Developed countries have recently begun considering wealth taxes to raise revenue and curb rising inequality. Should developing countries follow suit? On the one hand, developing countries are often afflicted by acute income and wealth inequality (Alvaredo et al., 2018), and could thus benefit from a more progressive tax system. On the other hand, the question remains whether governments can enforce wealth taxes on an elite that have a vast arsenal of tools to avoid and evade taxes altogether.

My job market paper explores individual responses to personal wealth taxes and enforcement policies in Colombia. Colombia provides a unique opportunity to study these issues thanks to its extensive administrative tax microdata on the assets and debts of wealthy individuals, its numerous tax policy changes since 2002, and its recent enforcement efforts to improve compliance among the rich.

Our data covers all income and wealth tax filers between 1993 and 2016. Critically, Colombian income taxpayers annually report their (taxable and non-taxable) wealth regardless of whether they owe wealth taxes. For example, end-of-year wealth in bank deposits, portfolio securities, real estate, vehicles, inventories, and debts are reported to the taxman. We match our tax records with the microdata from the “Panama Papers,” that is, the information leaked from Mossack Fonseca, one of the world’s five largest wholesalers of offshore secrecy at the time of the leak. This enables us to observe offshore sheltering in Colombia’s most relevant tax havens.

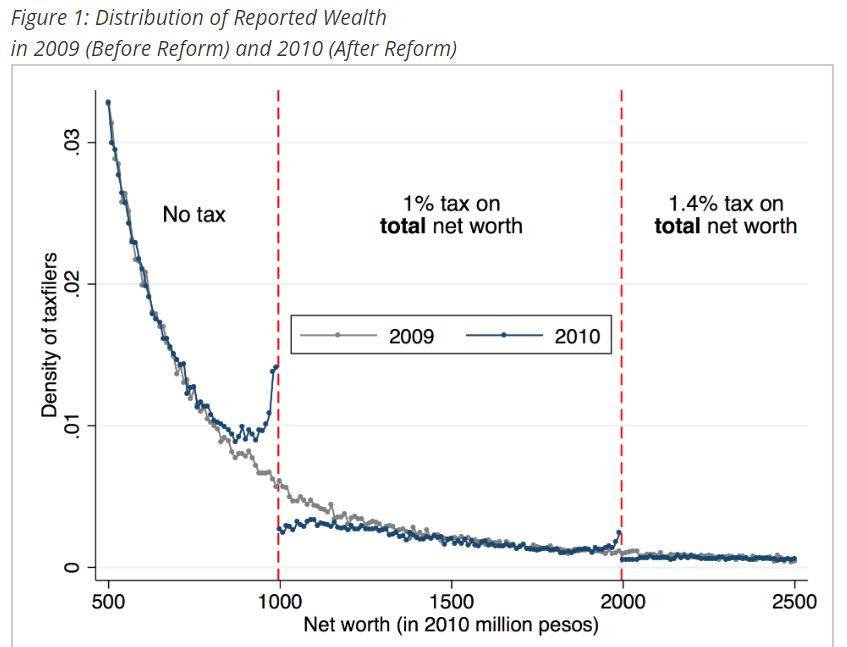

We first study responses to wealth taxes, exploiting quasi-experimental variation introduced by tax reforms and discontinuities in the wealth tax schedule. For instance, in 2010, a reform broadened the wealth tax base by lowering the exemption threshold from 3 billion pesos (US $1,562,490) to 1 billion pesos (US $520,830), thus levying individuals previously exempted from paying this tax. In addition, the schedule assigned each bracket of net worth an average tax rate, creating jumps in tax liability at bracket cutoffs. A taxpayer reporting 999.999 million pesos in wealth in 2010 was exempted from the wealth tax, while a taxpayer reporting an additional peso owed 1% of all taxable net wealth, i.e., a tax bill of US $5,208. If individuals did not respond to the wealth tax, reported wealth would be distributed smoothly around this threshold. If, instead, individuals avoided the jump in tax liability, there would be bunching in reported wealth below it; the degree of bunching indicating the responsiveness of reported wealth to the tax (see Saez, 2010; Kleven & Waseem, 2013).

We find large and immediate responses to wealth taxation as well as tax changes. This provides clear evidence that individuals respond to the incentives created by tax policies (see Figure 1). In our main analysis, the marginal “buncher” would have reported 21% more wealth in the absence of the wealth tax. Our estimated elasticity suggests that a 1% increase in (one minus) the wealth tax rate raises reported wealth by 2%. These responses generate revenue losses of up to one-fifth of the mechanical projected revenue.

Unlike earnings responses to income taxes, which potentially conflate real and sheltering responses, bunching in the distribution of reported wealth predominantly reflects sheltering. It is difficult for individuals to immediately bunch below the notch points using real responses (e.g., investment) because wealth partly depends on asset prices, which are uncertain and fluctuate throughout the year (Jakobsen et al., 2018). Furthermore, in Colombia there has been limited systematic crosschecking of items reported in the wealth tax return using third-party reported information. This enabled individuals to avoid taxes, as we show, by under-reporting the value of assets not subject to third-party reporting and fabricating debt.

In addition, wealthy individuals often have access to sophisticated tax sheltering strategies and may reduce their tax burden by offshoring assets to tax havens. Illustrating this point, the Panama Papers reveal offshore entities are used predominantly by very wealthy Colombians: the wealthiest 0.01% of the distribution is 24 times as likely to appear named in the leak than the wealthiest 5%. Further, assets reported to the tax authority significantly drop immediately after an individual incorporates an offshore entity, which is consistent with wealth obfuscation for the purpose of minimising the tax burden. Not surprisingly, these offshore entities have been used more aggressively since the reintroduction of wealth taxation in Colombia.

Can better enforcement recover tax on hidden wealth and crack down on offshore evasion? To answer this question, we evaluate Colombia’s voluntary disclosure scheme, which took place between 2015 and 2017. Similar disclosure schemes have been introduced in many countries, including the United States, to encourage reporting foreign assets and recover tax on offshore investments. Colombia’s scheme awarded tax incentives for disclosing unreported (foreign and domestic) assets and nonexistent debts. Disclosers waived past income and wealth tax liabilities but paid a penalty worth 10–13% of their disclosed wealth, while evaders who did not come forward faced higher fines if caught cheating.

Colombia’s program encouraged disclosures worth more than 1.7% of GDP and raised 0.2% of GDP in penalty revenues. People who disclosed under the scheme are among the wealthiest individuals in the country: in all, two-fifths of individuals in the wealthiest 0.01% admitted to prior noncompliance and disclosed hidden wealth. Most hidden wealth had been concealed abroad, reflecting the pervasiveness of offshore tax evasion at the top. The scheme raised tax liability for the wealthiest taxpayers: comparing disclosers and non-disclosers across time, disclosers reported more wealth as well as more capital income from asset ownership three years after their first admission of noncompliance. As a result, they also paid 39% more income taxes relative to non-disclosers, further enhancing tax progressivity in the longer term.

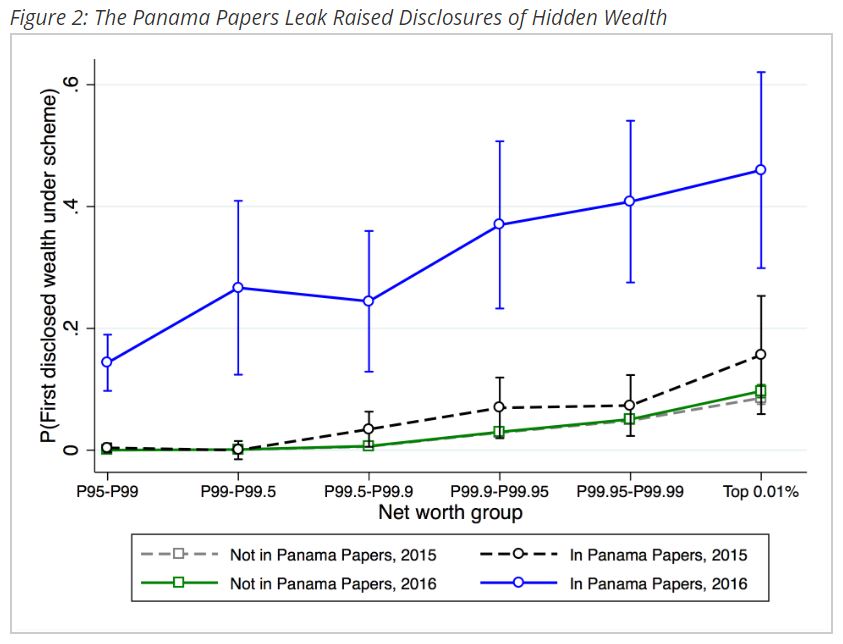

Crucially, two events increased the perceived risk of detection and punishment for failing to disclose hidden wealth. First, halfway through the scheme, the Panama Papers news story broke and the names of Mossack Fonseca’s clients were thrust into the public spotlight. The Colombian tax authority reacted by scrutinising Mossack Fonseca and its clients, contacting taxpayers named in the leak and requesting documentation of their offshore activities and transactions. Three weeks later, the governments of Colombia and Panama announced a tax information exchange agreement between the two countries. We exploit the exogenous timing of the leak and compare outcomes between wealth tax filers named (treated) and not named (control) in the leak before and after it occurred. We find that the Panama Papers leak induced a more than 800% increase in disclosures under the scheme (Figure 2) and an even larger rise in disclosures of foreign assets in particular. Consequently, taxes paid by these individuals more than doubled.

Second, in December 2016, Colombia criminalised tax evasion for the first time. Tax evaders could face up to nine years in prison. We find that most participants disclosed hidden wealth six months later, at least in part due to this harsher punishment of tax evasion.

Overall, we interpret our findings as evidence that greater enforcement improves wealth tax collection. Wider coverage of third-party reporting, if coupled with systematic cross-validation of reported information and increased scrutiny of high net worth taxpayers, can strengthen enforcement capacity in developing countries. Furthermore, policies to promote financial transparency and encourage foreign asset reporting are key to curb offshore sheltering at the top. Voluntary disclosure schemes help collect new information about offshore assets and income and generate more revenues from wealthy taxpayers. For such programs to be effective in improving compliance in the shorter and longer term, stricter enforcement needs tough noncompliance sanctions and a credible threat of detection, for example, by exploiting the automatic exchange of tax information and whistle-blower data. With better enforcement, wealth taxes can complement progressive income taxes to reinforce progressivity and address inequality in contexts where elites are difficult to tax.

This piece was originally published by the World Bank in its job market series.