The African Tax Research Network (ATRN) Congress, convened by the African Tax Administration Forum (ATAF), celebrated its 10th anniversary in Cape Town, South Africa, from 16–18 September 2025. Since its launch in 2015, the ATRN Congress has become a leading platform for African tax researchers, policymakers, and practitioners to share knowledge and debate pressing issues in tax policy, administration, and legislation. This year’s event brought together hundreds of participants and featured a rich programme of plenaries, research presentations, and master classes in English, French, and Portuguese.

A long-standing ATAF friend and partner, the International Centre for Tax and Development (ICTD) co-sponsored this year’s Annual Congress and actively contributed to the event through panel discussions, research presentations, a master class, and a booth that welcomed participants throughout the three days.

Day 1: Panel on Africa’s Tax Thought Leadership

On the opening day, ICTD Research Fellow Daisy Ogembo joined the first plenary session, “A Decade of Insight, Future of Influence: Building Africa’s Tax Thought Leadership for a Changing World.” In her intervention, Ogembo highlighted the role of Digital Public Infrastructure (DPI) in shaping fairer and more inclusive tax systems. She argued that successful tax reforms must “put principles before platforms,” stressing that secure, interoperable, and citizen-centric systems are the foundation for building stronger social contracts between governments and citizens.

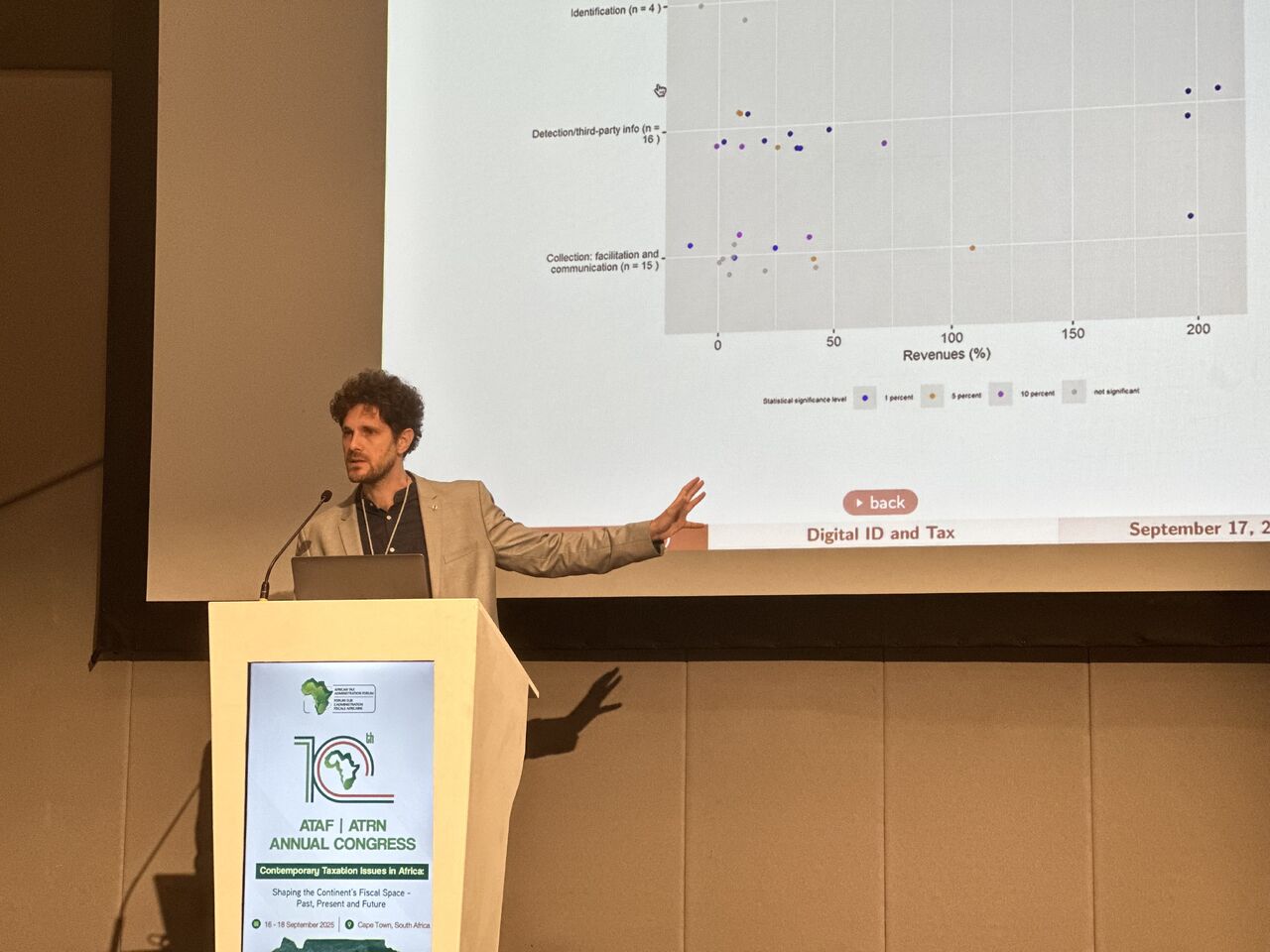

Day 2: Research on Digital IDs in Ghana

The second day featured a paper presentation by ICTD Research Fellow Fabrizio Santoro. His study, “The Potential of Digital ID Systems for Tax Administration: The Case of Ghana,” examined how digital identification can strengthen tax administration. The research found that digital IDs have boosted taxpayer registration, particularly among women and younger people, though uptake has been slow, with only 7 per cent of taxpayers migrating to the new system after two years. Santoro highlighted opportunities for data-driven registration drives, stronger system integration, and safeguards for data privacy. The discussion underscored the importance of collaboration with the Ghana Revenue Authority and the need for legislative reforms to maximise the benefits of digital ID integration.

Day 3: Master Class on Digital Public Infrastructure

On the final day, ICTD delivered a successful master class titled “The Role of Digital Public Infrastructure in Tax Administration: The Case of Uganda, Ghana, Rwanda and Senegal.” Led by Santoro and Ogembo, the interactive session engaged up to 30 participants in activities such as a live mapping of African DPI ecosystems and a policy simulation lab. The workshop explored the opportunities and risks of digitalisation for taxation and offered participants practical tools and evidence-based insights.

ICTD Booth

Throughout the Congress, ICTD’s booth served as a space for engaging with policymakers, researchers, and practitioners. The team, including Research Consultant Lucia Rossell and Communications and Impact Specialist Bushra Saleem, shared ICTD’s latest research and built new connections across the tax and development community.

Looking Ahead

ICTD’s active participation in the ATRN’s 10th anniversary reflects its ongoing commitment to working with Revenue Authorities to generate high-quality research, foster dialogue, and support evidence-based reforms in African tax systems. As the Congress concluded, ICTD looks forward to further collaborations with ATAF and ATRN members and partners to strengthen domestic revenue mobilisation and build fairer, more inclusive tax systems across the continent.