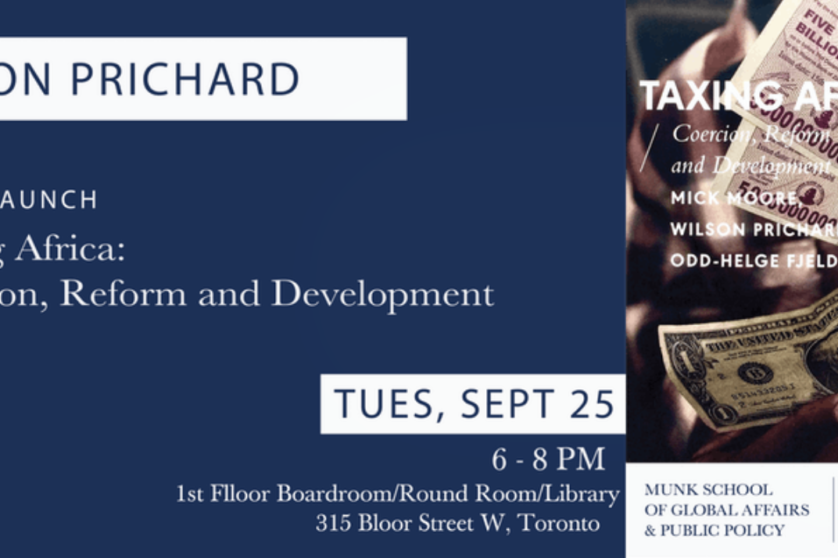

The Munk School of Global Affairs and Public Policy is hosting a launch of our book Taxing Africa: Coercion, Reform and Development.

The event will be held on Tuesday September 25th from 6:00 – 8:00pm in the Round Room on the first floor of the Munk School Observatory Building (315 Bloor Street West), and will feature a presentation and discussion with one of the book’s authors.

Speaker: Wilson Prichard

Wilson Prichard is an Associate Professor jointly appointed to the Department of Political Science and the Munk School of Global Affairs and Public Policy. He is a Research Fellow at the Institute of Development Studies at the University of Sussex and is the Research Director of International Centre for Tax and Development. His broad research focus is in international development, with a particular focus on sub-Saharan Africa, and he has an interdisciplinary background in comparative politics, international political economy and economics. His current research explores the political foundations of development, with a focus on the differential implications of taxation, resource wealth, and foreign aid for development outcomes, particularly in post-conflict settings. He works closely with civil society organisations, national governments, regional organisations in sub-Saharan Africa, and international agencies and institutions, including the World Bank, IMF, OECD, the UN, and various aid agencies.

The Book

Taxation has been seen as the domain of charisma-free accountants, lawyers and number crunchers – an unlikely place to encounter big societal questions about democracy, equity or good governance. Yet it is exactly these issues that pervade conversations about taxation among policymakers, tax collectors, civil society activists, journalists and foreign aid donors in Africa today. Tax has become viewed as central to African development.

Written by leading international experts, Taxing Africa offers a cutting-edge analysis of the continent’s tax regime, displaying the crucial role such arrangements have on attempts to create social justice and push economic advancement. From tax evasion by multinational corporations and African elites to how ordinary people navigate complex webs of ‘informal’ local taxation, the book examines the crucial potential for reform.