Domestic resource mobilisation (DRM) is one of the core issues on the agenda at next week’s Financing for Development Conference. The conference’s final outcome document, the Compromiso de Sevilla states that “public resources, policies, and plans will be at the heart of our efforts for a sustainable development drive.”

It also expressly notes that member states will “provide support to countries in their efforts to strengthen [DRM]” and called on development partners to “collectively at least double this support to developing countries by 2030.”

ICTD Executive Director Giulia Mascagni said, “with the sharp decrease in aid, this a particularly crucial time to invest in building sustainable and fair tax systems which both underpin development and build trust.”

New brief on succeeding in ‘The Tax Era of Development’

Ahead of the conference, ICTD has published a new policy brief titled ‘The Tax Era of Development: Taxing Smarter for Equity, Growth and Resilience’. The brief asserts that the world is now “firmly in the tax era of development, in which domestic revenue is no longer one of many finance sources, but the primary one.”

Written by ICTD’s research leads, the brief describes how “the future of poverty reduction, expanding public health and education, making progress towards the Sustainable Development Goals… are all effectively dependent on [lower-income countries’] ability to rapidly develop their tax capacity”.

The authors caution, however, that “if done poorly, these efforts may not only be unsuccessful on their own terms, but will also have damaging spillover effects: deepening inequalities, weakening business environments, triggering public protests, and eroding trust.”

Raising more revenue requires well-designed reforms tailored to local political, economic, and administrative realities. As they write, “The key to thriving in this new era is not just taxing harder, but taxing smarter – implementing evidence-based reforms, and integrating research more closely with tax administration.” Read the brief here.

Side event on the critical role of research for DRM

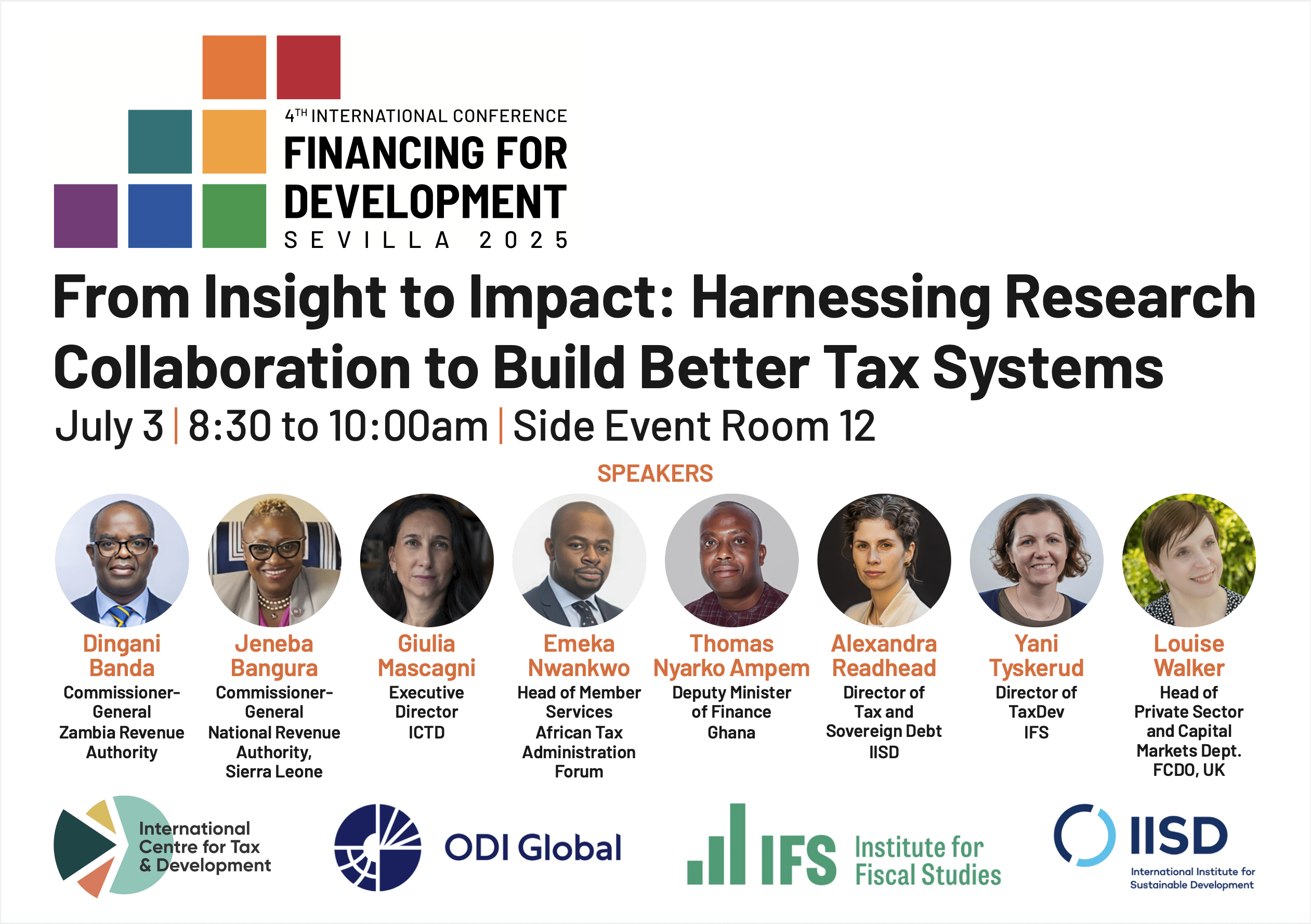

The ICTD will co-host a side-event at the FfD4 conference on the morning of July 3rd titled ‘From Insight to Impact: Harnessing Research Collaboration to Build Better Tax Systems’.

In partnership with ODI Global, the Institute for Fiscal Studies (IFS), and the International Institute for Sustainable Development (IISD), the event will feature leading experts and high-level African officials from ministries of finance and revenue authorities, exploring how research partnerships have driven tangible improvements in tax policy and administration, and how these successes can be scaled further. Register for the event here.

Launch of new Coalition for Tax Expenditure Reform

The ICTD is also a founding member of a new Coalition for Tax Expenditure Reform, which will be launched under the Seville Platform for Action. Revenue forgone from tax expenditures is equivalent to 4% of GDP and 25% of tax revenue globally. In partnership with IISD, ODI Global, the Council on Economic Policies (CEP), and the German Institute of Development Sustainability (IDOS), the Coalition aims to drive “a decade of focused action on tax expenditure reform.” The Coalition will help design, implement, and monitor tax expenditures more effectively and to ensure they align with countries’ development goals, protect tax revenues, and promote sustainable growth.

The launch will take place on June 30th, from 15:30 to 16:00 in the Seville Platform for Action Initiative Announcement Room.

Meet our team in Seville

Connect with the members of our team who will be participating in the conference:

- Giulia Mascagni, Executive Director

- Max Gallien, Research Fellow and co-lead of the Informality and Tax programme

- Giovanni Occhiali, Research Fellow and lead on taxing the wealthy and Climate and Environmental Tax

- Wilson Prichard, Associate Research Fellow and Chair of the Local Government Revenue Initiative (LoGRI)

- Moyo Arewa, Programme Director, Local Government Revenue Initiative (LoGRI)

- Emilie Wilson, Head of Communications and Impact

- Rhiannon McCluskey, Policy Engagement Consultant

For media enquiries, please contact Emilie at [email protected] or on +44(0)7973197871

Dr Mascagni will speak at the following side events:

Illicit Financial Flows, Fiscal Space and Fair Taxation: Advancing Africa-Europe Cooperation for a United Measurement and Reform Agenda

- Date: 1st July (Tuesday)

- Time: 10:30-12:00 CET

- Venue: Side Event Room 5

- Organisers: Africa Europe Foundation and partners

Tax Inspectors Without Borders: A Decade of Impact and the Road Ahead

- Date: 2nd July (Wednesday)

- Time: 8:30-10:00 CET

- Venue: Side Event Room 14

- Organisers: UNDP, OECD, and partners

Dr Prichard will speak at the following side events:

Financing the Localisation of the SDGs

- Date: 2nd July (Wednesday)

- Time: 09:30-11:15 CET

- Venue: Sala Santo Tomas, Seville City Hall, Nueva Square, 1, 41001, Sevilla

- Organisers: Local2030 Coalition, UNEP, UNDP, UN-HABITAT, and UNICEF

Financing our Urban Future: Scaling Up Investment in and through Cities

- Date: 3rd July (Thursday)

- Time: 12:30-14:00 CET

- Venue: Side Event Room 24

- Organisers: UN-HABITAT and partners

We look forward to either seeing you in Seville, or sharing our reflections with you afterwards!

Hear from our FFD4 Engagement Lead: