Since the pioneering mobile money service M-PESA was launched in Kenya in 2007, helping to drive impressive gains in financial inclusion, mobile money has been widely seen as a new engine for global development.

But since these services also tend to be engines of profit, governments in Africa are increasingly eyeing mobile money and other digital financial services (DFS) as a lucrative source of tax revenue. Ghana is the latest country to push forward with a new tax on electronic transactions, despite uncertainty over its effects and design.

While the government sees the tax as a way of shoring up public finances, critics are calling the e-levy – and others like it in Uganda, Cameroon, and Zimbabwe – “punishing.” They stress that the burden of these taxes “falls disproportionately on the poor,” suggesting that they “could dent” the growth of Africa’s digital economy or even “reverse all the gains made with digital financial services, leading clients to revert to cash.”

Given that these taxes are relatively new, the jury is still out on their full impacts. But with more than a decade of research on the spread of DFS, can we make any confident predictions about their effects? What clues does the evidence hold, and where is further research needed?

Understanding the Research on Digital Financial Services

Designing better tax policies for DFS without adversely affecting the adoption and use of these services requires an understanding of:

- the factors that enable usage of DFS, and

- the potential impacts of DFS

If DFS is the developmental driver some have proclaimed it to be, then taxing it could have serious repercussions. But if the impacts of DFS are overblown, as others argue, then so too are the repercussions of taxing it. This raises a clear question: Just how instrumental are these services? An equally clear answer requires navigating the broad but largely uncharted landscape of research on DFS, which can be dicey. What – and where – is the evidence? Where is it well-established, still nascent or non-existent? And where are there gaps?

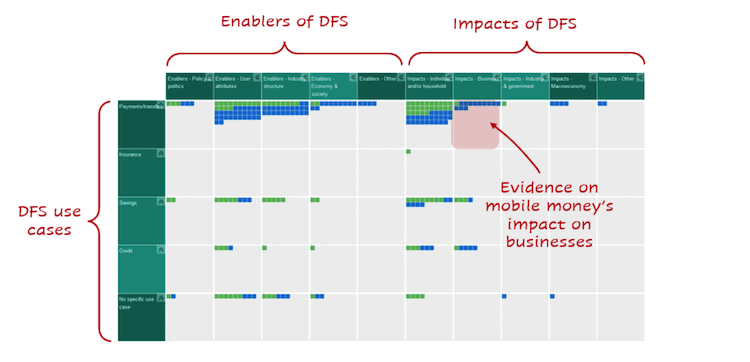

To begin to answer these questions, the International Centre for Tax and Development created an Evidence Gap Map (EGM). The EGM presents an intuitive, user-friendly visual overview of where evidence is lacking, and where it exists, in a curated and organised manner.

While EGMs do not provide a systematic review of the contents of research, they do synthesise a wide range of research evidence and provide a starting point for users to do their own, more in-depth reviews.

Using the Evidence Gap Map

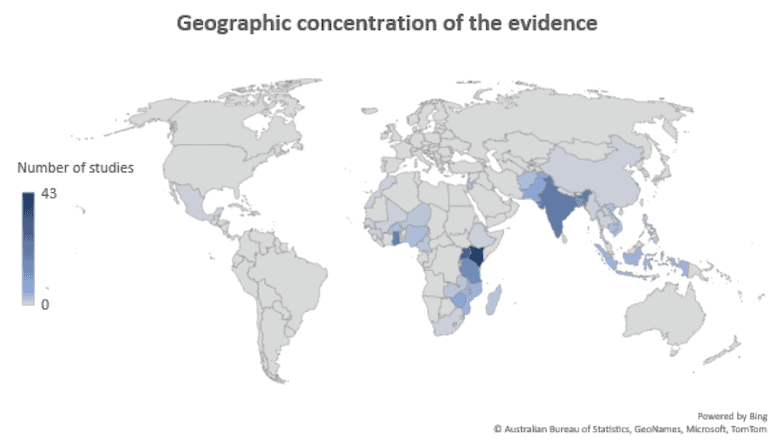

To create the Evidence Gap Map, we searched a variety of databases in May 2021 using a series of search terms, such as “mobile money” or “digital financial services,” and filtering the results by location (low- and middle-income countries only) and time (after 2007). At this stage, we only excluded studies whose titles or geographic locations fell outside our scope. From this, we identified nearly 400 studies. Next, we screened the study abstracts, resulting in a final sample of 205 studies, whose quality we then assessed. Using a bespoke grading system, we determined that it is possible to have “high” confidence in the results of 40 of these studies, “medium” confidence in a further 97 and “low” confidence in the remaining 68.

Our two interactive maps are based on the high- and medium-confidence studies. One map shows the high- and medium-confidence studies together. The second map delves deeper into the high-confidence studies.

The maps offer one-click access to the most relevant studies. Imagine someone wants to answer the question: “What does the research say about mobile money’s impact on businesses?”. Using these maps, they can readily access the most relevant evidence in relation to different DFS use cases (such as payments, savings or credit) and different enablers or impacts.

What Kind of Evidence on DFS is out there?

Much of the research on DFS is very new: Most publications are from 2017 onwards. The research is concentrated on sub-Saharan Africa. We found a large number of studies on payments and transfers (mobile money), fewer on savings and credit, and none at all on insurance.

Most of the evidence is concentrated on how user attributes and industry structures affect DFS usage, and on the impact of DFS on individuals and households. But there is much less evidence on how policy and politics – including taxation – and macroeconomic factors affect DFS usage.

The EGM does not show whether results are positive, negative or mixed. We plan to update the map soon with evidence published after mid-2021.

There are large evidence gaps on core questions, such as the impact of the growth of DFS on the macro-economy and government activities. This is relevant because some opponents of taxes on DFS have argued that taxing DFS might ultimately reduce, rather than improve, tax intake.

For instance, if entrepreneurs who use DFS payment options can no longer afford these services after the tax is implemented, and lose access to the customers they’d served via digital marketplaces, their business growth – and economic growth more broadly – will be lower, and tax revenues from business income taxes will ultimately be smaller.

However, at least based on the current evidence, we cannot say with any certainty whether this is true or not.

Where Do We Go From Here?

Returning to Ghana’s e-levy and other similar taxes, what does the evidence say, and what’s next? For starters, it is clear that direct evidence on the impacts of taxes themselves is still lacking at this point in time. Still, there are informative findings that can provide a solid basis for cogent arguments about potential impacts.

For instance, among our high-confidence studies, several of them (in Mozambique, Kenya and Tanzania) showed that mobile money users are less vulnerable to adverse shocks than non-users. This is because they can access funding from a wider network via remittances, to continue covering their essential expenses.

So if we assume that taxes are at least partially passed on to consumers, increasing the cost, and mobile money use reduces as a result of these cost increases, then some households might become less financially resilient. Admittedly, this argument rests on many assumptions, which may not hold: For example, mobile money users might find good substitutes with which to mitigate any price increases.

A 2017 paper suggests that demand for long-distance mobile money transfers is less price-elastic than for short-distance transfers, which means that mobile money users might walk an extra mile or pay for a local service in cash to avoid the tax, but will still send money to relatives in the countryside when needed.

More generally, we also don’t have strong evidence on whether DFS usage has any more transformative effects, like longer-term poverty alleviation or greater wealth accumulation. This means that while the evidence incontestably contains many interesting insights on the impacts of taxes on DFS, there is still no smoking gun in sight.

So, to truly answer the question on the impact of taxes on mobile money and other DFS, there’s only one clear path: More research must be conducted to provide a broader – and richer – body of evidence.

Learn more about the Evidence Gap Map here.

This blog was first published by NextBillion here.