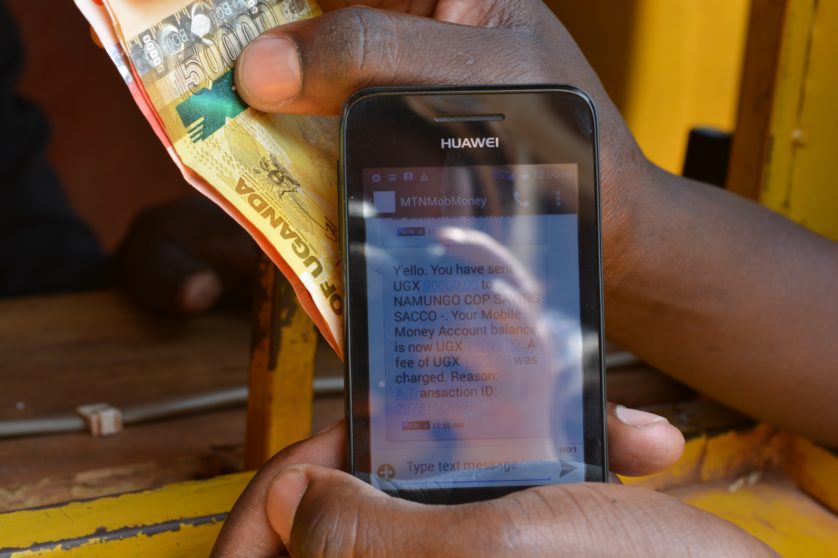

In the context of the Covid-19 pandemic, cash-strapped governments across Africa will be looking for ways to fill revenue gaps. Having long faced challenges in taxing large multinational corporations and significant informal economic activities, they may be tempted to raise much-needed revenue relatively easily by imposing taxes on rapidly growing digital financial services, particularly mobile money. However, increasing mobile money usage across the continent has the potential to expand financial inclusion. And levying taxes, particularly on transactions, is likely to have a regressive effect.

A new GSMA paper by Killian Clifford explores the causes and consequences of these taxes by examining the cases of four countries where a tax on mobile money transactions was proposed. The experiences of Uganda, Cote d’Ivoire, Malawi, and Congo-Brazzaville point to several unintended consequences including the reduction or reversal of the taxes due to public outcry and a decrease in mobile money usage. The cases also illustrate the potential for these taxes to result in the deferral of infrastructure investment by operators, and to undermine financial inclusion of vulnerable groups and national digital development plans.

In this webinar, Killian will present the paper’s findings and discussants Dr. Waziona Ligomeka, Professor Njuguna Ndung’u, and Professor Mick Moore will share their thoughts. The event will be moderated by Rhiannon McCluskey and Moyosore Arewa of the ICTD, who will facilitate questions from the audience in the final 20 minutes.

Please register here to attend here. This event is connected to the ICTD’s new DIGITAX programme on digital financial services, digital ID, and tax.

Speaker details:

- Presenter: Killian Clifford is the Director of Policy and Advocacy for Mobile Money at the GSMA. He is the author of The causes and consequences of mobile money taxation: An examination of mobile money transaction taxes in sub-Saharan Africa.

- Discussant: Dr. Waziona Ligomeka is the Director of Policy, Planning and Research at the Malawi Revenue Authority. He is the author of the paper Assessing the Performance of African Tax Administrations: A Malawian Puzzle.

- Discussant: Professor Njuguna Ndung’u is the Executive Director of the African Economic Research Consortium and an advisor to the Brookings Africa Growth Initiative, the Alliance for Financial Inclusion, and the Better Than Cash Alliance. He is also the former Governor of the Central Bank of Kenya. He is the author of the report Taxing mobile phone transactions in Africa: Lessons from Kenya.

- Discussant: Professor Mick Moore is a Senior Fellow of the International Centre for Tax and Development (ICTD), based at the Institute of Development Studies. He has written extensively on tax and development, including the book Taxing Africa, and the recent piece How can African tax collectors help cope with the economic impacts of Covid-19?

- Moderators: Rhiannon McCluskey is the Communications and Impact Manager and Moyosore Arewa is a Program and Research Officer at the ICTD. They are the co-chairs of the Digital Financial Services and Tax Working Group, which has members from over a dozen organisations in the field and has been collectively exploring the issues for the last two years.

Timezones

- 8-9am Washington, D.C.

- 1-2pm London, UK

- 2-3pm Lilongwe, Malawi

- 3-4pm Nairobi, Kenya

- 12-1pm Abidjan, Côte d’Ivoire