The IPCC’s Sixth Assessment Report, published in August, is the latest clarion call to decarbonise the global economy if the worst excesses of the climate crisis are to be averted. This is especially true in Sub-Saharan Africa, where floods and droughts are expected to have devastating effects.

Carbon taxes – levies imposed on the carbon content of fossil fuels – can and must play a central role in reducing the GHG emissions causing this crisis. An academic consensus indicates that carbon taxes should be swiftly introduced in both high- and low-income countries to cut emissions and raise revenue, which is particularly important in low-income economies affected by COVID-19.

On closer inspection, however, carbon taxes may not be the ‘green’ bullets that academic wisdom implies–not least in some of the world’s poorest countries.

Carbon taxes need carbon footprints

Carbon taxes assume there is carbon to be taxed in the first place – but Sub-Saharan Africa has a tiny carbon footprint. Africa accounts for a mere 3.8% of global emissions, many of which originate in Northern Africa and South Africa, itself the world’s 14th largest emitter of GHGs.

Historically, Africa’s emissions have arisen from land use, land use change and forestry (LULUCF), rather than fossil fuels. This means that carbon emissions have mostly been produced by people clearing land for the expansion of agriculture, as well as deforestation, fires and forest degradation – all of which reduce the amount of carbon that ecosystems can absorb from the atmosphere.

In addition, low-income households have met their energy needs with firewood and charcoal, state-run electric utilities are already saddled with debt, and fuel subsidies increase the consumption of certain fuels.

Furthermore, energy access and consumption are very unevenly distributed across the continent, with northern Africa and South Africa using three-quarters of all Africa’s power.

The lack of regional energy markets, which prevents consumers from switching to cleaner fuels, limits the impact of price effects.

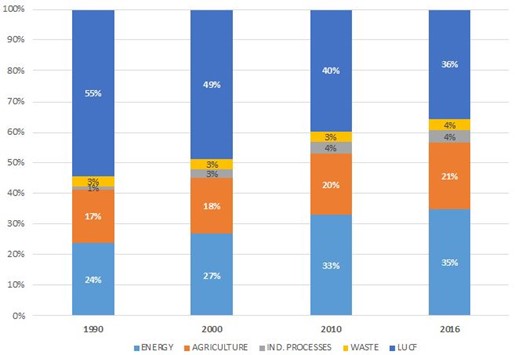

In addition, carbon emissions from the energy sector have also been steadily growing in sub-Saharan Africa, particularly in the transport sector, which is responsible for most new regional GHG emissions (see Figure 1).

African tax policy makers should thus pay careful attention to how they deploy carbon taxes to avoid any unintended environmental and financial consequences. Despite the taxes being levied on fuels at the point of extraction or import, the tax burden is principally felt by the end consumer. However bothersome, this could also make carbon taxes more impactful, as their effect hinges on behavioural changes on the consumer end.

Increasing energy prices, decreasing forest cover?

Introducing carbon taxes in Sub-Saharan Africa is complicated by the fact that 83% percent of the population relies on traditional fuel sources such as wood and charcoal for cooking. In 2019, the International Energy Agency estimated the number of people without access to modern cooking fuels at around 900 million, and those without access to electricity at around 600 million.

Such reliance on biomass drives deforestation – and by making other fuels more expensive, carbon taxes risk making firewood more attractive. Estimates suggest that 90% of the wood extracted from African forests and woodlands is used as fuel. A lack of “modern energy” for cooking significantly contributes to GHGs emissions, both through its impact on deforestation and through the emission of methane during the combustion process.

The higher price of “modern” fuels such as gas and electricity represents a significant barrier to their adoption. Carbon taxes, which might make them more costly, might end up pushing more people into biomass use. When it comes to household cooking fuels, the solution for reducing GHGs emissions in Africa passes through an increase – and not a decrease – in the consumption of fossil fuels, as LPG stoves are much greener than charcoal ones.

Carbon revenue – or carbon debt?

Carbon taxes have been suggested as an opportunity to fund additional electricity generation in Sub-Saharan Africa. However, finance ministries must also consider the dire financial situation of the region’s electric utilities.

A 2016 study from the World Bank concluded that out of 39 African utilities, only two were able to recover both capital and operative expenditures. With 47% of the region’s installed capacity coming from natural gas, diesel and fuel oil, carbon taxes would represent a major financial burden for African utilities.

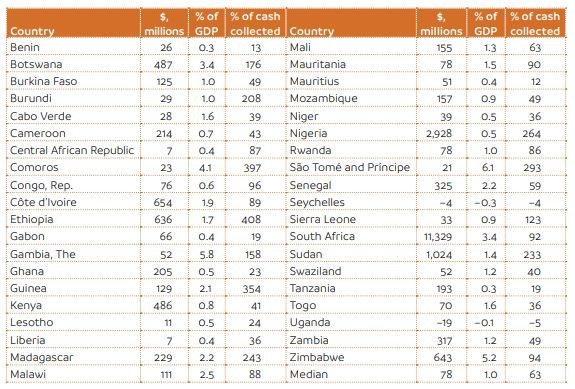

Of course, utilities could pass the costs imposed by the carbon tax onto consumers, but given very poor payment discipline across the continent, it is far from guaranteed that this would be a successful strategy. A tax on carbon might not contribute much revenue, as African states would likely have to intervene to cover the financial deficit of their utilities – a situation known as a “quasi-fiscal deficit.” Given how high some of these deficits already are (see Table 1), the net effect could even be negative.

Table 1. Quasi-fiscal deficits across Sub-Saharan African utilities – World Bank, 2016

Proceed with (carbon) caution

Carbon taxes are rightly hailed as a powerful instrument for reducing emissions and supporting a green transition. Yet most of what we know about how they work comes from high-income country energy markets, which are a poor proxy for Sub-Saharan African country contexts.

Improperly implemented carbon taxes in these contexts might create as many problems as they were intended to solve: more woes for state-run utilities and more deforestation as people face steeper prices for electricity and gas. If carefully designed, however, carbon taxes offer an opportunity for green transitions in Sub-Saharan Africa.

Carbon taxes also offer a chance for African tax justice. In the context of the EU Carbon Border Adjustment Mechanism–slated to begin in 2023–African nations are exposed to the risk of additional taxes on carbon-rich exports. Although still under debate, there is already some evidence that this policy could have an impact in some Sub-Saharan African countries.

With all of this in mind, African fiscal policymakers should seriously investigate the opportunities that carbon taxes represent–but be clear-eyed about their limited firepower.