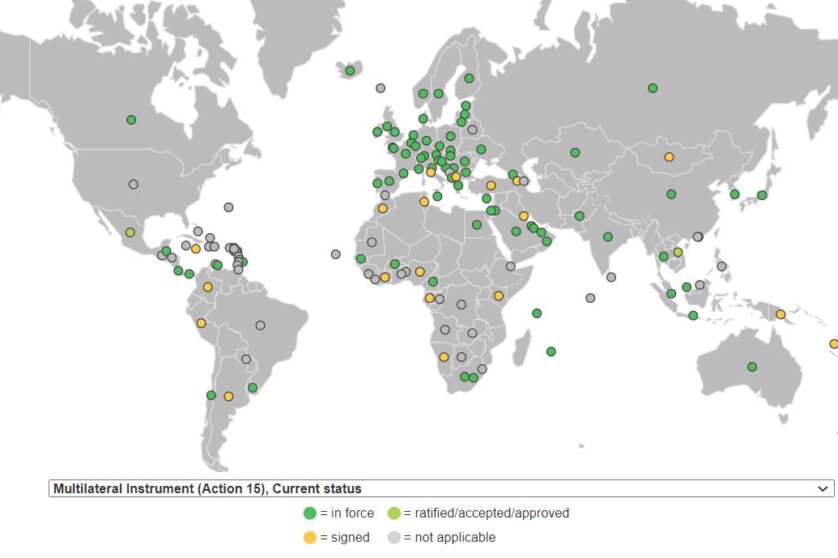

Notwithstanding the major diplomatic achievement, the success of the BEPS Multilateral Instrument (MLI) was limited. It failed to zero out treaty shopping and optional articles were hardly taken up.

While the intention of bilateral tax treaties is to avoid double taxation, they have increasingly been perceived to create opportunities for multinational tax avoidance and “double non-taxation”. In 2015, the OECD/G20 countries agreed on the first internationally coordinated measures against base erosion and profit shifting (BEPS) condensed in 15 action points, also tackling avoidance opportunities related to double taxation treaties. Therefore, several of the 15 BEPS action points required changes in the existing bilateral tax treaty network. To allow for a swift implementation of treaty-related modifications, the OECD designed a special instrument – the “multilateral instrument” (BEPS MLI). It allows Inclusive Framework member countries to take-up the OECD’s treaty-related anti-BEPS measures without cumbersome bilateral renegotiations of their tax treaty network.

Similar to the BEPS MLI, a UN Multilateral Instrument (UN MLI) was discussed in the twenty-fifth session of the Committee of Experts on International Cooperation in Tax Matters. The main goal is to implement changes that have already been made to the UN Model, for example the insertion of Article 12A (Fees for Technical Services) or 12B (Income from Automated Digital Services). The latest proposal envisions a fast-track instrument (FTI) as the UN MLI which would consist of one generic multilateral instrument with a number of protocols obtaining the opt-ins. Currently, pros and cons of this instrument are being discussed.

In order to inform the discussion on the pros and cons of a UN MLI, a closer look at how the BEPS MLI works can provide valuable insight.

How does the BEPS MLI work?

The BEPS MLI seeks to introduce a comprehensive set of amendments to a significant number of existing tax treaties, with the participation of as many countries as possible, through a single multilateral instrument. The proposed changes cover a range of topics, including measures to prevent treaty-shopping, revised definitions of permanent establishment, and new rules for resolving double taxation disputes. Some of these are mandatory articles which are part of the BEPS minimum standard, but multiple other articles are optional. BEPS items that are part of the minimum standard come into effect for a given tax treaty if i) both treaty partners sign and ratify the MLI and ii) if both treaty partners select a treaty to be changed under the MLI. Optional treaty-related BEPS items are adopted if i) and ii) holds and if, additionally, both treaty partners iii) select a given optional treaty item to be changed under the MLI.

What can we learn from the BEPS MLI?

In a recent working paper, Hohmann, Merlo and Riedel (2023) show that MLI take-up is incomplete. Even though the Inclusive Framework countries committed to implement the BEPS minimum standard, not all countries make use of the MLI to do so. High tax capacity countries (proxied by the World Bank’s Paying Taxes score (part of Doing Business)) as well as countries affected more strongly by treaty-shopping (proxied by inward foreign direct investment (FDI) from conduits) are more likely to take up the MLI. In a theoretical model it is shown that one explanation might be that lower tax capacity raises the opportunity costs of enforcing anti-treaty shopping provisions. Moreover, joining the MLI itself involves administrative costs, which may inversely depend on countries’ tax capacity. Moreover, conditional on MLI signature, countries do not list their entire treaty network. However, all conduit countries, which are beneficiaries of treaty shopping, signed the MLI early on and listed the majority of their treaties. One potential explanation is that conduit countries can benefit from anti-treaty shopping laws as firms have incentives to scale-up real activity in conduit nations in order to be exempted from the new anti-treaty shopping rules (which only apply if arrangements serve the sole purpose to save taxes).

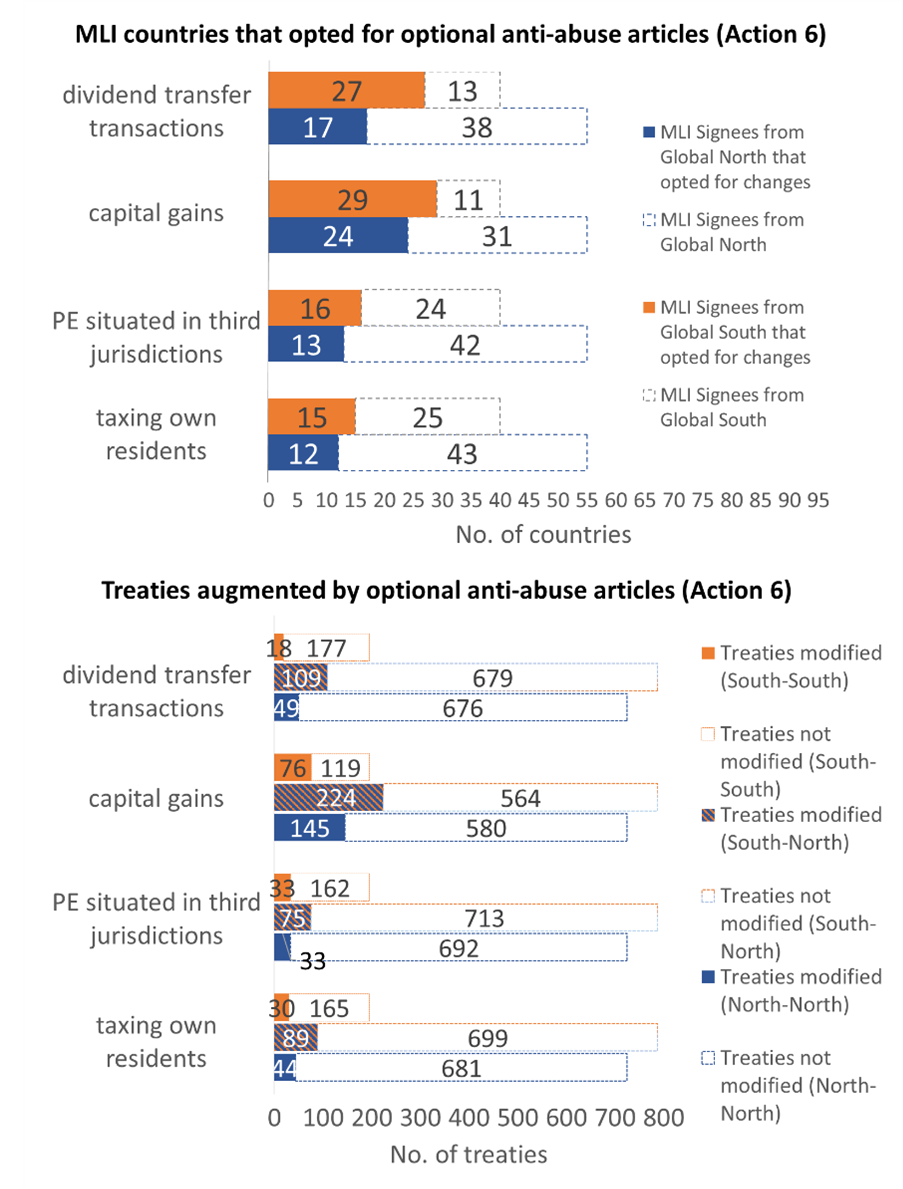

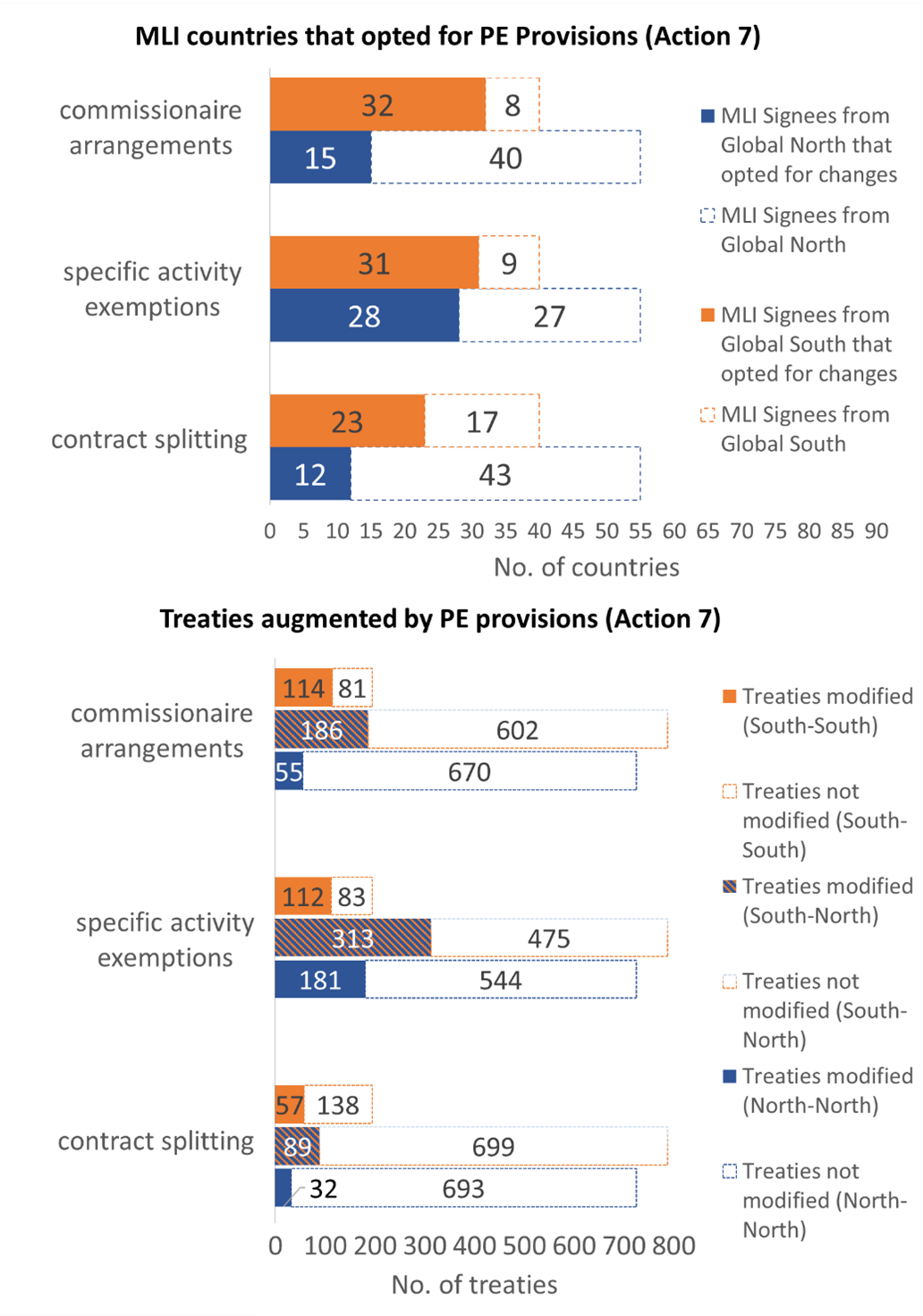

Mismatches in optional articles

Another observation is that optional treaty-related items are hardly taken up. Few countries opt for changes which are not part of the minimum standard. And even when they did, treaty partners often did not, and the treaty change failed to become effective. The upper part of the figure always shows how many countries opt in favour of the respective MLI article. The lower part shows the number of treaties augmented from all treaties covered by the MLI.[1] For example, only 29 countries (16 from the Global South and 13 from the Global North[2]) opted to implement an anti-abuse rule for permanent establishments situated in third jurisdictions (Article 10 of the MLI). This resulted in 141 augmented tax treaties, from which 33 are South-South, 75 South-North, and 33 North-North treaties. [3]

This outcome is generally consistent with countries’ behavioural incentives. Take Action 7 on permanent establishments as an example: Action 7 shifts taxing rights from residence to source countries. Capital importing countries of the Global South are significantly more likely to opt for the permanent establishment (PE) provisions than capital-exporting countries in the Global North. On North-North and North-South routes, BEPS Action 7 items hence rarely became active.

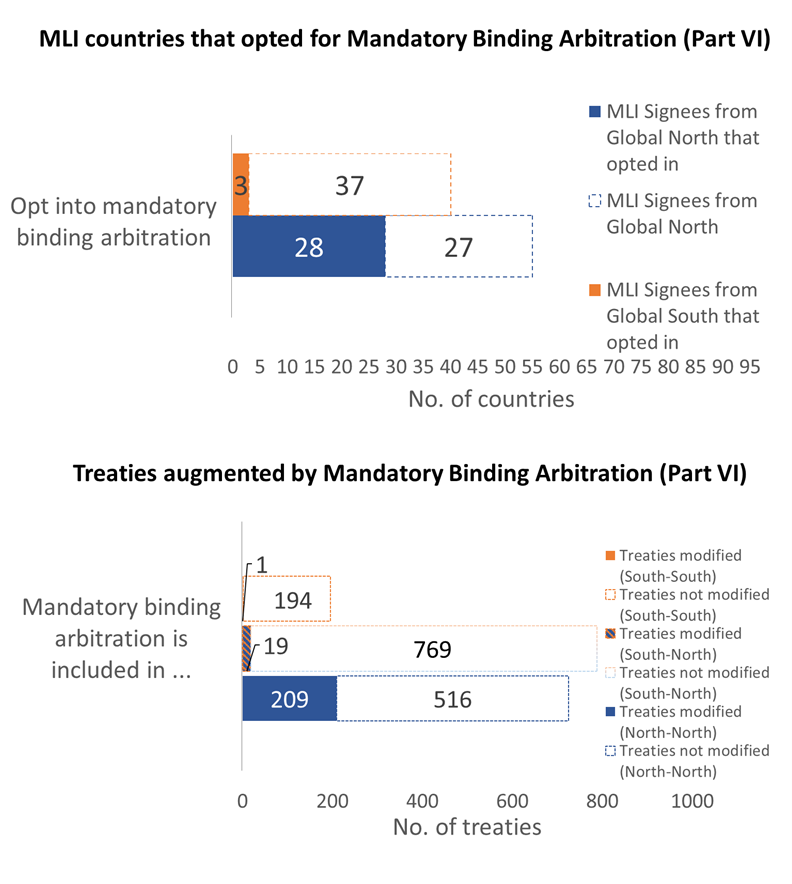

This highlights a general weakness of the BEPS agreement: the adoption of many BEPS action items was left as optional. Obstacles that prevented binary agreements on treaty changes in the pre-BEPS periods hence prevailed in the post-BEPS world. If before the BEPS process, shifts in taxation rights were not incorporated because they benefited one treaty partner at the expense of the other, the same holds true in the post-BEPS world. The in many aspects non-binding nature of the OECD’s agreement may, however, have ensured that many countries were willing to join the agreement in the first place. Many developing countries for example were not willing to enter the agreement while mandatory binding arbitration was still included as a mandatory provision. Consistent with this behaviour, only a very small number of countries opted for mandatory binding arbitration and practically all those which did are located in the Global North. This is consistent with the notion that global mandatory binding arbitration is challenging to administer for tax administrations in less developed countries. In consequence, only 15% of the treaties are modified such as to incorporate mandatory binding arbitration.

Constraining treaty shopping is a challenging endeavour

Notwithstanding that the OECD’s BEPS agreement has been a major diplomatic achievement, the analysis highlights that the path to a world without international tax avoidance is thorny. Even for the mandatory anti-treaty-shopping provisions, there are loopholes. Empirical analyses indeed reject major changes in treaty shopping behaviour after the implementation of the MLI and anti-treaty shopping clauses – suggesting that the measures have so far not yet been able to eradicate treaty shopping practices as envisaged by the OECD. FDI flows through conduit countries declined moderately at best. This finding is robust to a number of different empirical specifications. The results also indicate that firms indeed enhance their real economic activity in conduit nations. Furthermore, even if BEPS countries will eventually be successful in effectively constraining treaty shopping within their network, some incentives for treaty shopping through non-participating nations prevail. Conclusively, the BEPS MLI’s implementation highlights the need to consider countries’ incentives for participation and actual implementation of its provisions, as well as keeping in mind the complexity involved.

This is the second of several blog posts in the run up to an ICTD conference facilitating critical debates on the future of multilateral cooperation. Join the discussions by tuning in to the ICTD’s livestream.

[1] MLI positions were retrieved from the MLI Matching Database as of 08 June 2021. It is important to note that the take-up may still change, particularly for countries that have not yet ratified the MLI and have only submitted provisional positions.

[2] Countries are divided into Global North and Global South according to the income classification of the World Bank. Global North refers to countries with high income and Global South to countries with upper middle income, lower middle income and low income.

[3] Please note that we only highlight augmented treaties by the MLI and do not verify whether countries have implemented the provisions beforehand.