Tax Treaties and Developing Countries

The use of tax treaties by developing countries is controversial: Best case scenario? Tax treaties help attract foreign direct investment by reducing the risk of double taxation. Evidence for this is weak. Worst case scenario? They become a vehicle for multinational tax avoidance leading to huge revenue losses for developing countries.

Despite the uncertain benefits and widely recognised risks, developing countries continue to sign tax treaties. In this context, an understanding of good treaty practice – how countries in a similar position have negotiated, reviewed, or modified their treaties to better protect their tax base – can help lay the foundations for fairer and more sustainable tax treaties.

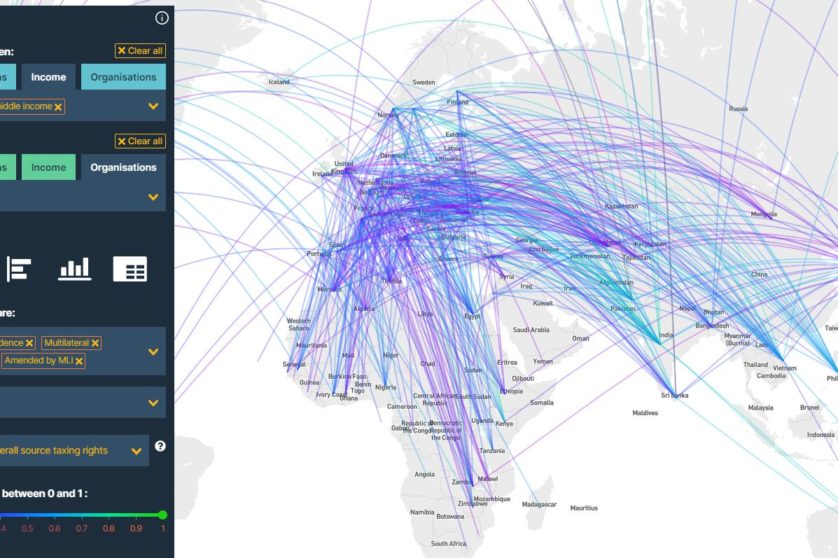

The Tax Treaties Explorer

The Tax Treaties Explorer is a website that allows you to visualise a new dataset of almost every tax treaty signed by developing countries. It includes over 2,500 bilateral tax treaties, almost 300 amending protocols, 8 multilateral treaties, and certain changes made to these treaties by the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS (MLI). As far as possible, the dataset covers all treaties signed by 118 countries comprising: those that are or were until recently low and lower-middle income countries, all countries in Africa, and all members of the Intergovernmental Group of 24.

The various visualisation options provide a means to compare and contrast different treaties in ways that complement analysis of the legal wording. For non-specialist policymakers and others with a stake in tax policy, this is an accessible entry point to understand treaties in comparative context.

The Tax Treaties Explorer is a project of the ICTD supported by the World Bank and the G-24, with data visualisations by Agile Collective.

The Launch Event

The ICTD and the Global Tax Program of the World Bank recently hosted a webinar to launch the new tool.

The event was moderated by Dr Ana Cebreiro, Senior Economist from the World Bank. Following her opening remarks, the ICTD’s international tax research programme lead Dr Martin Hearson introduced the Tax Treaties Explorer, demonstrating how it can be used by practitioners and researchers.

Then domestic resource mobilisation specialist Ashima Neb presented the Toolkit on Tax Treaty Negotiations produced by the Platform for Collaboration on Tax.

This was followed by reflections from Marine Khurtsidze, a former tax treaty negotiator and Head of the Tax and Customs Policy Department at the Ministry of Finance of Georgia. Ms Khurtsidze is an Elected Chair of the Conference of the Parties to the MLI at the OECD, where she represents Georgia in several working parties and forums.

New Research Using the Dataset

The webinar then featured the presentation of three research studies that use the Explorer data:

- Using New Data to Support Tax Treaty Negotiation by Martin Hearson, Marco Carreras, and Anna Custers, presented by Dr Martin Hearson.

- Taxing Profits from International Transport in Africa: Past, Present and Future of Article 8 (Alternative B) of the UN Model by Tatiana Falcão and Bob Michel, presented by Dr Tatiana Falcão.

- Tax Treaty Aggressiveness: Who is Undermining Taxing Rights in Africa? by Markus Meinzer, Maimouna Diakité, Lucas Millán Narotzky, and Mirsolav Palansky presented by Lucas Millán Narotzky.

Event Materials

Watch the event recording in English below (or here in French):