Tax, Conflict, and Fragility

In fragile and conflict-affected settings, taxation is not only a source of revenue but also a critical foundation for building state legitimacy, strengthening public authority, and fostering more equitable governance. Our research explores how taxation functions in fragile settings, examining the challenges, risks, and opportunities it presents for peacebuilding, state-building, and citizen engagement. We aim to inform more coherent and context-sensitive policy approaches that support sustainable development and effective governance in fragile states.

Our work focuses both on how formal tax systems operate in fragile settings, as well as on the informal fiscal systems that often exist in these contexts. This includes, but is not limited to, work on:

- Building tax systems in fragile contexts

- The relationship between tax and statebuilding

- Armed group taxation

- Informal taxation

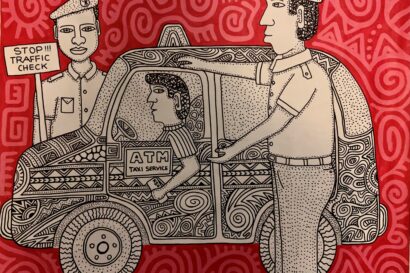

- Roadblock taxation