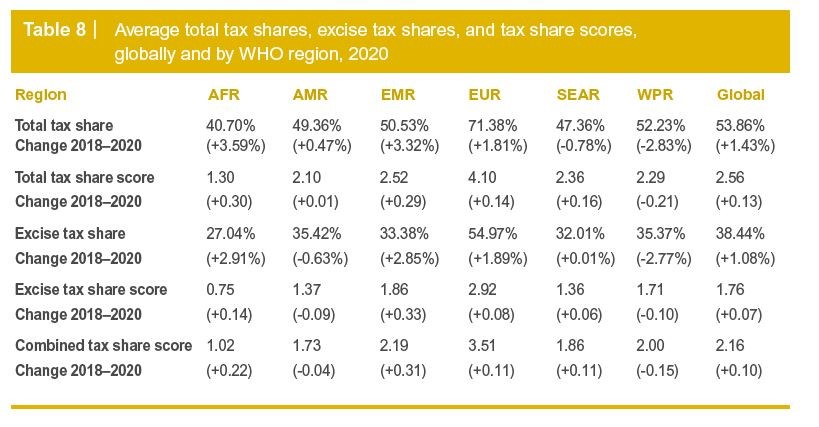

Countries in Africa also have the lowest tax shares in the world at only 40.7%, far lower than the widely-accepted best practice of benchmark that tobacco excise tax account for at least 70% of retail prices of tobacco products. However, the region has also seen the highest average gains in total tax share and excise tax share from 2018 to 2020.

Overall, only 8 African countries rank in the top half of the scorecard. Among these, only Botswana (4.13), Seychelles (4.13), Liberia (3.13), and Mauritius (3.13) rank in the top 50 countries.

Effective implementation vital for increased revenue and improved public health

The scorecard results show that by strengthening tax design and raising cigarette tax rates, African countries can reduce smoking and generate revenues to address economic and public health burdens. Previously, South Africa was heralded globally as an example of successful tobacco taxation for public health. In ten years of tobacco tax increases beginning in 1994, consumption fell by 36%, saving thousands of lives and increasing tax revenues for social programmes.

The current challenge is in effective implementation, as most governments are still failing to apply successful tax policies, despite some improvements.

To create a win-win scenario for public health and increased revenues for Covid-19 recovery, African governments must seize the opportunity to substantially improve their cigarette tax policies.

Doing so would improve population health and governments could also reap significant fiscal benefits through increased tax revenues.

To find out more, read the full scorecard report here.