See here for a response to Professor Bird’s critique by the World Bank framework’s lead author and ICTD Research Director Wilson Prichard.

Innovations in Tax Compliance, a recent World Bank working paper, undertakes two tasks. First, it reviews the rapidly growing theoretical and especially empirical literature on how countries can improve tax compliance and, not so incidentally, raise more tax revenues than most low-income countries now do. Second, it sets out an approach to tax reform that it suggests should yield more sustainable results than past efforts.

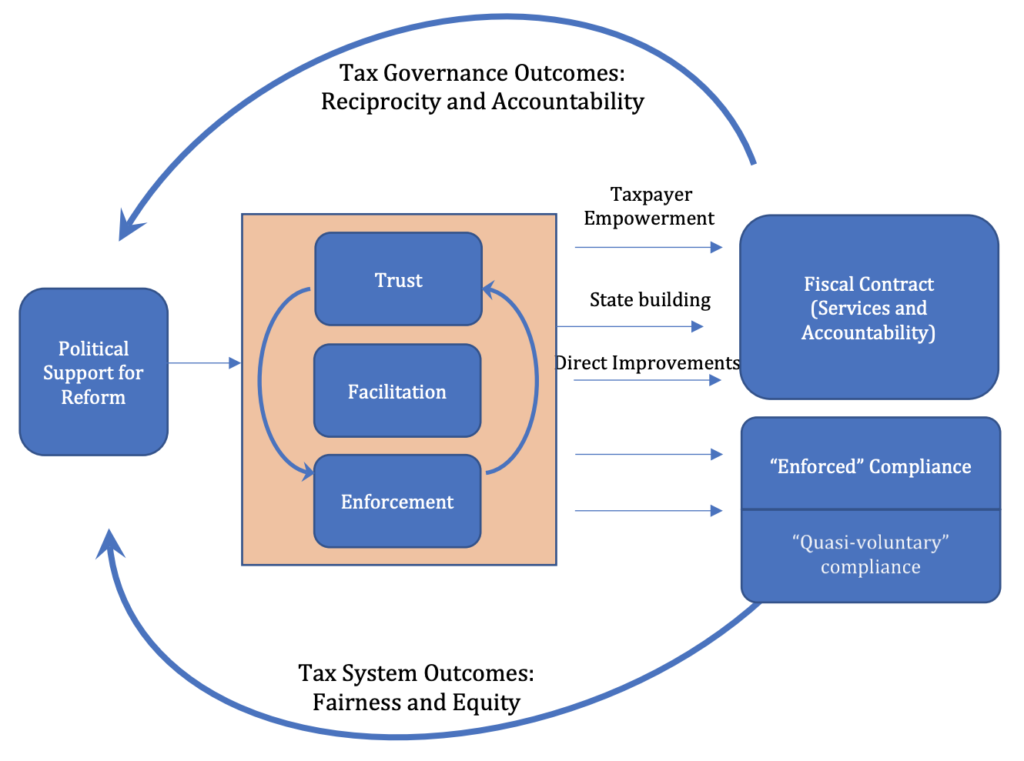

The literature survey is fairly comprehensive and provides a useful reference for policymakers and analysts. However, it contains little that should be news to anyone already engaged with tax issues in developing countries. The key roles played by political support in launching and implementing reform, by institutional capacity for enforcement and facilitation in expanding quasi-voluntary compliance, and by fiscal contracting (accountability and the link between taxes and services) and perceptions of how fairly and equitably the tax system is applied in building the trust (social capital) needed to make the system have long been known. The more novel part of the paper is its attempt to combine these elements into a potentially operational framework to guide tax reform.

The foundations of fiscal development

As Sven Steinmo observes in a recent book, the key ‘fiscal foundation’ of successful democracies is that their citizens have, so far, proved willing to make the ‘leap of faith’ required to allow their governments control of an increasing share of their income and wealth. He (and his co-authors) agree with the Bank paper that developing state capacity to administer taxes in a way that most people consider fair while also delivering public services that most consider worth the price are essential elements in developing an accountable democratic state. In the concluding chapter (with Marcelo Bergman) Steinmo stresses three guidelines countries should follow to create and maintain an adequate tax system: Ensure that 1) taxation finances services that people want 2) everyone (especially the rich) pays something and that the tax system is acceptably progressive, and 3) that it is as simple, certain, and well-enforced as possible. These suggestions are not very different from those in the Bank paper.

The Steinmo book emphasises the twists and turns and many, many years required to achieve the fiscal (and supporting political and administrative) development of modern democratic states. In contrast, the Bank paper– perhaps not surprisingly, given the institution’s mission – seems considerably more optimistic about the speed and ease of moving from ‘here’ – where many low-income countries now are fiscally – to ‘there’, where they (presumably) want to be – namely, with (in most cases) larger and certainly better-functioning (and more accountable) public sectors. Although Innovations frequently (and correctly) stresses the need for much more research on almost every aspect of the issues it discusses, its suggested approach to the quintessentially political economy task of designing acceptable and sustainable tax systems is ambitious and stimulating, if perhaps a bit beyond the reach of many countries in need of such reforms.

The thorny question of political will

To take a simple example, while the Bank paper clearly recognises the critical importance of ‘political will’ – sufficient sustainable support from key decision-makers – for tax reform it does not reach what would seem to be the most obvious conclusion following from this recognition, namely, that if the ‘will’ is not there, no ‘framework’ for reform, no matter how clearly set out, is likely to be followed.[1] External agencies wishing to support reform in countries where those in power are not really interested in it would seem well advised to adopt the ‘long game,’ and to focus primarily on doing what they can to build up state administrative capacity, public awareness of fiscal realities (who pays how much in what way, and what they get for it), and general civic capacity to participate knowledgeably in the policy debate if and when more reform-minded people come to power. Trust-building is certainly needed to improve governance, but at least some degree of good governance seems needed not only to build trust but also to ensure that those in power wish to do so. Until a country is up to the starting gate, efforts to turn it into a fiscal winner are unlikely to be successful.

The objectives and process of reform

Similarly, the Bank paper places considerable emphasis is on the desirability of setting clear objectives for any reform – ideally, not simply the usual 1 or 2 percent increase in the tax-to-GDP ratio but all the social, political, and economic objectives that should be considered in designing the right package of reforms. One cannot really argue with this as an ideal. But life is seldom this neat. As anyone who has ever done a simple cost-benefit analysis of any project soon learns, often the real objectives of the exercise, (and the weights attached to them by different interests) like the real constraints, only become clear in the process of doing the analysis and interacting with those affected. Policy analysis, like policy reform, is always and everywhere a process, not a product, and the nature of the process (path-dependent and context-specific as it is) often shapes the outcome much more than such presumed abstract goals as efficiency or equity. The careful systematic analysis of policy proposals is often more useful to help those for whom the analysis is done to figure out what they really want than to tell them either what they should want or how they should get it.

From this perspective, some of the items emphasised in Innovations may at times make it harder rather than easier to reach a sensible, feasible and sustainable result. One instance is the emphasis at various points on sub-national and local issues.[2] As one who has spent much of my life working on such matters, I of course agree that they are important, particularly with respect to building a secure base for better governance in general as well as for accountable and welfare-improving fiscal reform. However, in too many countries the current political arena evidences little concern for democratic accountability, so it is not clear that insisting that such issues can or should be explicitly considered in depth when considering any national tax reform is always essential. Improving the accountability and competence of local governments is important but insisting that countries that do not agree take on this concern when dealing with national tax reform seems a step too far.

Is more openness always better?

Equally, while in principle it is easy to agree that increased civic consultation and participation in fiscal matters is desirable, in practice even political economists, as in the study by Tasha Fairfield cited in Innovations, sometimes suggest that a degree of obscurity may be essential to achieve agreement on reforms, even reforms that will (one hopes) benefit those who would perhaps be inclined to veto them for fear of loss or simply to express the negative bias with which change in any field tends to be met.[3] When it comes to policy changes, what you (think you) see is not always what you get, and devices such as earmarking and some of the simplification generally supported in the Bank paper may sometimes succeed more by obfuscating rather than clarifying what is really going on. This does not mean that such measures may not sometimes be useful, but useful tools may cut in more than one direction, and a problem with a general framework for analysis like that set out in the paper is that, as indeed the authors clearly recognise, generalities, while often useful in pointing out the questions that should be asked, seldom tell us much that provides a clear guide to the best solution for any particular problem.

The proof will be (in the eating of) the pudding

Until the World Bank, or someone, carries out a variety of detailed case studies utilising the suggested framework – studies that I suspect will inevitably lead to changes, complexifying, and amendment of the framework to fit each case – all one can really say about this bold attempt to compress decades of work by hundreds of scholars into a framework that will, in the words of the abstract “…help policy makers to think about the right combination of strategies in specific contexts, and thus to allocate resources most effectively” is that it is a worthy attempt that anyone interested in improving fiscal outcomes in any country will find interesting and perhaps stimulating. Whether it will lead to better studies of tax reform, let alone to better tax reforms, remains to be seen, hopefully soon, as the Bank (and others) explore the practical applicability and usefulness of the approach.

For a response to this critique by the World Bank framework’s lead author Wilson Prichard, see here.

Notes

[1] Perhaps one way to judge whether a country is serious may be simply to consider the extent to which the data held by other public agencies that would be useful to the tax agency is actually made available to that agency. In all too many countries, such data silos are defended fiercely by those, both within and outside the administration who think, often correctly, that knowledge equals power. If a President or Minister of Finance is unwilling to deal with such easily resolved internal problems, the likelihood that a real tax reform will be supported from the top seems small.

[2] Another instance is the emphasis on helping the poor. I agree in principle. In practice, however, it is hard to believe this objective is high on the priority list in many countries. Often, the really important ingredient needed for policy success is to ensure the elites are on board. In the tax field, as this study usefully recognises, this mainly implies somehow getting the business sector – the main revenue base as a rule – to cooperate. Unfortunately, it provides few suggestions about how one can get them on board without letting them steer the ship.

[3] The paper recognises this problem to some extent, as well as the possible need often to ‘nudge’ or provide an incentive like earmarking – in effect, sugar to make the medicine more palatable – to induce people to act in their own best interests, but it does not really face the problem of how to know what those interests really are in most countries, other than as understood by those designing the policy change in question. Anyone who has ever had to make a decision even on such a simple issue as who gets which office in a building, knows how very difficult and time-consuming it can be to strike an acceptable balance between the conflicting interests and (as they see them, needs and entitlements) of a heterogeneous group. Representative democracy is, despite its many obvious flaws and failures in practice, perhaps the most acceptable and (so far) sustainable way large heterogeneous societies have developed to reach agreement on what can and should be done. One way of interpreting this paper is as a useful step towards recognising more explicitly not only that an adequate political institutional structure is needed to support economic reform, but also that certain reforms can help develop their own support system. But what if the country is controlled by those who do not welcome such political reforms? The question of how, and to what extent, the framework suggested in the paper can be useful even in such a hostile environment perhaps deserves more attention.