The need for research-driven, evidence-based policymaking on tax has never been greater. Aid is retreating and sovereign debt is at crisis levels, so governments are increasingly turning to domestic tax to plug public finances. Pressure to raise more revenue and raise it quickly can, however, result in hasty reforms which can lead to public discontent, potentially triggering protests and undermining trust, as was seen in Kenya, Sri Lanka and South Africa.

Earlier this year, the Uganda Revenue Authority (URA), a long-standing ICTD partner, was tasked with the ambitious target to collect UGX 36.7 trillion (GBP 7.65 billion) for the new fiscal year, the highest in its history. This target is against a backdrop of a growing economy and a strong track record – last financial year, the URA exceeded its target of UGX 31.3 trillion (GBP 6.7 billion) with a surplus of UGX174.11b (GBP 37 million). Nonetheless, recognising the risk inherent in the pressure to raise more revenue quickly, and the need for research-informed approaches, the URA recently hosted its first-ever Research Day, with the support of ICTD and UNU-WIDER.

Strengthening tax policymaking through evidence

Under the theme “Linking tax research to policy for stronger domestic revenue mobilisation”, the Research Day marked an important step in URA’s commitment to transformation into a fully data-driven organisation.

Abel Kagumire, Commissioner of Executive Office Operations, delivered the opening remarks on behalf of the Commissioner General, John R. Musinguzi. Commissioner Kagumire said: “Evidence-based policy and decision-making are central to achieving our revenue ambitions and to ensuring that every policy, reform, and administrative measure is both effective and fair.”

He added that partnerships with ICTD and UNU-WIDER “illustrate how global collaboration can directly improve domestic tax policy and administration,” resulting in transformative outcomes such as strengthening URA’s approach to taxing the wealthy.

Similarly, Allen Nassanga, Ag. Commissioner for Strategy & Risk Management, emphasised the value of data sharing: “The Research Day is an opportunity to share our findings and recommendations with URA staff and stakeholders, to discuss and debate them, and to identify key takeaways that can shape tax policy and administration.”

She also expressed her commitment to making the Research Day an annual event, celebrating the growing body of research produced by URA.

Representing the Ministry of Finance, Planning and Economic Development, Moses Kaggwa, Director of Economic Affairs, linked the discussions to Uganda’s broader fiscal ambitions: “Our long-term aspiration, as articulated in the Domestic Revenue Mobilisation Strategy, is to raise Uganda’s tax-to-GDP ratio to 20% by FY 2029/30. As a ministry, we believe that research shouldn’t sit in archives but rather guide decisions. […] Let us use evidence not just to assess performance, but to shape the future of revenue mobilisation and economic transformation in Uganda and the region”.

A decade long partnership between ICTD and URA advancing research and innovation

Giulia Mascagni, ICTD Executive Director, reflected on the 12-year partnership between ICTD and URA which has helped embed research within Uganda’s tax system: “This Research Day wouldn’t have been possible ten years ago. When I first started working with administrative data from African revenue authorities, none had shared their data with researchers for the purpose of doing research and informing policy. Fast forward a decade, we now have a Research Lab at the URA that researchers can access”.

She noted that access to local data through the Data Lab – inaugurated in 2022 as part of URA’s collaboration with UNU-WIDER – enables policymakers to draw insights that are context-specific, rather than relying on external evidence that may not reflect Uganda’s realities.

Jukka Pirttilä, Non-Resident Senior Research Fellow at UNU-WIDER, added that the lab has already launched calls for research proposals, the last of which happened earlier this year.

“Selected teams have been supported to prepare studies addressing current policy matters related to tax administration design and tax policy in Uganda,” he said.

Research presentations: Drawing on real-time data and applying evidence to practice

The Research Day concluded with presentations showcasing recent studies based on URA administrative data. Presentations included:

- Adrienne Lees, ICTD Doctoral Fellow, shared findings on tax compliance costs for firms in Uganda, examining on how administrative processes affect business operations and compliance behaviour.

- Frederik Kalyango, Manager of Refunds in the Domestic Taxes Department at URA, presented a study co-authored with Giovanni Occhiali (ICTD Research Fellow) on the impact of tax agents on tax compliance.

- Ian Mwesigye Kananura, Supervisor Tax Crime Investigations at URA, discussed insights from an ICTD-funded study on rental income tax in Uganda.

As the day concluded, participants agreed that the inaugural Research Day marked a major step toward embedding research at the heart of tax policymaking, laying the foundation for more effective and equitable domestic revenue mobilisation in Uganda.

URA Commissioner General reaffirms commitment to research

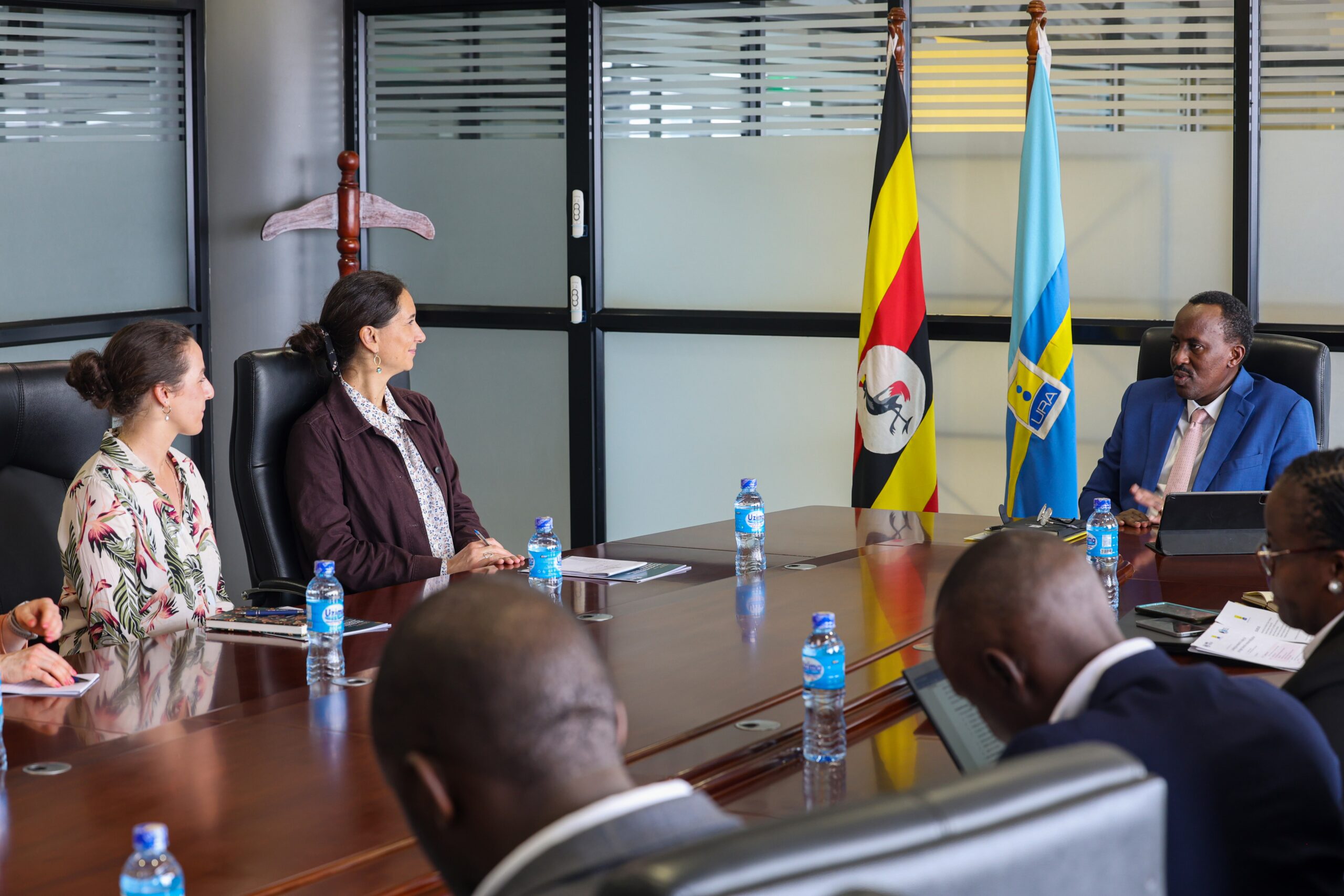

Following the event, Commissioner General John R. Musinguzi met with a delegation from ICTD and UNU-WIDER, reaffirming URA’s commitment to strengthening research as a driver of innovation and sustainable revenue growth in a changing tax landscape.

Echoing his remarks, Giulia Mascagni highlighted ICTD’s longstanding partnership with URA and the Centre’s mission to drive collaborative research that makes tax systems more effective, fair and sustainable.