Property taxes offer a significant potential for developing cities in Africa, which crucially need revenues to fund local public services and sustainable urban planning.

In 2014, Senegal adopted its current development plan, “Plan Senegal Émergent”, with the main goal of bringing the country to an emerging economy status by 2035, with the mobilisation of property taxes as crucial to the Senegalese context.

As a result, modernising the property tax system in Dakar, the capital city, could have far-reaching positive effects. However in Sub-Saharan Africa, property taxes amount to two percent of fiscal revenues on average, against around nine percent in the OECD, and this figure is even lower for Senegal, at 0.3 percent.

Since 2017, we have partnered with the Senegalese Tax Administration (Direction Générale des Impôts et Domaines -DGID) to assess the hurdles of property taxation and to develop an improved property tax administration system. Over the course of our partnership, we have discovered that the methodology used to assess property values and hence tax liabilities was a crucial issue that needed to be addressed for an effective property tax reform.

Explaining the under-performance of Dakar’s property tax system

Property owners in Dakar are subject to an annual tax, corresponding to five percent of the rental value of their property — the total value that could be claimed by the owner if the property was rented at market value.

Although property tax revenues are allocated to local budgets in Senegal, the legal framework is set at a national level, and assessment and collection activities are managed by different central government agencies.

The Tax Administration (DGID) is in charge of creating and updating the valuation roll, and the National Treasury of collecting payments. In theory, property owners are supposed to make annual declarations to the Tax Administration, indicating the values of their properties, and, after the hand-delivery of tax notifications by the treasury, they are required to pay in-person at a Treasury Office.

However, the system is under-performing.

In the absence of spontaneous declarations by property owners, the administration is mandated to carry out field work and agents must determine property values based on discussions with owners and tenants, and their knowledge of market values. This system can be labelled as discretionary.

Because both these field operations and spontaneous declarations are rare, not only is the valuation roll incomplete, but the registered values are also outdated. In spite of soaring market rents, the administrative data shows that only 0.9% of property values were updated at some point between 2016 and 2020.

Survey results from property owners

Using a combination of fiscal, cadastral, and survey data for 2,474 property owners in the region of Dakar, we estimate that only 15 percent of all plots in the region are registered on the tax roll.

In the areas with tax potential that were surveyed, 16.8 percent of owners paid the property tax in 2018, and tax revenues amount to 9 percent of the tax potential. Seventy-five percent of total tax potential amount is foregone due to property owners who are not paying the tax at all. Sixteen percent of tax potential is foregone because some payers are paying less than they should based on the value of their property. To calculate tax potential, we use property values collected in the survey, combined with information from satellite images and from a real estate expert survey.

Our analysis also reveals that there is a substantial share of taxpayers who were registered in the property register at some point, but for which there was no continued monitoring over time. In total, 42 percent of owners already paid property tax at least once in the past.

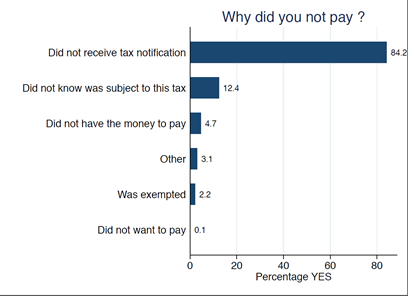

When asked why they did not pay, 86 percent respondents indicate that it is because they didn’t receive a tax notification (Figure 1).

Figure 1: Reasons for not paying property tax as declared by property owners

Note: Property owner survey conducted in 2018. 2,474 respondents. This question was asked to all respondents that declared not having paid the tax in 2018. Respondents could select multiple answers among those listed.

Who is in the tax net?

We do not find evidence that the administration is targeting properties with higher tax liabilities. This is in spite of the fact that in Senegal, a tax reduction for owner-occupied properties makes the property tax slightly progressive, on paper, meaning that owners of higher valued properties should be facing a higher effective tax rate. Furthermore, it could make sense for a resource constrained administration to focus efforts on higher valued properties.

Empirically however, our data shows that the probability of paying the tax only moderately increases with property value. Using property values, we were able to compare the distribution of the tax burden with the predicted one that would be observed under full compliance. For higher property values, there is a stronger likelihood that the tax paid is lower than the estimated tax calculated based on property .

Under weak enforcement, the taxation burden appears more regressive than what is provided for in the legal framework.

These shortfalls can be attributed to a set of factors that the diagnostic allowed to identify, among which the reliance on a declarative system in a context with low tax education, the absence of a harmonised addressing system, the under-utilisation of unique property or taxpayer identifiers, overly complex protocols for property valuation in the field, and finally, insufficient information sharing between the administration in charge of assessments and managing the valuation roll (the Tax Administration), and the one in charge of distribution and collecting payments (the National Treasury).

Introducing a new valuation method

This situation led all parties to agree on the relevance of introducing a valuation method that would not rely on spontaneous declarations, nor on agents’ discretion, and that would also be feasible at a large scale for an administration with limited resources.

We therefore developed a semi-automatised valuation method, tailored to the needs of the Senegalese context. This methodology is conceptually akin to a Computer Assisted Mass Appraisal approach (as exists in South Africa for instance), but with an effort to keep the valuation formula simple, and relying on easily observable property characteristics, in line with the points-based methodology currently being tested in other African cities (Freetown) in partnership with the African Property Tax Initiative. The valuation method has been incorporated in the new property tax management software.

To establish a simplified and semi-automatised valuation method, it is important to carry out the following steps, from which we draw suggestions for potential future projects with the same objectives:

- Needs assessments through qualitative work with operational staff, and verification of the possibility to experiment a semi-automatised valuation method under the current legal framework

- Identification of property characteristics considered relevant by the valuation office of the tax administration and visible from the outside of properties. Discussions with agents from the valuations departments, field work, and discussions with external practitioners, can be beneficial to identify context-specific property characteristics.

- GIS work to obtain an up-to-date cadastral mapping and exploit information from high resolution aerial imagery if available. In our case, the project team digitised built area measurements from drone images, since this is a key variable in the valuation formula.

- Conduct a large-scale property survey to collect information on rental values and property characteristics. The sampling should be carefully designed in order to calibrate a relevant valuation formula.

- Data driven work to calibrate a property valuation formula: finding the balance between statistical accuracy and complexity. In our case, the retained formula stems from a standard model (multivariate linear regression) because the gains in accuracy of using the latest developments of the statistical literature were limited, and these specifications were less transparent for the implementing administration.

Future implementations

The semi-automatised method is being experimented in a set of neighbourhoods in the region of Dakar, while the previous valuation method is used in other neighbourhoods. Comparing the results from two types of neighbourhoods will allow us to draw conclusions on the pros and cons of switching to a semi-automatised method in order to inform policymakers.

Not only can this method contribute to fund much needed urban planning projects, but their management through modernised systems can also create an important source of information for the authorities.

This is important in the Senegalese context, as recent legal developments have accentuated decentralisation. As a result, municipalities all across the country now have greater responsibilities, including financing a wider array of local public services and helping raise the revenues allowing them to do so.

A semi-automatised method may be the way forward to help ensure Senegalese cities develop in a sustainable way.