Zakat can add up to big money. Although estimates vary, some suggest that global annual zakat spending is higher than total annual development assistance. A study conducted in 2014 estimated the potential Zakat distributed in Morocco to be at least 40 billion MAD, or 4.1 billion USD – over three times the annual budget of the INDH, Morocco’s flagship poverty reduction program.

Given these sums, it is not surprising that Morocco seems to be the latest state seeking to ‘harness’ zakat revenues by setting up a state-run zakat fund. The new head of government, Aziz Akhannouch has previously argued that the existence of a ‘serious institution’ that people can pay in to would give people confidence and increase zakat payment, and that those funds could be used to improve the health sector, and especially the treatment of chronic diseases.

Most Muslim majority countries have established some sort of official fund to which contribution is either mandatory (Saudi Arabia, Pakistan, Malaysia) or voluntary (Kuwait, Egypt, Jordan). However, the effectiveness of state-run funds is not guaranteed. Our research in Pakistan and Egypt, for example, highlights that their state funds remain relatively ineffective and unpopular. In both countries, payments to zakat funds are comparatively small, and concerns particularly about transparency are substantial.

How can Morocco avoid these challenges? Is zakat a fitting way to fund health sector gaps, and would Moroccans even accept a state-run fund? Based on new, original survey data capturing the opinions of a nationally-representative sample of 1500 Moroccans in the autumn of 2020, we explore these questions. We argue that for a state-run zakat fund to be successful, Morocco needs to build trust with citizens and accept the diverse way in which people choose to give zakat.

Zakat in Morocco

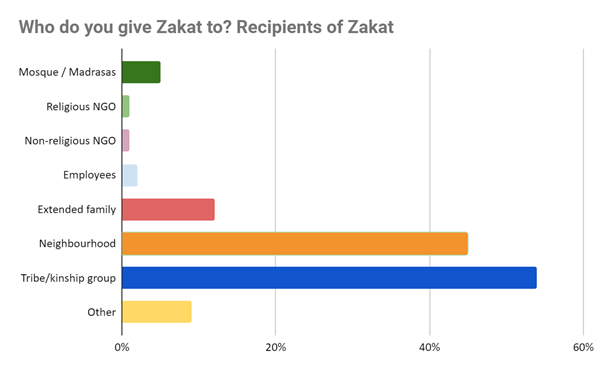

While only 11% of Moroccans we spoke to said they had paid zakat, the percentage of those who paid among those who are eligible is naturally higher. It is worth noting however that we found quite a few people who were unsure about their eligibility. We found that most Moroccans give zakat to people they have a personal relationship with, including members of their family, neighbourhood or kinship group. This also reflects the fact that more than a third of Moroccans (37%) believe that it is important to personally know the person to whom they are giving zakat.

What role for the state?

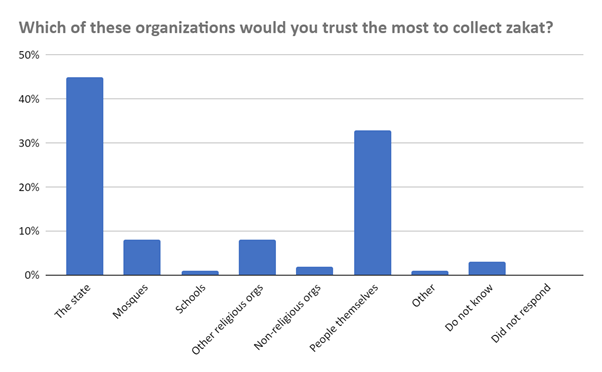

Given that many Moroccans see zakat as a personalised obligation, to what extent would they then be open to the idea of the state playing a greater role in its administration? Promisingly for the supporters of the proposed fund, almost half (45%) of the Moroccans surveyed – whether they actually pay zakat or not – reported that the state should have the primary responsibility to organise zakat. However, at the same time, a third of Moroccans see the primary responsibility to organise zakat with individuals themselves, rather than the state. Accordingly, at least for a substantive section of the population, there remains uncertainty about whether zakat-payers would choose to contribute to a state fund if it exists.

Trust is key

Trust is key

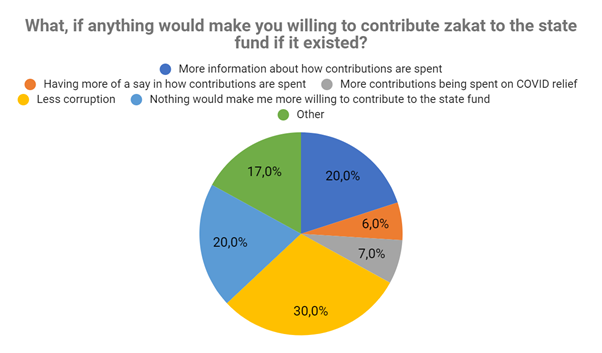

In any case, how this fund is managed would be critical to influencing citizens’ willingness to contribute. We asked Moroccans what – if anything – would make them more likely to contribute to a hypothetical state fund. While a minority (20 %) highlighted that they would never contribute to a state fund, many others noted that they would consider this if there was sufficient information about how money was used and if there were sufficient safeguards against corruption. This will likely be an uphill battle. When we asked if Moroccans trust their government to collect another payment – taxes – the majority did not agree. As such, trust will likely remain a challenge for the effectiveness of any state-run zakat fund in the country.

Conclusion

These findings suggest important lessons for Morocco’s planned zakat fund. First, it will be crucial that any new fund be structured in a way that builds trust and ensures transparency and accountability. This could be done through extensive reporting, or through giving payers options as to who will benefit from the payment, as is done for example in Kuwait.

Second, it is important to recognising the personalised connection individuals have to their zakat giving in Morocco, it will be important for Moroccan policymakers to recognise that a state fund, once established, will remain one of multiple ways through which Moroccans will engage with giving Zakat. Some will retain preferences for giving to people they know, or organisations they trust more.

Aside from public perceptions of a state fund, there is a broader question about the role of zakat in Morocco’s finances. Is it appropriate for the government to fill gaps in the financing of its health system with revenues from a personalised religious obligation? The obvious alternative solution here would be to focus on tax policy reforms. While zakat shares some features with wealth taxes, it can be complementary, rather than an alternative to a formal wealth tax. In fact, we also asked Moroccans if the government should use taxes focused on the rich to improve public services – over 85% agreed. This suggests that the move to introduce a state-run zakat fund should not negate the need for tax reforms to address critical public spending needs in the health sector and beyond.

This blog was first published in French by the Moroccan economic outlet Medias24 here.