Nigeria’s performance on collected taxes is poor. Non-oil revenue in the country is around 3-4 percent of GDP, far below countries such as South Africa and Brazil where non-oil revenues lie between 20 and 25 percent of their GDP – or other peers in sub-Saharan Africa who typically collect more than 10 percent of GDP in tax.

Why is Nigeria’s revenue performance so poor?

The immediate answer is that the quality of administration and enforcement is poor, particularly below the Federal level. But this is only part of the story. The existence of large rents from oil has meant that governments since independence have paid relatively little attention to tax as a source of revenue. The collapse in the oil price since 2015 is beginning to change that, with the government making strenuous efforts to boost tax revenue. But the experience of other countries suggests that it is necessary to build political support for taxation; to do this, one needs to know what people think about taxation and, in particular, their attitudes towards paying. This was the purpose of the Nigerian Economic Summit Group survey on the perceptions of taxation that was conducted in July 2018.

The NESG survey is a nationally representative survey of 16,000 Nigerians (it also covers 8000 small firms, 24 Focus Group Discussions and 17 In-depth Interviews with tax officials). It has a 50/50 gender balance, and is representative of rural and urban households. It is also representative at the geopolitical zone level. The survey was designed to understand the ‘tax morale’ of Nigerians – that is – the attitude that ordinary Nigerians have about paying and not paying taxes. The results were both shocking and important for the design of policies to boost tax revenue going forward.

Tax morale in Nigeria is extremely low. When asked the question ‘what do you think about people not paying taxes in income?’, more than a fifth (22%) of Nigerians said that it was ‘Not wrong at all’ to not pay your taxes; and over half (54%) said that it was ‘Wrong but understandable’. A mere 17 percent said that it was ‘Wrong and punishable’. Put differently, over 80 percent of Nigerians are at least sympathetic towards illegal non-payment of taxes.

Why is tax morale in Nigeria so low?

According to the survey data, there appear to be four reasons tax morale is so poor in Nigeria:

- People receive relatively little information about tax. International experience suggests that better information and knowledge about taxes facilitates payment. However, in Nigeria, almost half of the respondents to the survey said that getting information about what taxes to pay and how to pay them is difficult or very difficult. Only 12 percent had received any kind of communication from the government on taxation during the last year. As one participant in a Focus Group Discussion in Bauchi state put it “Getting information on how much you need to pay, we don’t know where, which office, who we are to go and get information from?”

- Most Nigerian’s day-to-day experience of the tax authorities is quite negative. Almost 15 percent of Nigerians say that they often or always have to pay a bribe to tax officials. On top of this, more than a fifth report having to pay protection money to local ‘area boys’ and other non-state actors; although this is not taxation by the state, it is regarded as taxation by ordinary Nigerians. And local tax officials do threaten small businesses with closure for non-payment. As one respondent from Lagos put it “Mostly, people coming from the local government collect bribe, … For instance maybe they want to lock up your shop, and you tell them that you don’t have the money or it is incomplete, and so they will tell you that for me not to lock it up, give me something, and they collect.”

- Most Nigerians believe that they get nothing back for the taxes that they pay. For most publicly provided services, around half of the respondents say that they are dissatisfied or very dissatisfied with the services they receive (particularly electricity, security and road maintenance). More generally, the link between taxation and service delivery appears to be broken – in most regions, people believe that services have gotten worse over the last three years while taxes have gone up. About one fourth of Nigerians indicate that poor services are the main reason for people to avoid paying tax. Another 17% each argue that taxes are either already too high, or people cannot afford to pay.

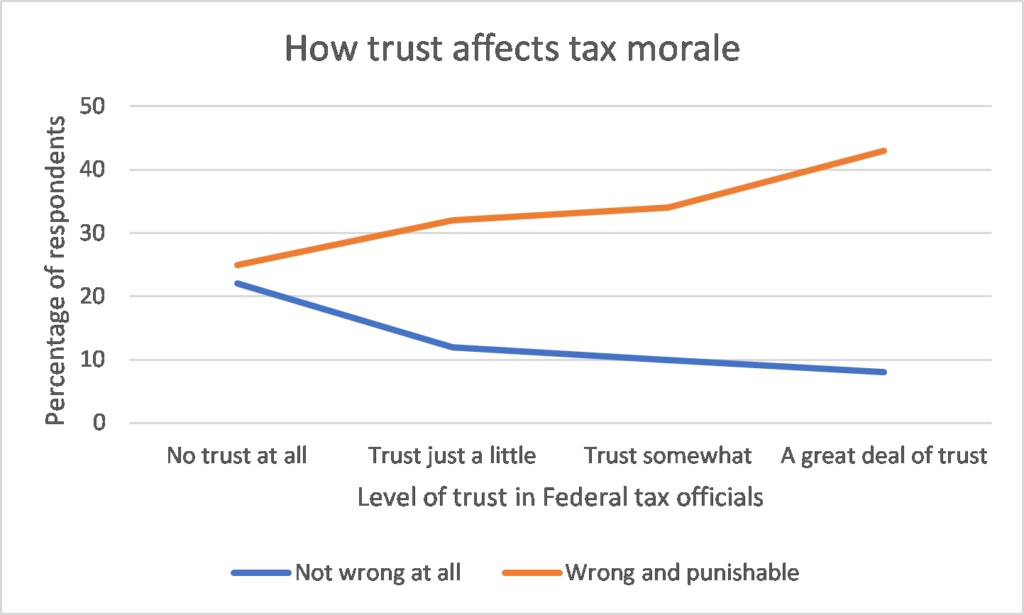

- With little information, a bad day-to-day experience, and little to show for the taxes they pay, many Nigerians do not trust tax officials or the government. 10% of Nigerians also believes that the tax system being unfair is the main reason for low tax morale. Trust is key to building a positive attitude towards tax. The figure below shows how those that trust their tax officials have much more positive tax morale than those that do not.

The way forward: Strengthening the social contract

But the survey also points to glimmers of hope. In theory, almost 65% of Nigerians agree that the authorities have the right to make people pay taxes. Most Nigerians want better services and many are willing to pay for them. More than a third of Nigerians say that they would be willing to pay more tax if they could be guaranteed that the money would be spent on better services. The evidence above suggests that the Nigerian government can do a lot of boost tax morale. Improved information and communication about tax obligations, along with simplified and clean payment mechanisms would provide taxpayers with the confidence that their money is not simply being stolen. Working together with the agencies responsible for the delivery of public goods – even linking some taxes to such delivery – could help to build confidence that taxation is used for the benefit of the people. Tax in Nigeria has a long way to go – but understanding how Nigerians really feel about it provide valuable pointers on how to boost tax as a share of GDP and build a better social contract for the future.