The past three decades have seen sweeping changes in the means by which many developing countries collect fiscal revenues. From a heavy reliance on trade taxes in the 1980’s, many low and middle-income countries, with guidance and support from the IMF, have seen their tax mixes change toward a greater reliance on consumption taxes such as the VAT.

Yet the effects of this shift in the tax mix on GDP growth rates have received little attention from researchers. This has, I suspect, mainly been due to the paucity of data for low-income countries. However the newly launched Government Revenue Dataset (GRD) from the ICTD, which draws from a number of existing sources such as (amongst others) the IMF and OECD in order to greatly improve data coverage in low- income countries has enabled us to carry out such an investigation: The GRD enables us to extend the work of previous research in order to provide new evidence on the role of tax structures in economic growth.

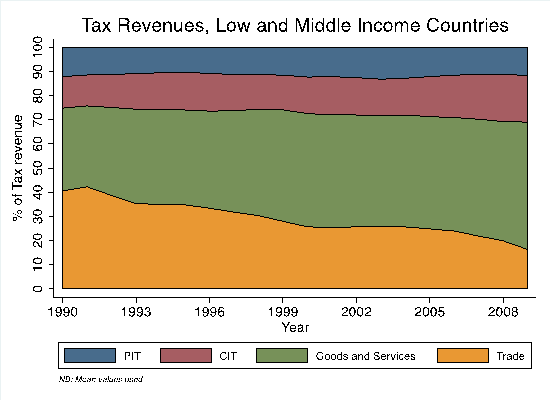

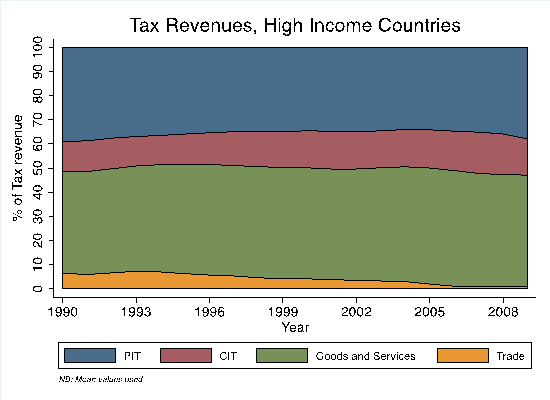

The increased coverage in the GRD, which includes tax revenue data for up to 30 years for almost 200 countries, has allowed us to study the effects of the aforementioned transformations in developing countries’ tax structures in much greater detail than has been done previously. The chart below offers a simple example of what the data can illustrate – showing the tax mix in low- and middle-income countries between 1990 and 2009 compared to that in high-income countries over the same period.

Our paper, Tax Structures and Economic Growth and Development, investigates the relationship between tax structures and economic growth in a panel of developed and developing countries, using the new ICTD GRD and a number of interesting features emerge:

(1) Low and middle-income countries rely on direct taxation (here just the sum of personal and corporate income taxes) to a much lesser extent than high income countries – the average is not more than 30% for the period in question. For the same period however, personal and corporate income taxes make up between 50 and 55% of total revenues in high-income countries. (2) There has been a much more dramatic shift away from trade toward consumption taxes in low and middle income countries, with the former making up around 35-40% of revenues in the early 1990’s, but only about one fifth of revenues by 2009.

The main focus of the research, however, was to consider the effects of such shifts on GDP growth rates. Our preliminary findings suggest that revenue neutral (i.e. holding constant the level of total tax receipts) increases in income taxes, offset by reductions in either trade or consumption taxes are harmful for economic growth. This is largely in line with what economic theory predicts, however a closer look suggests that it is those shifts toward personal, rather than corporate, income taxes that are most harmful to economic growth – an intriguing result indeed.

Our findings also suggest that the biggest shift seen in recent decades – that is, from trade to consumption taxes – has not been good for GDP growth rates, although at the same time we can’t say that it has necessarily been harmful either. In light of these results, the IMF’s ‘policy prescription’ (2011) of replacing trade with consumption taxes certainly appears wise, certainly compared to shifts toward income taxes. Taken alongside the results of studies such as Baunsgaard and Keen (2010), who found that revenue recovery in low and middle income countries had been relatively poor following trade liberalisation, our results further highlight the difficulties associated with tax reform.

References

Baunsgaard, T. and Keen, M. (2010) ‘Tax revenue and (or?) trade liberalization’, Journal of Public Economics 94(9): 563-577

IMF (2011) Revenue Mobilization in Developing Countries, International Monetary Fund, available at <http://www.imf.org/external/np/pp/eng/2011/030811.pdf> accessed 5 December 2013