As Zambia’s proposed e-levy on mobile money transfers takes shape, policymakers would be prudent to consider the lessons learnt by other African countries

With the significant upswing in mobile money (MM) usage in Zambia, the government is proposing to introduce a levy on MM transfers on 1 January 2024, pending approval from the National Assembly and presidential assent.

The primary objective is to ensure “that everyone contributes something, however small, to the provision of public services”, according to the Minister of Finance and National Planning in his 2024 Budget speech in September. Yet, the levy appears to target small traders, who constitute most of the labour force. The rationale for the rate bands is also unknown, and many uncertainties about the scope of the levy remain.

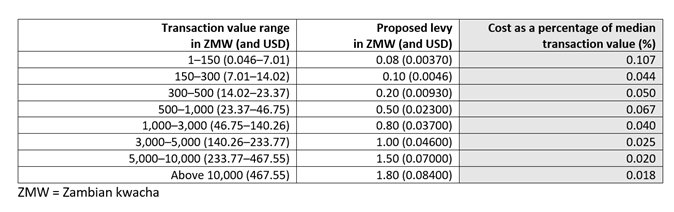

The 8-tiered structure of Zambia’s proposed levy

Zambia’s proposed levy has garnered attention due to its focus on person-to-person MM transfers and its 8-tiered fee structure based on transaction value (Table 1).

Table 1. Zambia’s proposed levy rates for mobile money transfers

The confusingly intricate levy rate structure

The proposed levy rates appear relatively modest compared to other African countries’ taxes on digital financial services, but the rationale for them is unclear. It is important to know whether the rate band variations align with the levy’s policy objective, and to understand their potential impact on various transaction types and on the distribution of the tax burden.

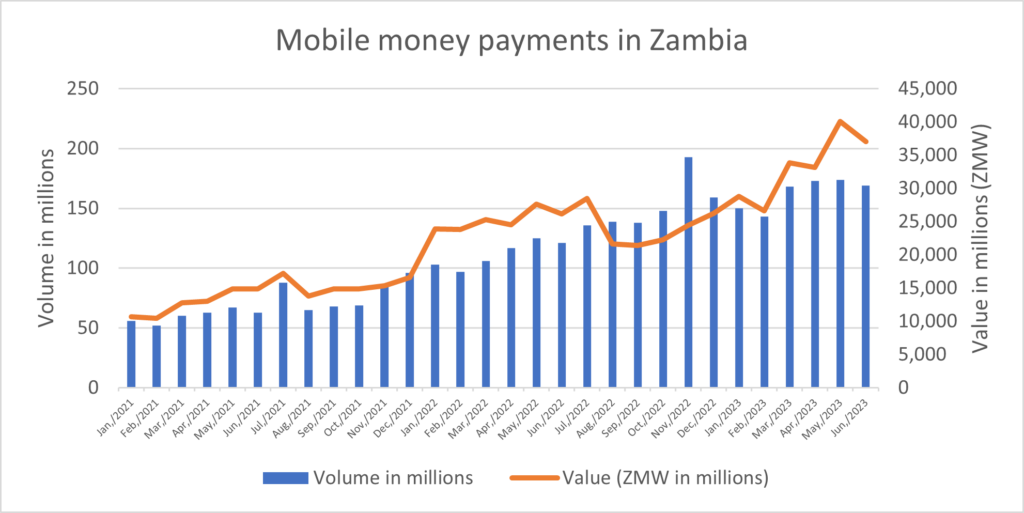

Moreover, the relevance and significance of the higher bands are in question within the Zambian context. In practice, how frequently will these bands be applied? And what will be the impact of the tiered structure on transfers of specific transaction values? Will it encourage or discourage transactions with certain value ranges? Most of these higher bands correspond to transaction values that greatly exceed the median and mean values observed in countries such as Uganda. Data from the Bank of Zambia in the first half of 2023 reveals a significant surge in mobile payments in Zambia (Figure 1), and a notable shift towards bigger transaction amounts. Will the levy address this shift, and is there room for adjustments based on changing usage patterns?

Figure 1. Volume and value of mobile money payments in Zambia: January 2021–June 2023 (ZMW = Zambian kwacha)

Source: Data is sourced from the Bank of Zambia, Payment Systems Statistics, Mobile Money

While individual fees may seem small in isolation, the cumulative cost for multiple transactions could become significant, potentially affecting individuals with lower incomes.

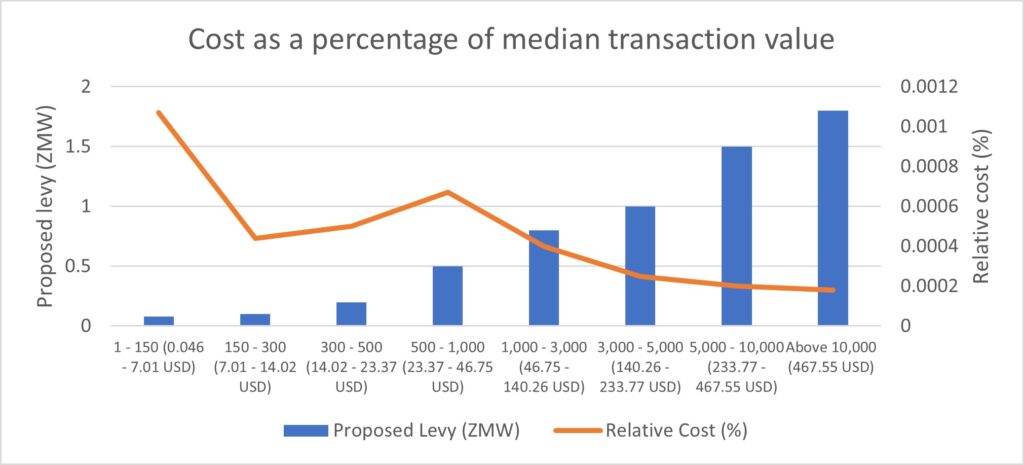

Under the tiered fee structure, as the transaction value rises, generally the relative cost falls, with the exception of two consecutive bands – specifically those spanning ZMW 300–500 (USD 14.02–23.37) and ZMW 500–1,000 (USD 23.37–46.75). Within these bands, as the transaction value rises, so too does the relative cost (Figure 2).

Figure 2. Cost of the proposed levy as a percentage of the median transaction value within each rate band (ZMW = Zambian kwacha)

Source: Zambia’s 2024 Budget on 29 September 2023, Sec. 230. Relative cost of median bracket has been calculated by the author.

The rationale behind the eight initial bands seems intricate. In practice, most MM users will mostly fall into the first three bands. Low-income earners, in particular, tend to rely more on smaller transactions.

Empirical data specific to Zambia is needed to understand the impact of levy rates on user behaviour, especially among low-income earners.

Uncertainties remain about the levy’s scope

The scope of the proposed levy, still in its early stages, has several uncertainties:

- It is unclear whether the party responsible for paying the levy is the sender or the recipient.

- With no clear exemptions, the levy appears to apply from the very first cent of a transaction.

- The precise scope of the levy remains undefined, creating uncertainties about its applicability to various transaction types such as transfers between MM accounts or between an MM account and a bank account.

- The term ‘transfer’ notably excludes deposits and withdrawals from the levy, a factor that might encourage cash handling. Careful scrutiny is needed to ensure that the selective imposition of the levy on transfers does not discourage people from using MM for fundamental financial services.

- The selective application of the levy to transfers raises questions about its coverage, including transfers by “legal persons” (business entities) and merchant transactions. This complexity is compounded by Zambia’s earlier attempts in 2022 to tax business MM usage, which currently remains in limbo. This endeavour aimed to align business MM transactions with bank transactions for taxation purposes, intending to link them to the taxpayer identification number (TPIN) for oversight by the Zambia Revenue Authority. However, discussions on its implementation have seemingly stalled, casting doubt on the extent to which business-related MM transactions are subject to taxation.

- The levy’s selective application – in contrast to untaxed bank-to-bank transfers – raises questions about its impact and equity.

These uncertainties call for further discussions and considerations for refining the proposed levy to balance revenue generation with equitable access to essential public services. While comprehensive information is expected with the publication of draft legislation, the delay in its release is somewhat surprising.

Could Zambia’s proposed levy do more harm than good?

Informal traders constitute 90% of Zambia’s labour force [PDF]. The levy’s design could discourage these traders from using MM for their transactions, with potential impacts on financial inclusion and the digitalisation of the informal economy. This policy choice appears to target small traders, further burdening those already grappling with such fees.

Various industry stakeholders, including Debt Alliance, Mufulira Chamber of Commerce and Industry and the Alliance of Zambia Informal Economy Associations, have expressed concerns about the proposed levy, particularly its potential impact on vulnerable groups, including recipients of Social Cash Transfers who rely on mobile platforms. Although these recipients may not be directly affected, the overarching concern is the indirect impact on their financial wellbeing and the potential burden on individuals with lower incomes. However, without publicly available evidence-based studies, the actual impact of the proposed levy on these vulnerable groups and individuals remains unclear.

Suggestions have been made for the government to consider implementing exemptions for transactions falling below a specific threshold to protect economically vulnerable individuals, while focusing on higher value transactions. One model to consider is Ghana’s e-Levy, which provides a daily exemption of 100 cedi (USD 8.51) per person.

Key lessons for optimising MM taxation in Zambia

To ensure the success of taxing MM in Zambia, policymakers should consider the following suggestions based on insights gleaned from experiences in other African countries:

- Look to the success of countries like Kenya, which has equalised tax rates between traditional banking and MM services. Differential taxation, as observed in Ghana, Tanzania and Uganda, could result in an unlevel playing field.

- Create a tiered structure that not only protects smaller transactions but also aligns with the principle of solidarity. Lowering taxes on smaller transactions can foster financial inclusion and ease the burden on lower-income households. Pilot research in Ghana suggests that MM taxes can place a disproportionate burden on low-income informal sector workers. Ghana’s e-levy attempts to mitigate this impact through exemptions. Additionally, lessons from Kenya show that MM tax can influence transaction frequency, especially among lower-income and larger households.

- Communicate clearly and engage relevant stakeholders, including mobile network operators, financial institutions, and the public. Experiences from Ghana, Tanzania and Cameroon underscore the significance of building public trust through transparent communication.

- Evaluate the tax policy regularly to assess its effectiveness and guide adjustments, as illustrated by Uganda, Tanzania and Ghana. Ensure consistency and thoroughness in these reviews, unlike, for example, Uganda, where no reviews have been conducted for five years.

Looking ahead: Balancing the levy’s objectives and stakeholders’ concerns

The proposed MM levy in Zambia is a significant step. As the government proceeds with this initiative, it should remain open to adjustments and prioritise the best interests of its citizens and the overall economy.

Transparency and administrative guidance are paramount, with collaboration between the government and telecommunication companies to devise innovative revenue-generation methods while fostering business growth.

Enhanced compliance strategies for traders receiving payments via MM [PDF] could unlock additional revenue streams for the government.

Striking a balance is essential to harness the benefits of mobile money while effectively addressing the concerns raised by various stakeholders.

The author would like to thank Chris Wales and Martin Hearson for their valuable suggestions.