Date: 30th May 2023, 13:30 – 14:30 London time

Duration: 60 minutes

Language: English only

There are three puzzling features of Sub-Saharan African tax systems. First, tax administrations maintain records on vast numbers of small enterprises that actually provide no revenue; second, they continually invest resources into registering even more of these “unproductive taxpayers”; and third, discussions about taxing small enterprises are framed by the ambiguous, misleading concept of the “informal sector”.

This webinar is hosted jointly by the World Bank West and Central Africa Governance Teams and the Revenue Administration Community of Practice (RA CoP).

Speakers

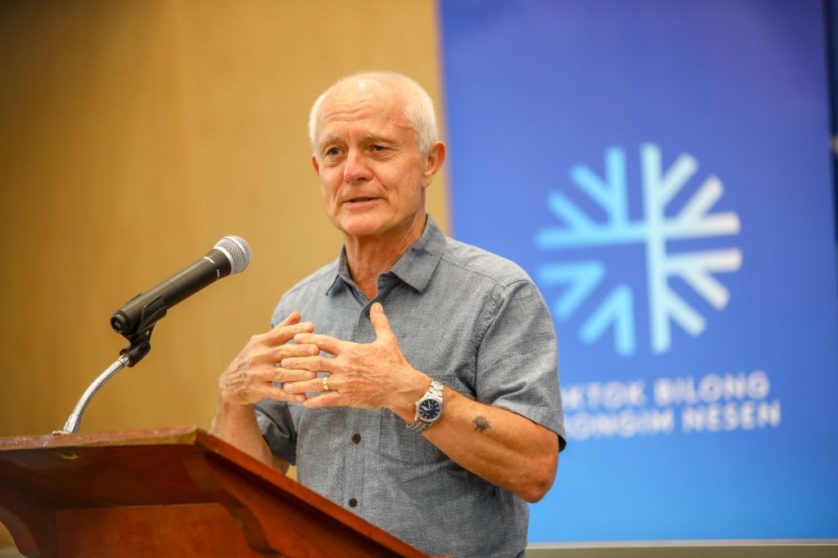

In this online event, Prof Mick Moore, Senior Fellow at the International Centre for Tax and Development and Professorial Fellow at the Institute of Development Studies of UK, will share the key findings of his paper “Tax Obsessions: Taxpayer Registration and the “Informal Sector” in Sub-Saharan Africa”. The presentation will be followed by discussion and reflections from World Bank colleagues working on the domestic resource mobilisation reform agenda.

- Opening Remarks: Abebe Adugna, EFI Regional Director, Western and Central Africa, World Bank

- Moderator and Opening Remarks: Gael Raballand, Practice Manager, EAWG1

- Presenter: Prof Mick Moore, Senior Fellow at the International Centre for Tax and Development, and Professorial Fellow, at the Institute of Development Studies, UK

- Discussants:

-

- Tuan Minh Le, Lead Economist, EAEM2.

- Diop Saidou, Lead Governance Specialist, EAWG1.

- Rajul Awasthi, Senior Public Sector Specialist, EAWG2.

- Ceren Ozer, Senior Economist, EMFTX.

- Julia Dhimitri, Public Sector Specialist, EAWG1 and Co-Chair of RA CoP.

5. Closing Remarks: Tracey Lane, Practice Manager, EAWG2.

How to join

You can join the event by following this link here.

Webinar Resources

Moore, M. (2023). Tax obsessions: Taxpayer registration and the “informal sector” in sub-Saharan Africa. Development Policy Review, 41, e12649.