Law 360 Tax Authority features ICTD Research on wealth taxes and tax compliance

The ICTD’s research on what lower-income countries should do to tax the wealthy was featured in Law 360 Tax Authority in the article Poor Nations Urged To Boost Enforcement Before Taxing Wealth.

ICTD Researchers publish Op-ed in Moroccan Media on Zakat

ICTD Research Fellows Dr Max Gallien, and Dr Vanessa van den Boogaard, along with Dr Umair Javid, assistant professor of politics and sociology at Lahore University of Management Sciences (LUMS) and ICTD research officer Soukayna Remmal co-authored an opinion piece on the potential of a Zakat state fund in Morocco, published on Moroccan economic outlet Medias24. Their analysis is also available in English on our website here.

ICTD Research Fellow Vanessa van den Boogaard publishes Expert Analysis on Somalia on Africa Portal

ICTD Research fellow and informal tax lead Dr Vanessa van den Boogaard published an expert analysis on research repository Africa Portal discussing findings from her paper on informal taxation and collective action in Somalia. Download the full working paper 126 ‘Co-Financing Community-Driven Development Through Informal Taxation: Experimental Evidence from South-Central Somalia‘.

Kenyan Media Notes APTI Participation to ATRN

Three Kenyan media outlets, namely the Kenya News Agency, All Africa, and The Star have noted the distinguished participation of team members of the African Property Tax Initiative (APTI) to the 6th African Tax Research Network (ATRN) conference themed ‘Maximizing the Revenue Potential of Property Taxes through Digitization’ and organized by the African Tax Administration Forum .

The Kenya News Agency highlights “The African Property Tax Initiative established in 2017 by the International Centre for Tax and Development states that property taxes have a great potential to constitute a mainstay revenue stream for African Countries when properly harnessed.”

Tax Notes Reviews Martin Hearson’s Book Imposing Standards

Nana Ama Sarfo, contributing editor at Tax Notes International, reviewed our research fellow and international tax lead Dr Martin Hearson’s latest book “Imposing Standards: The North-South Dimension to Global Tax Politics.” In her review, Sarfo asserts “Imposing Standards arrives at a pivotal moment in international tax policymaking. To know where we are going, we must know where we have been. Yet what has been missing from international tax reform discourse is a serious, and robust, historical analysis. Hearson’s book shines a light on that historical narrative and illuminates some paths forward for lower-income countries trying to establish their own norms.” Read the full review here.

Research Fellow Martin Hearson Authors Opinion Piece on The Washington Post About International Tax Negotiations

ICTD research fellow and international tax lead Dr Martin Hearson authored an opinion piece published by the The Washington Post’s ‘The Monkey Cage‘ blog on June 30, 2021 titled “Great powers have always dictated the terms of ‘global’ tax deals. This time may be different“. In this piece, Hearson provides a commentary on global tax politics in light of the recent international tax negotiations. His timely piece draws on some of the arguments discussed in his latest book: “Imposing Standards: The North-South Dimension to Global Tax Politics“.

Senior Advisor Doris Akol on TADAT-IMF Podcast on Gender and Revenue Administration

ICTD senior advisor Doris Akol took part to the third TADAT podcast on June 30, 2021 to discuss improving gender equality within tax administration, drawing on her experience as former Commissioner General of the Uganda Revenue Authority. The TADAT podcast is a special collaborative series by the International Monetary Fund’s Fiscal Affairs Department and the TADAT Secretariat. This episode was moderated by Ms. Vicki Perry, Deputy Director, Fiscal Affairs Department of the IMF, with guests speakers being Ms. Doris Akol and Ms. Deborah Jenkins, Deputy Commissioner, Small Business at the Australian Taxation Office (ATO). The episode is available here.

Senior Fellow Sol Picciotto interviewed on the radio about international tax negotiations

ICTD senior fellow Professor Sol Picciotto was interviewed on radio programme Voice of Islam Radio’s Saturday Morning Live on June 12, 2021 to discuss the recent negotiations on international tax reform. You can hear Professor Picciotto here from 57:00 to 1:17, and read his recent blog “Africa follows up the Biden proposals for international tax reforms” in which he discusses the perspective of African countries regarding the proposed reforms.

ICTD research featured in The Economist

The ICTD has been featured in a new article in The Economist titled “Will poorer countries benefit from international tax reform?“. The article cites elements from a conversation with Research Fellow and International Tax Lead Martin Hearson and findings from Working Paper 119 “Profit Shifting of Multinational Corporations Worldwide” and WP115 “At the Table, Off the Menu? Assessing the Participation of Lower-Income Countries in Global Tax Negotiations“.

ICTD research featured in Forbes

The ICTD has been featured in a new article in Forbes titled “Looking Beyond A Global Minimum Corporate Tax.” The article cites Research Fellow and International Tax Lead Martin Hearson’s summary brief “Corporate Tax Negotiations at the OECD: What’s at Stake for Developing Countries in 2020?”

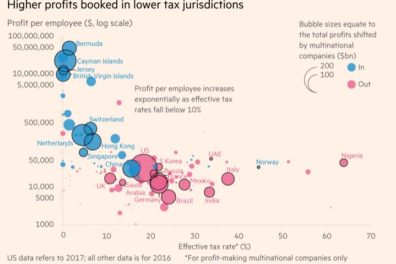

ICTD research featured in Financial Times

The ICTD has been featured in a new article in Financial Times titled “Biden’s global tax plan could leave developing nations ‘next to nothing.” The graph used in the article was generated using data from one of ICTD’s latest working papers “Profit Shifting of Multinational Corporations Worldwide” authored by Petr Janský, economist at Charles University in Prague and data scientist Javier Garcia-Bernardo.

ICTD’s support of Nigeria’s Tax & Technology event highlighted in national papers

The ICTD has been mentioned in several national papers in Nigeria for taking part in the organisation of the ‘Technology & Tax’ conference organized by the Nigeria Governors’ Forum with the support of the World Bank and the ICTD. This involvement is part of the work of the ICTD’s Nigerian Tax Research Network (NTRN). The NTRN is dedicated to enhancing the generation and exchange of tax knowledge in Nigeria. Topics addressed include the role of technology in improving revenue administration processes. ICTD’s contribution was reported on by The Cable, The Nation, the Nigerian Tribune, and The Sun.