Working Paper 142

Digital financial services (DFS) have expanded rapidly over the last decade, particularly in sub-Saharan Africa. They have been accompanied by claims that they can alleviate poverty, empower women, help businesses grow, and improve macroeconomic outcomes and government effectiveness. As they have become more widespread, some controversy has arisen as governments have identified DFS revenues and profits as potential sources of tax revenue. Evidence-based policy in relation to taxing DFS requires an understanding of the enablers and barriers (preconditions) of DFS, as well as the impacts of DFS.

This report aims to present insights from an Evidence Gap Map (EGM) on the enablers and barriers, and subsequent impacts, of DFS, including any research related to taxation. An EGM serves to clearly identify the gaps in the evidence base in a visually intuitive way, allowing researchers to address these gaps. This can help to shape future research agendas.

Our EGM draws on elements from the systematic review methodology. We develop a transparent set of inclusion criteria and comprehensive search strategy to identify relevant studies, and assess the confidence we can place in their causal findings. An extensive search initially identified 389 studies, 205 of which met the inclusion criteria and were assessed based on criteria of cogency, transparency and credibility. We categorised 40 studies as high confidence, 97 as medium confidence, and 68 as low confidence.

We find that the evidence base is still relatively thin, but growing rapidly. The high-confidence evidence base is dominated by quantitative approaches, especially experimental study designs. The geographical focus of many studies is East Africa. The dominant DFS intervention studied is mobile money. The majority of studies focus on DFS usage for payments and transfers; fewer studies focus on savings, very few on credit, and none on insurance. The strongest evidence base on enablers and barriers relates to how user attributes and industry structure affect DFS. Little is known about how policy and politics, including taxation, and macroeconomic and social factors, affect DFS. The evidence base on impacts is strongest at the individual and household level, and partly covers the business level. The impact of DFS on the macroeconomy, and the meso level of industry and government, is very limited. We find no high-confidence evidence on the role of taxation.

We need more higher quality evidence on a variety of topics. This should particularly look at enablers, constraints and impacts, including the role of taxation, beyond the individual and household level. Research going forward should cover more geographic areas and a wider range of purposes DFS can serve (use cases), including savings, and particularly credit. More methodological variety should be encouraged – experiments can be useful, but are not the best method for all research questions.

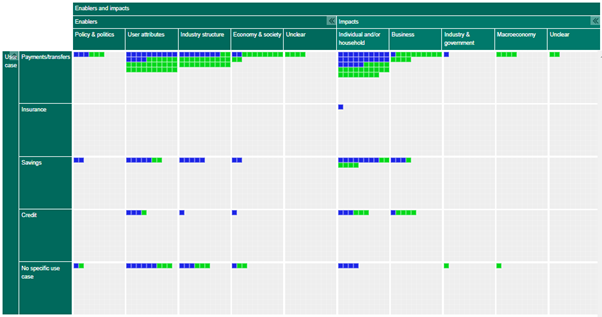

The Interactive Maps

You can navigate two interactive maps of the evidence:

1. A combined map of high-confidence and medium-confidence studies at a high level of generality. In this map, green boxes indicate high confidence studies while blue boxes indicate medium confidence studies.

Digital Financial Services Enablers and Impacts: High and Medium Confidence Studies

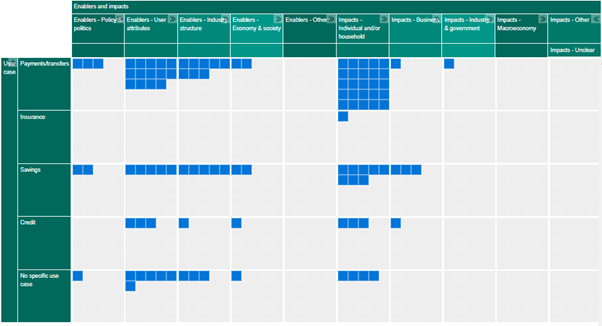

2. A map of only high-confidence studies, at a detailed level (blue boxes only).

DFS Enablers and Impacts: High confidence only

What the EGM does:

The horizontal axis shows different enablers, barriers, and impacts of DFS, while the vertical axis is what DFS are used for (e.g. making payments, savings, etc.). Clicking on a box brings up a panel with details on each study that contains evidence on a particular enabler/barrier/impact type and use case.

What the EGM does not do:

The presence of evidence does not imply that the evidence is positive, negative, or conclusive in any way. For this, users must read the original study.