ICTD and researchers mentioned in ABC News Australia

ABC News (Australia) has quoted the recent ICTD working paper Profit Shifting of Multinational Corporations Worldwide, co-authored by ICTD researchers Javier Garcia-Bernardo and Petr Janský in the article Multinational tax avoidance ‘scam’ targeted by Joe Biden, Janet Yellen with ‘global minimum tax’. The article also mentions the ICTD.

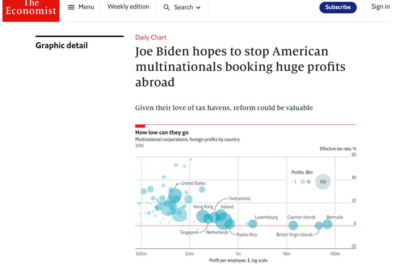

ICTD research featured in The Economist

The ICTD, alongside Petr Janský, an economist at Charles University in Prague and data scientist Javier Garcia-Bernardo have been featured in a new article in The Economist titled Joe Biden hopes to stop American multinationals booking huge profits abroad. The article highlights data from an ICTD working paper that Janský and Garcia-Bernardo recently co-authored called Profit Shifting of Multinational Corporations Worldwide.

Mick Moore featured in the Colombo Telegraph

In their article Port City Bill Red Flags: Experts Warn Of Economic Zone Will Be Black Money Tax Haven, Parallel Govt In Lanka, the Colombo Telegraph writes about taxation experts and economists sounding the alarm about the proposed tax-free regime for the Colombo Port City in Sri Lanka.

The ICTD’s Professor Mick Moore OBE has been featured, which cites his viewpoint that global experience had proved sweeping tax exemptions do not attract foreign investors, who are far more attracted by the reliability of a tax structure, rather than exceptions that can be removed at the stroke of a pen.

ICTD study written up by ICIJ

The ICTD, alongside Petr Janský, an economist at Charles University in Prague and data scientist Javier Garcia-Bernardo have been featured in a new article on the website of the International Consortium of Investigative Journalists, titled Multinationals shifted $1 trillion offshore, stripping countries of billions in tax revenues, study says. The article highlights data from an ICTD working paper that Janský and Garcia-Bernardo recently co-authored called Profit Shifting of Multinational Corporations Worldwide.

Mick Moore authors guest column in Daily FT

Professor Mick Moore OBE authored a guest column in Sri Lanka’s Daily FT website titled Don’t allow Port City to undermine national sovereignty. The column argues that proposed tax exemptions in the city will have no positive effect in attracting foreign investment and will threaten the country’s national sovereignty.

ICTD researchers co-author article in L’Economiste

ICTD Research Fellow Dr Max Gallien and Research and Communications Associate Soukayna Remmal co-authored the article La fiscalité actuelle encourage-t-elle vraiment l’économie informelle? (Does the tax system really encourage the informal economy?) in Morocco’s L’Economiste.com.

Martin Hearson featured in Washington Post

ICTD Research Fellow and International Tax lead Martin Hearson was featured in the Washington Post’s article “Biden told big multinational corporations to “get real” about paying taxes. Here’s what he plans to do“. The article mentions Martin’s forthcoming article on international tax in Perspectives on Politics.

ICTD Senior Fellows featured in Law360 articles

Insights from ICTD Research Fellow and International Tax lead Martin Hearson’s recent working paper At the Table, Off the Menu? Assessing the Participation of Lower-Income Countries in Global Tax Negotiations were recently featured in the Law360 article, Developing World Looks To Sway OECD On Tax Talks. In addition, ICTD Senior Fellow Michael Durst was mentioned in the website’s Simpler Transfer Pricing Helps Developing Nations, Tax Pros Say article.

Martin Hearson interviewed by Tax Notes Talk podcast

Tax Notes‘s podcast, Tax Notes Talk, is a weekly discussion of cutting-edge developments in tax, including up-to-the-minute changes in federal, state, and international tax law and regulations. ICTD International Tax lead Martin Hearson was featured in the podcast’s January 7th episode, speaking with David Stewart, Stephanie Soong Johnston, and Emmanuel Eze on the role and influence of developing countries in the OECD’s inclusive framework. You can listen to the episode here.

ICTD webinar covered by Tax Notes International

On December 18th, 2020, the ICTD hosted a virtual roundtable discussion on deepening the inclusiveness of global tax negotiations. The online event launched the research paper “At the Table, Off the Menu? Assessing the Participation of Lower-Income Countries in Global Tax Negotiations” by Rasmus Corlin Christensen, Martin Hearson, and Tovony Randriamanalina. Tax Notes International wrote about the event and research paper in the article “Lower-Income Countries Must Collaborate for Tax Policy Sway” by Sarah Paez.

Martin Hearson’s podcast appearance featured in Forbes

ICTD Research Fellow and International Tax lead Martin Hearson recently appeared in a Tax Notes Talk podcast episode. The transcript of the podcast has been featured in Forbes in an article called Tax Policy: How Inclusive Is The OECD’s Inclusive Framework?

Mick Moore OBE award covered by Brighton and Hove News

Brighton and Hove News writes about ICTD Founding CEO, Professor Mick Moore, and his recent appointment of an OBE by the Queen in her New Year Honours List. Read more in their article “Actors, academics and ambulance service veteran honoured by the Queen“.