Though education is a core duty of the state, public education in Sierra Leone is financed not only by the formal government budget and off-budget aid, but also by informal contributions, taxes, and fees paid by households. Since independence in 1961, the state has consistently supported the ideal of universal free primary education, though in practice has remained reliant on non-state actors for both the delivery and financing of primary public education. Formal and informal user fees may be officially abolished, but with insufficient domestic revenue mobilization, informal levies have emerged to fill the significant gaps in service provision. This reflects a broader trend across low-income countries, with negative equity implications. As described by UNESCO, “The issue in many countries is not an insufficient national effort on education spending but that a large part of that effort is by households.”

Drawing on over a year of qualitative and quantitative data collection in northern and eastern Sierra Leone, I find that, given inadequate public financing, the delivery of public education is only possible through informal financing by parents and communities – with significant negative implications for equity [paywall]. Households contribute to the financing of primary public education in a variety of ways, with contributions organised and collected through parent-teacher associations, school management committees, mothers’ clubs, or school administrations, often with the backing of the local chief. Demonstrating their widespread prevalence, in a survey of households conducted in eastern and northern Sierra Leone in 2017, only 5 percent of households made no informal payments to access “free” public primary education, with communities explaining, “we tax ourselves” to look after community needs.

Forms of informal financing

This localized financing of public education takes several forms. First, as government-assisted schools consistently receive insufficient per pupil subsidies from the government, informal fees help fund the running costs of government-funded schools. As described by UNESCO,

When trying to make up for the revenue lost in school fees [by the universal free education programme introduced in 2010], the per pupil subsidy was set too low at USD 2.20. Schools’ operating costs were not adequately covered, and schools’ differing needs were not taken into account. Fees were [unofficially] hastily brought back in many parts of the country (see also Pôle de Dakar et al. and UNESCO report).

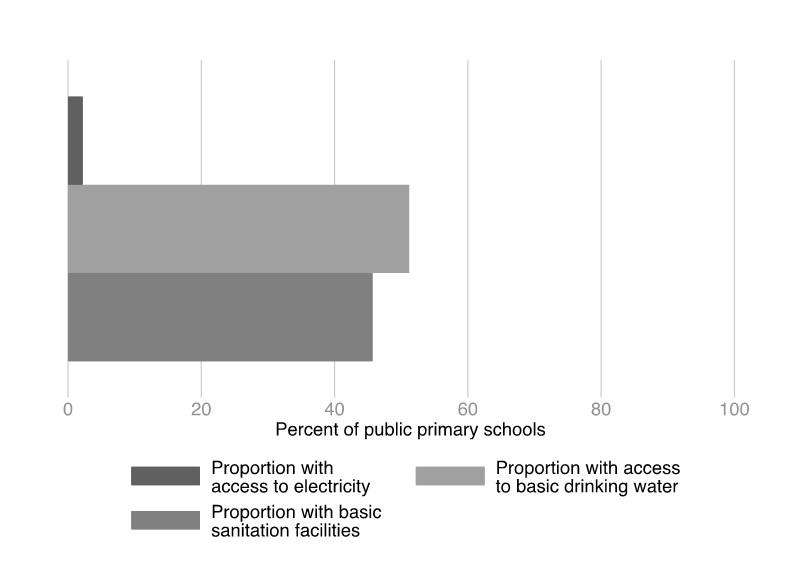

Second, given poor-quality infrastructure and classroom crowding, households are also often required to contribute to improving government-financed school infrastructure. By the end of 2010, 60 per cent of classrooms in all primary schools nationwide were in need of repairs, while access to electricity, water, and sanitation facilities is lacking in the majority of public schools (see Figure 1). Rural areas have even lower rates of access. The need for more space and improved basic infrastructure has led many schools and communities to informally fund classroom expansion and general school improvements.

Figure 1: Quality of school infrastructure, public primary schools, 2017

At the same time, students and parents are commonly expected to contribute time and labour for regular activities such as the sweeping of school compounds, cleaning toilets, and collecting water and firewood. A teacher explained, “Since the school is integrated with the community, parents should be involved in some minor work for the school”, while community members in a focus group explained that the community “works to develop itself”. Meanwhile, community members are commonly called on to support bigger building or improvement projects, providing labour, collecting local materials (i.e. sand, stones, and water), or providing food for labourers (Photo 1).

Photo 1: Schoolchildren collecting local materials to contribute to school building project

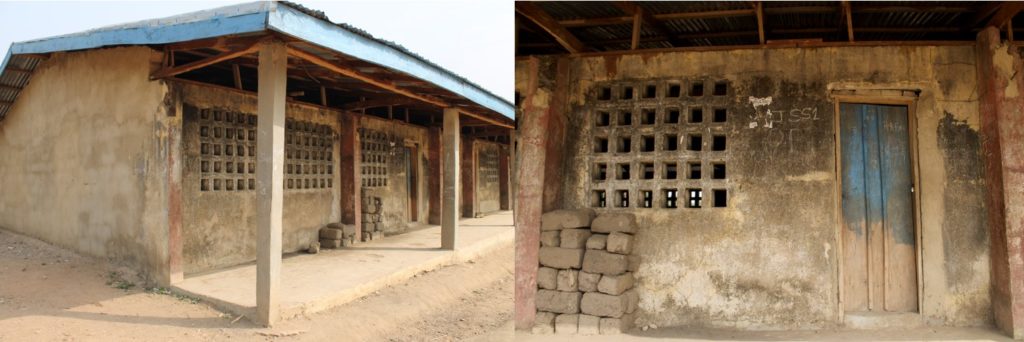

Third, with limited or no government financing, some areas of the country have relied heavily on self-built, self-funded, and often unapproved “community schools”, which make up approximately 19 and 14 percent of all schools in Northern and Eastern provinces, respectively. Given the lack of government funding, a Community Teachers’ Association chairman in a community school explained that he collects informal school charges to run the school, while it is communities themselves that organised the building of the school. In Koinadugu district, meanwhile, a town chief showed how a community raised funds from community members to “raise a school”, though the community had not yet been able to receive approval for the new school from the government (Photo 2).

Photo 2: JSS community school built by community

Fourth, as a result of a severe shortage of teachers relative to student enrolment, many schools — including both government and community-funded schools — rely on “community” teachers that are not on the government payroll but are paid through community contributions. In the three relatively rural and remote districts under study in Northern and Eastern provinces, the prevalence of community teachers was almost universal, with 94% of individuals reporting living in a community reliant on community teachers, with little variation between regions. For community teachers to survive without a government salary, focus group participants explained, “we tax ourselves to help community teachers”. A School Management Committee chairman described that “it is the responsibility of government to pay teachers; if the government doesn’t have that ability, and teachers are not on the payroll, it is our responsibility as parents to do that [pay them]”.

Finally, as teacher salaries remain low in absolute terms, with payments often delayed, there are also incentives for teachers on government payroll to seek additional financial support from students. While some such payments are akin to bribes, serving to corrupt the system, other payments are so institutionalised or heavily sanctioned as to be effectively mandatory and thus part of the real cost of financing public education. For instance, it has been “suggested that some teachers deliberately do not teach the full syllabus thereby forcing students to attend private classes”, particularly where students are required to take state exams to advance. Thus, in order to get the complete “free” public education, students need to pay extra.

Negative equity implications

Based on survey data of in-cash, in-kind, and labour contributions, I estimate that households contribute on average US$ 25 annually for public education, with government funding estimated at US$ 24 annually per pupil in 2017. While imperfect, this estimate illustrates the importance of informal financing in delivering “free” universal primary public education in Sierra Leone. To put these amounts in perspective, the most common formal tax paid, the local poll tax, is only US$ 0.67 per adult annually, highlighting that informal contributions are both a significant expense at an individual level and effectively making up for limited formal tax efforts.

The distributional and equity implications of revenue generation outside of the state are significant. My research shows that the individual distribution of informal revenue generation in Sierra Leone is regressive, with the lowest income quintile paying significantly more in informal user fees to access public goods relative to the highest income quintile [paywall]

More fundamentally, household and community-based financing of public education amount to the state shifting the financial responsibility for essential services onto citizens with negative equity effects. When public goods are financed locally, access depends on the ability to pay, while quality depends on the relative wealth of a particular area. Where informal taxes and fees are required to access public goods, access is by definition exclusionary. Insofar as public goods are funded locally and directly by users, the fiscal system is far less equitable; where the state abdicates its redistributive role by relying on informal fees to fund public goods provision, it accepts and reinforces the reality of inequitable tax burdens and unequal access to quality public goods.

Progressive taxation for quality education for all

Governments, however, cannot eliminate informal fees for education without replacing the revenue from those fees. Encouraged by international donors, low-income governments have repeatedly made declarations supporting universal fee-free education, though donors have not committed to funding the full costs of education and governments have often not sufficiently increased their domestic revenue mobilisation capacity. As a result, informal taxing continues to contribute to essential public goods. In contrast, funding education through a more progressive national tax system, with an emphasis on taxing high-net-worth individuals and international extractive companies, would result in a fairer distribution of fiscal burdens.

In Sierra Leone, the government of Julius Maada Bio, which came to power in 2018, has re-prioritised free universal primary education. While it is too early to assess the impacts of the government’s new education programme, preliminary anecdotal evidence suggests that there has been a reduction in informal taxes and fees for education in at least some parts of the country. This outcome may be possible through the exceptional steps taken by the government to raise domestic revenues so that the state does not have to tacitly rely on household and community contributions. Indeed, the state has undertaken structural reforms of the tax administration, resulting in unprecedented increases in tax revenues. It is on track to raise domestic revenue to 16.5% of Gross Domestic Product (GDP) by 2022 and, in part as a result of this increased fiscal capacity, has almost doubled the amount of the budget allocated to education.

While these are positive indicators, deeper changes are needed to address systemic issues in the delivery of public education, such as the processes of approving unregulated schools, absorbing qualified teachers into the payroll, and ensuring a sufficient supply of qualified teachers to ensure that communities do not have to rely on untrained and unfunded community teachers. If domestic revenue mobilisation and donor aid are insufficient to meet the ambitious target of universal fee-free education, informal taxes and fees will continue to supplement the public education system across the country.

Moreover, even with recent improvements, tax revenues will remain below the target of 20 percent of GDP that was recommended to achieve the Millennium Development Goals. Sierra Leone still has a significant opportunity to raise revenue in a more progressive manner to better finance public goods and services. Rather than passing the costs of funding basic public goods onto households and communities, a greater emphasis on taxing wealth and high-net-worth individuals – through taxes on income, property, and capital gains – would go a long way in making the tax system more equitable while providing the necessary foundations to publicly finance quality education for all.

This piece was originally published by the Network for international policies and cooperation in education and training (NORRAG), in its fifth special issue titled Domestic Financing: Tax and Education. It is republished here in accordance with the CC BY-NC 4.0 licence. The title and two of the subtitles have been changed, and references incorporated into the text as hyperlinks in this version. Read the full NORRAG Special Issue here.