Ghanaian local governments – metropolitan, municipal, and district assemblies (MMDAs) – face several challenges preventing them from raising more revenue from property taxes. These challenges include limited access to information about properties such as location, ownership and accurate valuations.

As part of its programmes, VNG International (the International Cooperation Agency of the Association of Netherlands Municipalities), developed a systems approach for 33 Ghanaian MMDAs seeking to sustainably increase property tax revenues. This approach was initiated in 2018 through the Tax Revenue for Economic Enhancement (TREE) project, spanning five years across MMDAs in the Western, Central and Ashanti regions. The project was implemented in partnership with the Dutch Embassy in Ghana, the Ghanaian Ministries of Finance, Local Government and Rural Development, and three regional Ministries.

Objectives of the systems approach

The systems approach implemented had three objectives:

- Improve the entire revenue collection process by introducing information technology (IT) tools and training the responsible staff members on how to use them.

- Bolster the reliability and accountability of the local government with MMDAs’ political leaders and staff by emphasising the social accountability aspect of local revenue mobilisation and the importance of linking revenues to service delivery.

- Sensitise citizens and businesses to the importance of paying property taxes while informing them of the potential benefits of tax compliance, mainly the financing of public services.

With these objectives, the project undertook several initiatives in critical areas, including property registration, billing, payments, and education and sensitisation efforts.

Adding properties to the register with a new mobile application

In most MMDAs, only a few hundred properties were registered on paper, and most did not have up-to-date valuations. Legally, the Lands Commission must establish the assessment of property values for tax purposes and MMDAs are mandated to cover a large part of the cost of property valuation, but they often do not have the financial capacity to pay for this.This creates a vicious cycle: no budget for valuations, therefore few properties in the database and insufficient revenue collection to allow for expanding the database.

Most properties, especially in rural areas, had no street name and house number, severely complicating the process of identification, registration, and bill distribution. Therefore, adding new properties to the existing property records was the starting point of the systems approach.

The MMDAs had defined subcategories of unvalued properties that resembled those already valued. In principle, this could make it possible to assess a high number of properties quickly. However, collecting a large volume of data on properties, ownership, and contact information was challenging, as it was mainly done manually.

To address this, the TREE project implemented a new registration app that functions on mobile devices, which simplified the registration process. The app enabled adding new features to the property register, such as pictures of properties, geocoordinates, and mobile phone numbers. These additional features, which are added to the database by an automated upload, made locating properties easier.

Designing an open-source billing and collection application

In most MMDAs, bill distribution was error-prone because bills were handwritten and manually distributed. During the assessment, it was found that a batch of over 200 handwritten bills contained over 40% significant mistakes including incorrect street names and house numbers.

In addition, budget estimates from MMDAs showed that up to 30% of the revenues were spent on bill distribution. A limited number of staff increased the chance of bills not being delivered. Thus, creating and distributing bills this way was an expensive, slow, and time-consuming process.

The TREE project implemented two strategies to improve billing. First, VNG designed and built an open-source billing and collection application called taxMan to automate the billing process. The app offers a set of features and functions including:

- Open source components and integration with mobile apps;

- Provision of e-billing, e-payment, and e-receipts;

- Flexible configuration of different revenue types by using only one application for all taxes, fees, and other revenues;

- Powerful billing and calculation engine supporting calculation rules;

- A configurable accounting scheme for flexible integration with national financial systems;

- A high level of traceability and auditability, as every manually-triggered database change is logged.

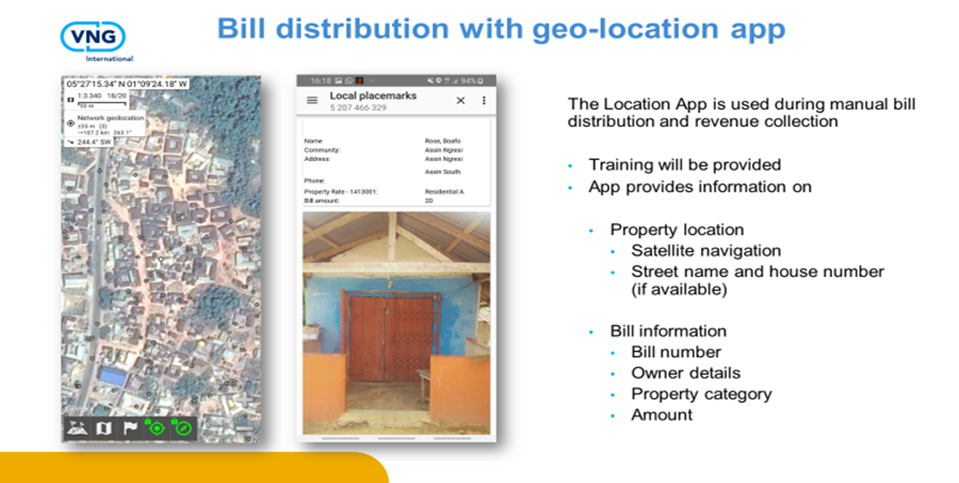

Second, it was determined that both a short-term and long-term solution would be required for bill distribution. The short-term solution was to develop an app to guide collectors to exact addresses by extracting data from the central database, including geolocation and bill data and transferring them to a mobile device. The long-term solution was the implementation of e-billing via a text message, which was then followed by a second text a few days later containing the bill and a payment ID. With the implementation of this solution, bills were distributed much faster and more cheaply.

Enabling payment with mobile money

The use of mobile money in Ghana is high, with the volume of mobile money transactions increasing by 737.4% from 2012 to 2016. Therefore, the project made it possible for taxpayers to pay their e-bills using mobile money.

This involved introducing work instructions and creating audit trails on cash payment processing in office processes, as well as providing taxpayers with information in the e-bills about how to make payments electronically.

Property tax payments are now made to a trusted third party equipped with the technical infrastructure to handle large numbers of e-payments. When this process is completed, the taxpayer receives a text message with an e-receipt containing a unique e-receipt ID. Payments are then forwarded to the bank account of the municipality. The payment message received by the municipality is automatically processed and matched with the taxpayer’s account in the database.

Education and outreach to improve compliance and accountability

Tax non-compliance continues to be a significant challenge that prevents MMDAs from raising more property tax revenues. Low levels of compliance stem mainly from the fact that citizens do not see tangible benefits from their tax payments.

The strategy adopted consisted of rolling out over 300 communication campaigns in the 33 MMDAs using communication channels often used in Ghana (town hall meetings, radio, vans, etc.). The main objective was to inform and educate taxpayers about the importance of paying taxes.

In addition, training sessions for public servants were conducted on customer relations, mass communication skills, and the need to improve transparency in budget expenditure and service delivery. This was combined with two-day leadership masterclasses for assembly officials including mayors, finance and budget officers, financial committee Chairpersons and Elected Assembly members. The training focused on:

- Accountability and transparency in budget expenditure and investment in better services to increase taxpayers’ trust;

- Creating political commitment to supporting effective property taxation;

- Practical training on taxpayer communication and integrity for municipal staff;

- Communicating with residents about the importance of paying taxes and the benefits of tax-funded services.

Progress in increasing property tax collection

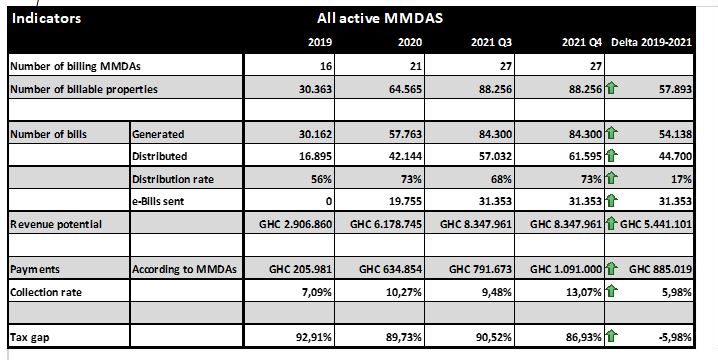

The table above shows the progress made in up to 27 MMDAs from 2019 to the end of 2021. Across these areas, the number of billable properties increased by 57,893. More tax bills were also distributed, increasing from 16,895 to 61,595 in the last quarter of 2021, with a 17% increase in the distribution rate. In addition, e-Bills were sent for the first time in 2020, with over 31,000 properties receiving tax bills electronically in 2021.

With these advances, the revenue potential from property tax increased by more than 5 million Ghanaian cedi (over USD 88,000). The tax collection rate increased by nearly 6%, with over a million Ghanaian cedi (over USD 160,000) collected in the past quarter. Although the tax gap across all MMDAs in the project was reduced by nearly 6%, the collection rate still stands at only 13%, showing the need for further improvement.

The experience of these MMDAs demonstrates that there isn’t a single solution to increasing property tax revenues. Incremental improvements form the basis of the systems approach to broaden the tax base, and improving bill generation and distribution, electronic payments, and communication campaigns were deemed the best strategies.

Although the approach has yielded remarkable results, it only lightly focused on enforcement, which is equally crucial for municipalities to meet their revenue targets. Therefore, continuous efforts to strengthen enforcement can further enhance effective property taxation in Ghana.