Non-compliance can be down to more than just intentional evasion – taxpaying can be time-consuming, complicated and costly. Tackling compliance costs can help. For many countries, digitalisation is top of the list.

For many taxpayers in low-income countries, paying taxes is a time-consuming and laborious manual process. Tax systems are often complex and difficult for taxpayers to understand, requiring frequent interactions with tax officials to access information and help. While intentional evasion might be behind a large amount of non-compliance, lack of taxpayer knowledge, barriers to tax filing, and transaction costs are likely to explain part of the non-compliance problem.

Making tax simpler

Efforts to improve compliance are therefore considering the importance of improving taxpayer services – simplifying the tax system and reducing the costs borne by taxpayers in complying with their obligations. For many revenue authorities, digitalising the tax compliance process is at the top of the agenda, making compliance easier and reducing opportunities for corruption. For instance, digitising tax payments could reduce the time taxpayers spend travelling and queuing to make cash payments, as well as reducing the risk of leakage. Moreover, with a digital paper trail for each taxpayer, revenue authorities are better equipped to analyse payment patterns and detect evasion.

What do we mean by tax compliance costs?

Taxation entails a very obvious cost to doing business – a portion of all profits earned is paid to the state. But the process of tax compliance isn’t entirely costless either. These hidden costs of taxation include:

- Direct monetary costs, such as buying specialised tax software or paying a tax accountant.

- Time spent on tax activities by taxpayers themselves (or their staff).

- Incidental, non-labour costs, such as transaction fees or travelling to a tax office.

- A psychological burden, causing frustration or anxiety, particularly in relation to audits and tax investigations.

Measuring these costs is not straightforward, particularly for small businesses which may not keep reliable records. Researchers have typically relied on measures based on surveys, either through asking firms directly about their own tax compliance or using estimates of the hours spent on tax compliance by a ‘representative’ firm, as in the discontinued World Bank Doing Business Index.

How large is the problem of compliance costs?

There is relatively little (recent) empirical evidence on the size of tax compliance costs for businesses in low-income countries.

However, what we do know points to some significant concerns, particularly for smaller businesses. For instance, a survey of Ethiopian businesses indicated that their average tax compliance cost amounted to 5.4 per cent of turnover, but this burden was especially regressive. Indeed, the majority of small businesses reported that the process of tax compliance was more burdensome than their actual tax liabilities. This is not a uniquely Ethiopian problem.

In another example, ICTD researchers found that new taxpayers in Rwanda have very limited knowledge of the tax system, negatively affecting their compliance. Not only did training programmes led by the Rwanda Revenue Authority boost revenue in the short term, but it also helped taxpayers build a habit of filing declarations.

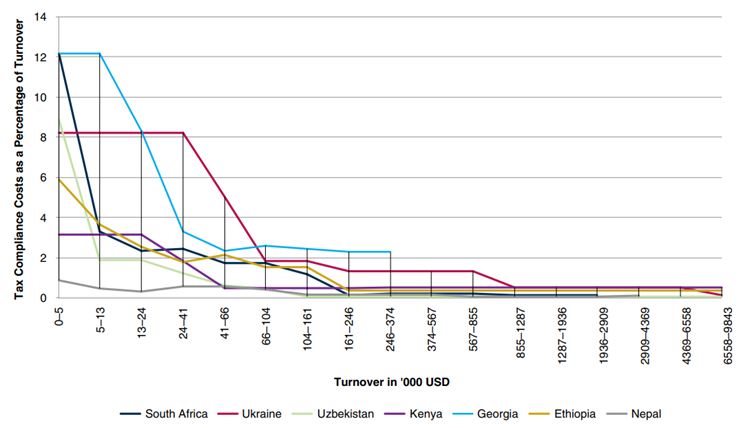

Using comparative survey data, the figure below shows that compliance costs in many lower-income countries are regressive, with some small businesses incurring costs exceeding 12 per cent of turnover.

Source: World Bank, 2016

The impact on businesses

Tax complexity leads to high compliance costs and can have a real economic impact for firms. Some may even pay more tax than they owe. Research in Rwanda found that tax cuts aiming to simplify and reduce taxes for small businesses sometimes had the opposite effect, with businesses paying just as much as they did before the cuts. Investigating this puzzle, researchers found that businesses consistently aimed to pay an identical amount of tax every year, rather than responding to real changes in income and tax rates. Constraints in measuring and documenting revenues to properly determine tax liabilities, as well as difficulties in accessing updated tax information, partly explain this behaviour.

From an economic perspective, high compliance costs could also be seen as a waste of economic resources, increasing the total effective tax burden without increasing government revenues. To the extent that firms adjust their behaviour to reduce their compliance burden, high compliance costs might distort their economic decision-making, leading to inefficiencies and reduced productivity. By reducing these costs, governments help firms to reallocate their resources more productively. This could create a virtuous cycle where everybody wins: firms are more productive, earn more revenue, and consequently pay more taxes.

Can digitalisation help?

Intuitively, digitalisation seems appealing. Electronic filing, pre-filled tax returns, cashless payments, and automated data verification might reduce errors, and time spent filing and paying taxes. Removing direct interactions between taxpayers and tax officials might minimise opportunities for rent-seeking and corruption, further reducing the psychological and financial burden of tax compliance. Digitalisation and electronic payment systems also generate increasing amounts of data on taxpayers, which could be used for more effective monitoring and to deter evasion.

So far, the evidence is mixed:

- In Nepal, Ukraine, and South Africa, e-filing adoption may have reduced tax compliance costs in the long run, but these benefits couldn’t necessarily be expected in the short run. The advantages were partially eroded by the use of business capital to invest in e-filing, and the time taken to learn new ways of operating.

- In Ukraine, e-filing increased tax compliance costs as most small firms double-filed, due to a lack of trust in the online system, showing the importance of careful policy implementation.

- In Tajikistan, researchers found that e-filing reduced the time firms spend on taxes by up to 40 per cent, and increased the tax paid by those firms which had previously been more likely to evade. The tax authority also benefitted from efficiency gains: researchers estimated that e-filing freed up over 5,800 tax-official-hours monthly, which could be reallocated to other activities.

- In Eswatini, ICTD researchers found that mandating e-filing improved the accuracy and timeliness of declarations and payments. This was facilitated by deadline reminders and information on outstanding liabilities through the e-filing platform.

- Through qualitative interviews in Rwanda, ICTD researchers found that practical challenges, including connectivity problems and slow systems, undermined the potential benefits of e-services.

Increasing tax compliance, and therefore tax revenue, could have a significant positive impact on government capacity. But to make tax compliance less of a burden for taxpayers, policymakers need a clear and comprehensive understanding of the nature and scale of tax compliance costs, as well as their impact on decisions taxpayers make about their compliance behaviour. Effective and innovative ways to reduce these costs are crucial: for instance, digitalisation, simplifying tax laws and reducing reporting requirements.

Fortunately for both policymakers and taxpayers, this is an exciting and fast-growing area of research with some promising ways forward.

Links

- Digital merchant payments as a medium of tax compliance

- An introduction to digital tax payment systems in low- and middle-income countries

- Increasing tax collection in African countries: The role of information technology

- Mandating digital tax tools as a response to COVID: Evidence from Eswatini

- Technology and tax: Adoption and impacts of e-services in Rwanda