Across Africa, the use of digital financial services (DFS) continues to grow, and an increasing number of countries are exploring how best to tax them. With this fluidity, stakeholders need up-to-date information on changes as they happen, as much as their history. ICTD’s DIGITAX Research Programme has launched a dynamic web portal – the DFS TaxMap – that tracks the evolution and variety of approaches to the taxation of DFS.

This new portal marks a significant milestone in DIGITAX’s mission to empower our audience with comprehensive tax information. By providing a centralised platform on DFS taxes, we simplify the complex landscape of tax regulations, while at the same time enabling cross-comparisons. Our goal is to present facts and figures for effortless navigation through the intricacies of taxation.

The context: taxation of digital financial services in Africa

With the exponential growth of mobile money and DFS over the past decade, and the need for more tax revenue, several African countries have specifically targeted DFS as a potential revenue source. By December 2022, more than ten countries in Africa had already implemented a specific tax on DFS transactions. While these taxes differ in various ways – such as rate, tax type, exemptions, transactions targeted (e.g., deposits, withdrawals or transfers), and tax base – all are designed to generate tax revenue or to include the informal sector in the taxable base.

These taxes have far-reaching implications for several stakeholders: policymakers, revenue authorities, and the private sector. It is crucial for all these groups to be actively involved in assessing the effectiveness of different tax instruments and their impact on the adoption and expansion of DFS, like mobile money.

The problem – and a solution

How can stakeholders make sure they’re up to date on the latest innovations or changes in legislation in different countries? This information has not been available under one roof – until now.

At DIGITAX, we are in the unique position of contributing to filling this gap by providing a perspective on DFS taxation across multiple African countries. Our new web portal, Taxation of digital financial services in Africa – the DFS TaxMap – was launched on 18th July and is available in both French and English. It’s designed as a one-stop shop for information on DFS taxation in Africa. The portal provides stakeholders – including practitioners and researchers – with clear, accurate, up-to-date information on current and past tax policies. The DFS TaxMap enables comparison of different instruments across countries as well as an overview of past policies to trace how reforms have evolved. It has two key components: a map for easy visualisation of data, plus individual, in-depth country profiles.

The DFS TaxMap

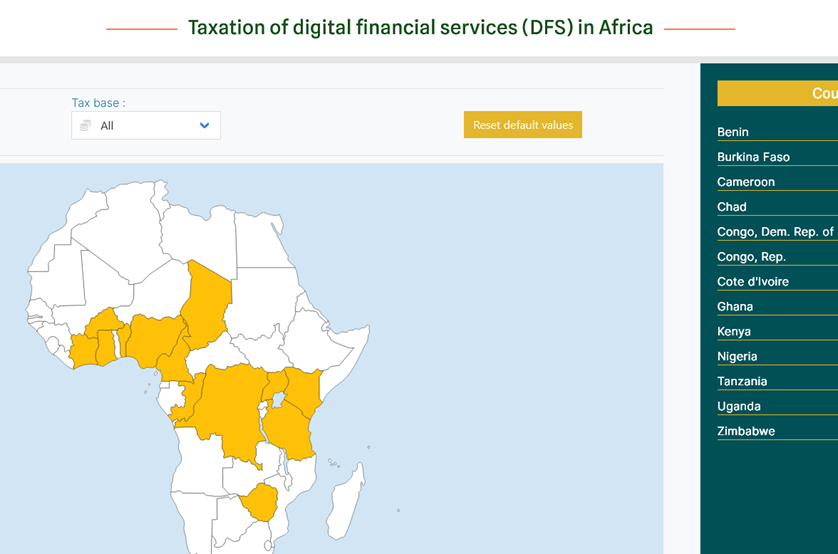

- The map highlights all countries applying a tax specific to DFS transactions at the level of consumers (values and fees) and operators. Thanks to a clear geographical visualisation, we can quickly identify which countries have implemented a specific tax.

- Users can filter information by year and tax base (transaction values, fees or turnover).

- For each taxing country, the map presents DFS tax specifics such as the tax’s name, rate, exemptions and targeted transactions.

- Thirteen countries are featured: Benin, Burkina Faso, Cameroon, Chad, Democratic Republic of Congo, Republic of Congo, Côte d’Ivoire, Ghana, Kenya, Nigeria, Tanzania, Uganda and Zimbabwe. The map will be regularly updated to reflect changes and evolutions in the DFS tax landscape.

Country profiles

- Clicking on a country brings up detailed information on tax legislation and reforms, enabling comparison of policies, tax rates and associated regulations. A timeline provides historical information showing when the tax was established and the changes since. There are links to legal sources to enable users download, study and cite the documents underpinning the reforms.

- Country profiles also provide usage statistics of mobile money and other financial services, number of agents, transaction values and volumes, disparities in the use of DFS between the richest and poorest, and differences between women and men.

- Information on digital payment usage, mobile money accounts, and financial institution accounts is sourced from the World Bank’s Global Findex. Data on the usage and growth of financial services and mobile money is also sourced from the International Monetary Fund’s Financial Access Survey.

- You will also find downloadable country-level infographics with facts and figures for a first set countries.

Robust, reliable data

DIGITAX has collected and collated publicly available information on all DFS-specific taxes from multiple sources, including legislation, official statistics, government reports, academic papers, and news articles – selected based on their credibility, relevance, and publication date. Data are reviewed, analysed, and synthesised to extract relevant information. This vast, multi-source data are presented in user-friendly format (tables, graphs, infographics) with intuitive navigation so that users easily find the information they need. There is a glossary of key terms.

Looking ahead

The tax landscape is constantly changing, with new taxes being formulated and enacted. At DIGITAX, we’ll endeavour to keep our finger on the pulse. Whether that be by adding more country profiles, updating existing profiles with the most recent data, or providing links to new legislation, we will strive to ensure that the DFS TaxMap remains trustworthy, and the first port of call for stakeholders seeking reliable, current information on the status of the DFS tax landscape.

In this regard, should you know of any changes or notice any inaccuracies, we’d be grateful if you’d please let us know at [email protected]

Links

- DFS TaxMap web portal – English | Français

- Short announcement launching the DFS TaxMap web portal

- The Africa Report: How should Africa’s digital payments be taxed?

- The Economist: African governments hope digital taxes will fill a budget hole

- DIGITAX Research Programme webpage