Globally, governments are adjusting their tax policies to help address the effects of the coronavirus pandemic. In most countries, these adjustments have focused on supporting businesses to weather the economic disruptions of Covid-19 restrictions. Governments everywhere have been called on to defer or waive taxes on the businesses most affected by lockdowns and other restrictions.

With many countries now loosening restrictions, discussions are increasingly turning toward how to fill revenue gaps created by the pandemic response. Some suggest this should be done by targeting those with the greatest ability to pay—the rich. There is a strong case to focus revenue-raising efforts on the rich. But aggressive enforcement targeting this group is likely to encounter resistance, as they will point to the harm they have suffered from Covid-19 restrictions to justify their inability to pay. This blog explores the opportunities and challenges of an alternative strategy—focusing on the firms and sectors that the Uganda Revenue Agency (URA) knows have actually benefited from the restrictions: the “Covid-19 winners.”

Who benefits from the Covid-19 restrictions in Uganda?

Public health interventions to limit the spread of the coronavirus harm some industries, and benefit others. In Uganda, the President has suspended movement through the country’s borders and airport, restricted movement within the country by closing all forms of public transport, and closed general trading activities, bars, churches, schools, and leisure activities such as music and drama shows. Some sectors, such as manufacturing, financial services, and construction, have been allowed to stay open, but with very limited numbers of staff and provided they can be accommodated while following all public health guidelines. All night-time economic activities have been suspended by the declared curfew of 7pm to 6am, which remains in effect.

These interventions have obviously harmed some businesses. Sectors requiring travel and movement, face-to-face contact, or crowding of people to carry out their business have been particularly effected. But these interventions have also benefitted others. Businesses that provide essential services and those that can function without face-to-face contact are de facto exempt from the restrictions. Traders of food stuffs, farmers, medical service providers, supermarkets, cargo transporters, and utility companies, for instance, have maintained operations—and many have seen an uptick in activity. With the entire population forced to work from home, the providers of online shopping services (e-commerce) and internet service providers have also benefited.

Businesses that have been harmed are requesting targeted relief to manage the Covid-19 disruptions. It therefore makes sense to ask businesses that have benefited from the disruptions to help fill the fiscal gap.

How much do the Covid-19 winners already contribute?

Currently, most Covid-19 winners contribute very little to the overall tax burden in Uganda. Those benefitting from the Covid-19 response, for the most part, are largely tax non-compliant—especially when it comes to income taxes. With the noted exception of the telecom providers, the contribution of Covid-19 winners to the tax base is very small.

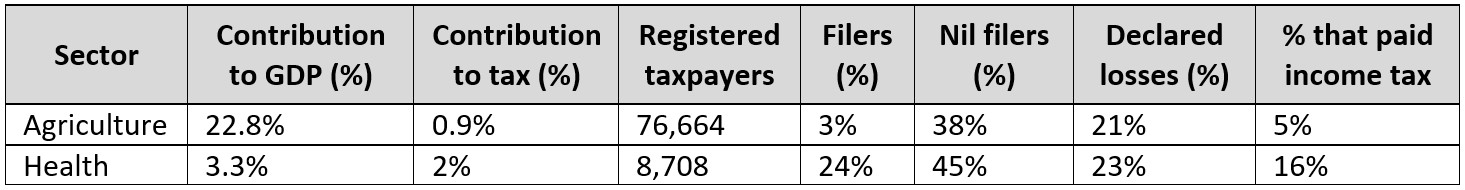

The agriculture sector, for instance, which makes up about 23% of GDP, contributes less than 1% of total tax revenue. Only about 3 percent of taxpayers in the agriculture sector file income tax returns. Most filers either file losses or nil returns. In 2017/18, only about 5% of the over 70,000 registered taxpayers in the agriculture sector paid some income tax.

Similarly, the health sector contributes only 2% to total tax revenue, and less than a quarter of registered taxpayers in the health sector filed their annual income tax returns in 2017/18. Of filers, less than a third filed positive returns, and only 16% made any income tax payments.

Source: GDP figures are from the 2019 UBOS Statistical Abstract and revenue statistics are authors’ computations from URA databases.

Source: GDP figures are from the 2019 UBOS Statistical Abstract and revenue statistics are authors’ computations from URA databases.

This culture of poor compliance is similar or even worse among retailers of food stuffs, professionals, and cargo transporters. Because of legislative gaps, e-commerce firms in Uganda continue to operate largely untaxed. As a result of these gaps, the winners of the Covid-19 response contribute an overall small portion of the tax burden.

Challenges of taxing Covid-19 winners

Depending on the sector, Covid-19 winners present different challenges in terms of taxation. These challenges range from political interference and exemptions, to weaknesses in the existing tax administration and tax laws.

Agriculture is largely practiced by the rural populace, 85% of whom are poor. However, we know there are some large-scale commercial farming operations in the sector that record significant profits and contribute limited taxes. In the past, attempts to expand taxation of these large-scale operations have been derailed by interference from politicians and by tax exemptions.

When section 118E of the Income Tax Act was amended in 2018/19 to provide for a 1% withholding tax on agricultural supplies in excess of UGX 1 million (USD 265), farmers organised protests and the tax became politicised. The income tax amendment was abolished the following year, and efforts to re-instate it have been repeatedly blocked by parliament.

In the health sector, liberalization has resulted in an upsurge of private health facilities. In 2015/16, the government owned most of the of health facilities in Uganda with a market share of 59%. By 2017/18, privately-owned health facilities accounted for about 55% of the market. The share of for-profit private health facilities has almost doubled from 24% in 2015/16 to about 40% in 2017/18. Despite the rapid growth of the for-profit healthcare sector, income tax compliance remains low.

Exemptions for the agriculture and health sectors have also limited tax revenue. Most supplies in these sectors are now either exempted from VAT or zero-rated. All pharmaceutical products, for instance, are zero-rated for customs duties, and profits from agro-processing are exempted from any income tax. Taxpayers in the agriculture and health sectors are now only liable for some income tax, and withholding taxes such as payroll taxes.

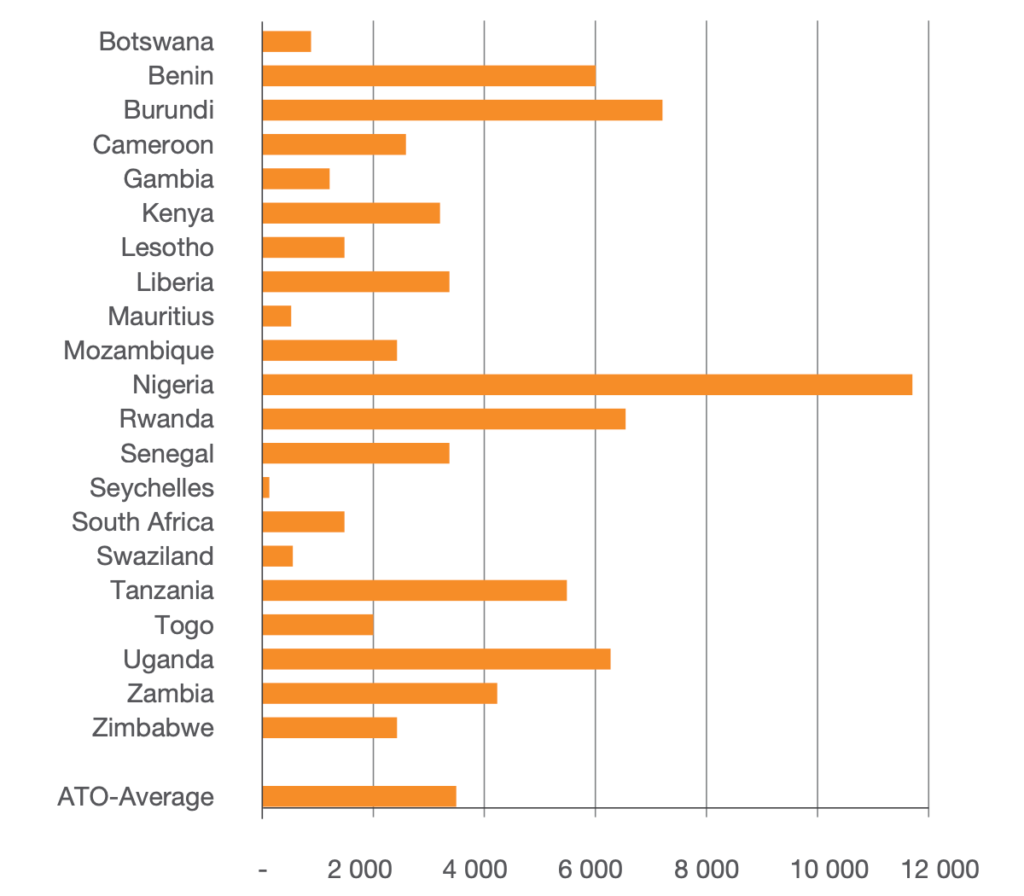

The capacity of the tax administration to effectively enforce existing tax rules on these sectors is also limited. The Uganda Revenue Authority is one of the most understaffed tax authorities in Africa. According to the African Tax Administration Forum, Uganda has a ratio of labour force to tax administration staff of over 6,000:1. Most countries in Africa have a ratio of less than 4,000:1. Staffing gaps limit the authority’s enforcement and audit capacity. Weak technical capacity and a lack of access to information is most problematic for taxation of players in the ICT and e-commerce sectors. Current tax law in Uganda also puts an emphasis on physical presence, making regulation and taxation of e-commerce firms particularly challenging.

Short-term strategies to make taxing Covid-19 winners a political reality

There are opportunities to increase revenue from Covid-19 winners while avoiding some of the challenges. In the short-term, the URA should:

- Avoid talking about taxing farmers and health facilities in a general sense to avoid political interference. It should, however, target just the most profitable firms in these sectors with more thorough enforcement to make taxation more politically feasible.

- Expand tax compliance enforcement on suppliers in the winning sectors—especially those with huge contracts supplying government and private institutions that have not complied with existing income tax rules. Data already available at the URA shows that there are a number of agricultural and medical suppliers that have fulfilled contracts worth large sums of money but have not complied with income tax laws. The URA should pursue enforcement on these large firms now.

Medium- and long-term strategies to expand taxation of Covid-19 winners

The most effective way to tax in Uganda is through the withholding system. In the medium term, the URA should upgrade its existing withholding tax system by:

- Updating the e-tax system to validate Taxpayer Identification Numbers (TINs) of declared suppliers.

- Making TIN declaration a mandatory field when supplies involving large sums of money are declared.

- Requiring withholding agents to declare sufficient identifying information on each of their suppliers, instead of the current common practice of aggregating suppliers and declaring them as one item under “various suppliers.”

For more long-term solutions, the withholding system should be expanded in three main ways:

- Negotiate the reinstatement of withholding tax on agriculture supplies, as it is the only effective way to tax the agriculture sector. In 2018/19, when the 1% withholding tax was introduced, it raised over UGX 32.6 billion (USD 8.6 million) in tax revenue—almost twice that collected in income tax from all agricultural taxpayers.

- Empower banks and Forex bureaus to act as withholding agents on digital payments under the Income Tax Act. This will allow the URA to expand revenue collection from e-commerce transactions. For instance, payments made for digital advertisements first need to pass through domestic banks. Gazetting the banks as withholding agents will allow them to deduct a withholding tax on such payments on behalf of the URA.

- Implement measures to effectively tax e-commerce transactions. This will require, among other initiatives, further building the capacity of the URA to monitor and enforce compliance on this sector. It may also require amending existing laws such as the permanent establishment status of the Income Tax Act to include electronic services; amending section 16(d) of the VAT Act to broaden the scope of taxable e-commerce transactions; the introduction of a source-based regime in the VAT Act; and a review of the current exemption scheme for low-value goods.

Many businesses are experiencing a very difficult time because of the Covid-19 response. Pursuing these simple enforcement strategies on firms that have benefitted the most—and eventually expanding the capacity of the withholding tax system—will increase the fiscal firepower of the government to address the current, as well as future crises.