Nigeria’s dependence on oil

Nigeria relies more on oil than it does on direct taxes or any other forms of revenue to run its economy. Since discovering oil in 1956, Nigeria has become heavily reliant on oil revenue for survival – in the boom period preceding the 2014 oil price plummet (2010 – 2013), the oil sector made up an average of over 74% of federally collected revenues. Despite being Nigeria’s major source of revenue, the oil sector lags behind agriculture and services sectors in terms of GDP contribution. The relative importance of the oil and gas sector in Nigeria appears to be declining, from 13% of Nigeria’s GDP in 2013 to slightly above 6% in 2015, while those of agriculture, manufacturing and the services sector were 20.9%; 9.5% and 59.4% respectively.

This low contribution to GDP may suggest that Nigeria’s output has a low tax effort in key sectors that contribute to output (e.g. agriculture and services sectors). Though the oil sector contributed up to 61% of its total taxes, Nigeria’s tax-to-GDP ratio is amongst the lowest when compared with its regional, structural and aspirational peers, at around 5%. This figure is significantly lower when compared to Sub-Saharan Africa’s regional average of 16%. Ratio in Europe & Central Asia and Latin American countries as at 2016 stood at 23.9% and 19% respectively (tax-to-GDP ratio still based on old assumptions, results of new calculations to emerge soon).

Has the oil economy succeeded?

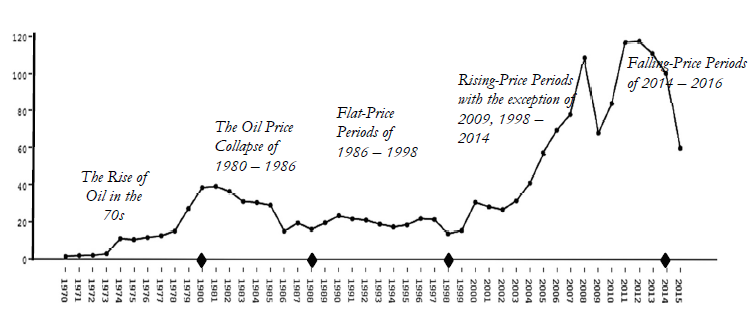

Nigeria has suffered great economic losses as a result of its over-dependence on oil rents. The volatile nature of commodity prices has meant that Nigeria had to suffer revenue and growth shocks at various times. The mid-2014 oil decline was the latest of the recurring episodes of volatile business cycles. This recent experience shares similarities with the oil collapse of 1981-82 to 1986 and the sharp decline recorded in 2009 shortly after the 2008 global financial crisis when oil prices fell fell from over $100 to $60 within a year.

The outcome of Nigeria’s over-dependence on oil became even more visible when a full recession was recorded by the third quarter of 2016, after two consecutive quarters of negative growth. Government budgets were put under pressure as the global oil prices dropped and their revenues sharply declined. In order to shore up revenues, debt levels increased tremendously and have resulted in increasing absolute debt figures since 2010.

In less than a decade, the external debt stock quadrupled and the domestic debt stock tripled. The sustainability of rising debt has become a problem. The interest payments on debt have increased to 63% of total revenue in 2018. This constrained revenue space resulting from the high debt burden is amongst reasons why the authorities are performing poorly in budget execution.

Is low tax yield really the problem?

Economics teaches us that debt is only sustained by a strong revenue and economy base. Thus, there is no other way to sustainably overcome the problem but to broaden the sources of government revenue i.e. ensuring that the main GDP sectors are revenue-based. A legitimate but not so easy way of doing this is to raise more revenue from taxes. This can be done in two ways: by increasing tax rate, such as VAT and/or by expanding the tax base.

In the light of Nigeria’s relatively low VAT rate, both choices will be highly recommended. However, caution must be applied in implementing a tax rate increase in periods of low aggregate demand. The consequence may include increased poverty levels – a blanket increase in tax on consumption will most likely have a poverty effect by further shrinking an already squeezed middle class. Perhaps, what is needed is an increased emphasis on direct taxes (e.g. taxes on income, property and other assets) indicating a more progressive tax system.

Base expansion is more difficult to implement as it will require a shift in Nigeria’s perverse social contract. The notion that citizens can decide to not pay taxes in exchange that the state is not strongly held accountable for the delivery of services needs to change. Nigeria is not alone in this problem. In fact, it remains an unanswered question in many African countries – Evidence shows that direct taxes to GDP are relatively low in sub-Saharan Africa compared to those of other regions.

Labour market trends and tax base expansion

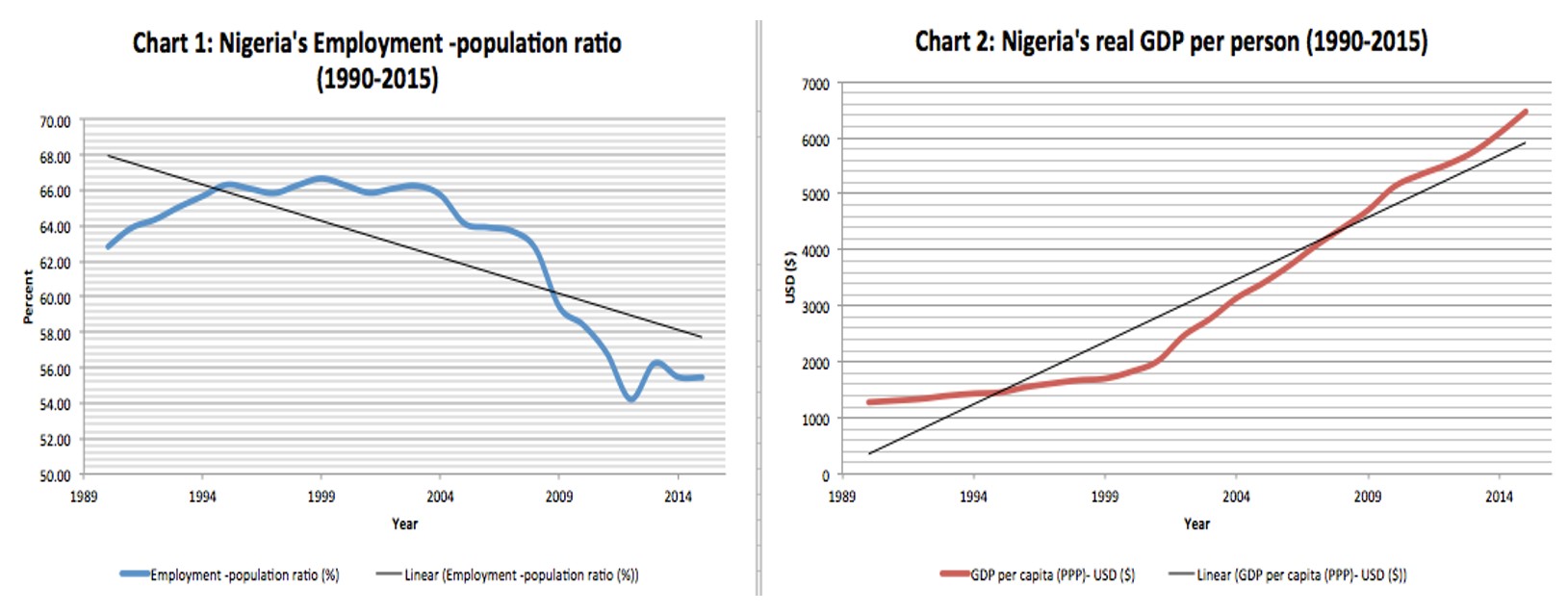

Oil is a far-less labour intensive sector, meaning that the overdependence on the sector has some implications on job creation in the economy. Evidence shows that Nigeria has struggled with employment generation even in periods of highest growth. Employment rates in Nigeria fell on trend from 2009 while output rose above trend in the same year. This implies that Nigeria’s growth in the years preceding the 2014 oil price plummet has been jobless.

The jobs problem became worse as the economy slid into a recession in 2016. The absolute number of employed persons fell from 56 million persons in 2015 to 51 million persons from 2016. More striking is the fact that there have been more entrants to the labour market, implying that unemployment figures have been on the increase generally. While new entrants find it difficult to get jobs, labour movements/reallocations between sectors have been conspicuous. These labour movements are mainly from agriculture and manufacturing towards low productivity non-tradable services such as low-tech transportation, telecoms, hospitality etc. This trend has increased the level of underemployment and led to premature de-industrialization.

From a fiscal policy stand point, this structural make-up of the Nigerian jobs system affects the ability of the state to raise revenue effectively. With the flow of labour to an informal services sector, the revenue generating agencies may be faced with higher collection costs in order to adequately capture this tax payer group. An analysis of the social impacts and the potential costs and benefits of generating taxes from these groups is important to determine what approach works best.

Some states in Nigeria have began implementing a presumptive tax system as well as a tax for service approach. This aims to effectively engage the informal sector and promote taxpayer voluntary compliance. However, these reform efforts need to be backed by locally-grounded evidence – determining the tax potential of the informal sector will be an important first step.

Any solution in sight?

The current fiscal crisis presents an opportunity for transformational change. There is need for a new reform narrative that emphasizes the creation of new social contract around accountability, responsiveness, tax burden and performance. This is not automatic as it will require strong political will and legitimacy to drive. In the aftermath of the 2019 elections, it will be important to promote reform advocacy towards ensuring that these issues get into the policy agenda of the new administration (including sub-national governments). The generation and use of evidence will be important for guiding the authorities to the locally-grounded approaches to adopt. As a starting point, lessons from the Lagos experience in raising its internal revenues may be useful. Reforms targeted at addressing the core structural factors that limit the proliferation of high productivity jobs in key (innovation led/knowledge driven) sectors of the economy will also be important.