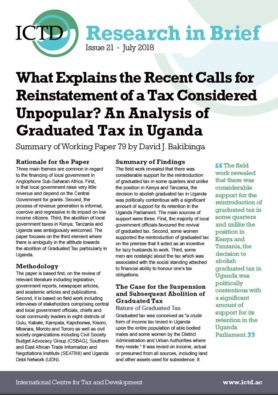

ICTD Research in Brief 21

This ICTD Research in Brief is a two-page summary of ICTD Working Paper 79 by David J Bakibinga, Julia Kangave and Dan Ngabirano. This series is aimed at policy makers, tax administrators, fellow researchers and anyone else who is big on interest and short on time. Graduated tax became unpopular for a variety of reasons. First, it was coercively enforced using defence units with tax defaulters being subjected to beatings, arrest, unknown detentions and in extreme cases, imprisonment. However there is considerable support for the reintroduction of graduated tax in some quarters of Uganda.