Across Africa, the rapid growth of digital financial services (DFS) has led to increased interest in effectively taxing these services.

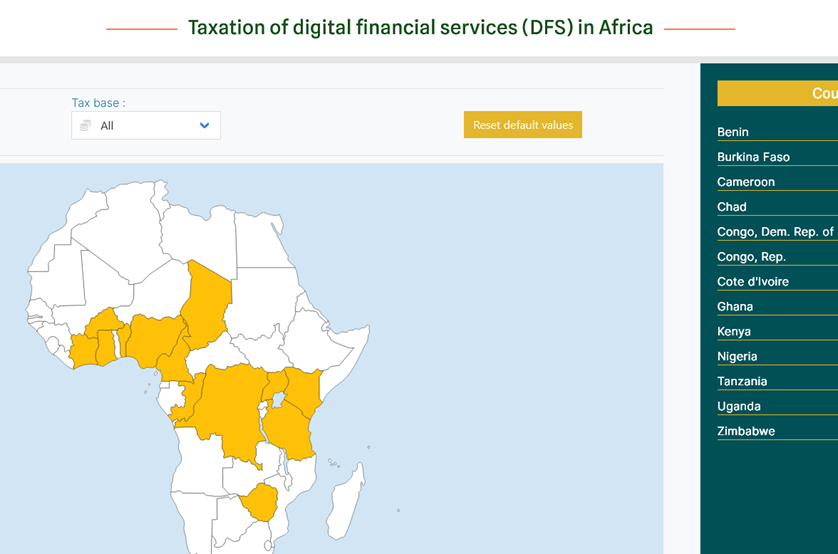

To meet the need for up-to-date information on evolving tax regulations, ICTD’s DIGITAX Research Programme has launched the DFS TaxMap, a dynamic web portal in English and French tracking the diverse approaches to DFS taxation.

The DFS TaxMap simplifies the complex landscape of tax regulations and provides comprehensive tax information. It is a centralised platform that enables stakeholders to effortlessly navigate the intricacies of taxation and make informed decisions.

Key features of the DFS TaxMap include:

- An interactive map presenting countries applying specific taxes on DFS transactions at the consumer and operator levels.

- Country profiles, with detailed information on tax legislation, reforms, usage statistics, and disparities in DFS adoption.

As the tax landscape evolves, the DFS TaxMap will continue to provide reliable and current information, ensuring stakeholders have a trusted resource for navigating the DFS tax landscape.

Visit the DFS TaxMap to discover and explore the taxation of digital financial services in Africa.

- Blogpost on the DFS TaxMap